News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 17)|U.S. seasonally adjusted nonfarm payrolls for November increased by 64,000; BlackRock transferred approximately $140 million worth of ETH to a CEX2Bitget US Stock Morning Brief | Fed Independence Reaffirmed; NFP Beats Expectations; Tech Rally Lifts Market (December 17, 2025)

Trump to interview pro-crypto Christopher Waller for next Fed Chair: WSJ

The Block·2025/12/17 04:45

Ethereum Spot ETFs Face Alarming $223.7M Exodus: 4th Day of Major Outflows

Bitcoinworld·2025/12/17 04:45

Bitcoin ETF Shock: $277.4 Million Flees US Funds as BlackRock Leads Outflow

Bitcoinworld·2025/12/17 04:42

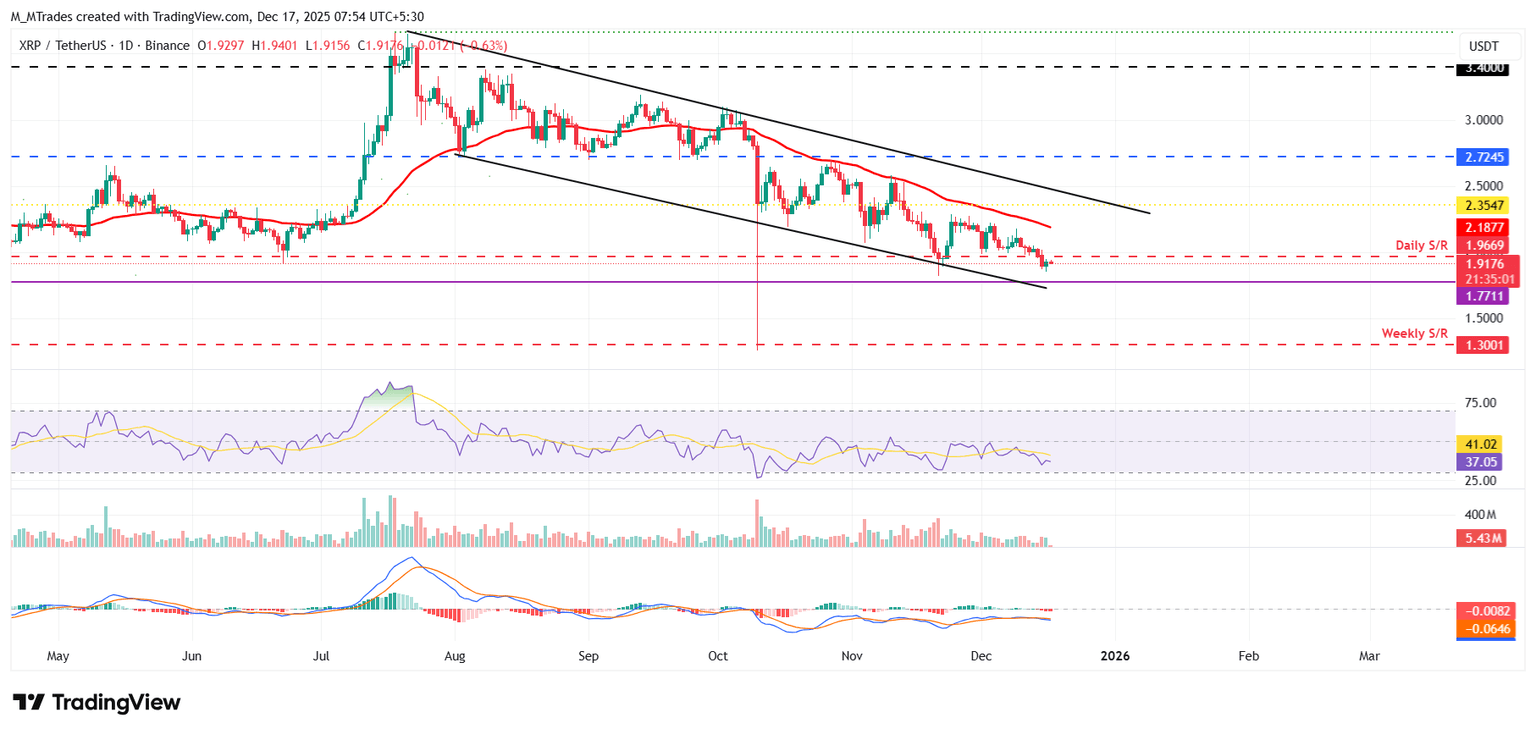

Why XRP Price Falling Below $1.93 Could Change the Short-Term Market Structure

币界网·2025/12/17 04:24

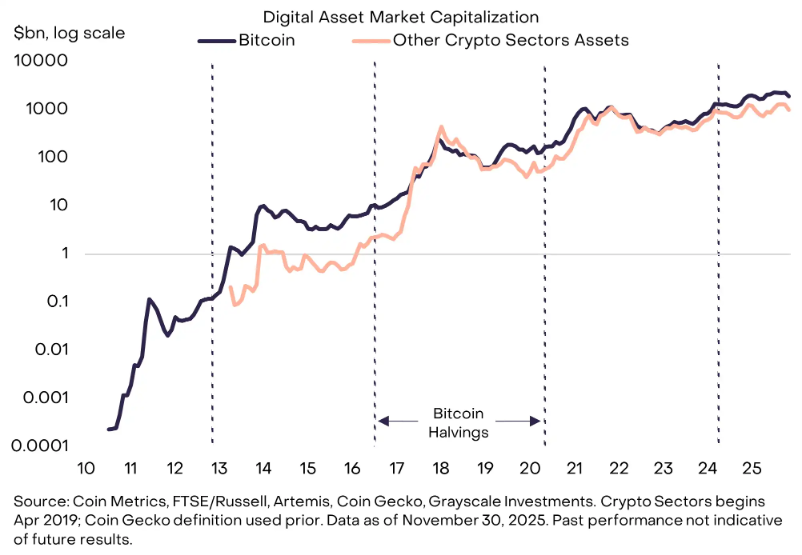

Looking Ahead to 2026: Institutional Consensus on the Crypto Market

AIcoin·2025/12/17 04:24

Unlocking Potential: Animoca Brands Japan & Babylon Labs Forge Strategic Bitcoin Staking Partnership

Bitcoinworld·2025/12/17 03:57

Flash

- 04:54Metaplex Foundation has opened voting on MIP 012, a proposal to allow creators to close cNFT Merkle trees and reclaim rent.Jinse Finance reported that, according to SolanaFloor, the Metaplex Foundation has initiated voting on MIP 012. This proposal suggests updating the Bubblegum program to allow creators to close unused cNFT Merkle trees and reclaim rent.

- 04:45Polymarket predicts a 32% probability of "Bitcoin dropping below $80,000 in December"BlockBeats News, December 17th: The probability of "Bitcoin dropping below $80,000 in December" on Polymarket is currently 32%, while the probability of dropping below $70,000 is 6%. Furthermore, the probability of surpassing $100,000 is currently 9%.

- 04:42Yesterday, the net outflow of Ethereum spot ETF reached $223.66 millions.According to TechFlow, on December 17, monitored by Trader T, the net outflow of Ethereum spot ETFs reached $223.66 million yesterday. Among them, BlackRock's ETHA saw an outflow of $220.72 million, Fidelity's FETH had an outflow of $2.94 million, and there was no capital movement in other ETF products on the same day.

News