News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1 Bitget Daily Digest (Dec. 18)|U.S. SEC issues a Statement on the Custody of Crypto Asset Securities by Broker-Dealers; LayerZero (ZRO) to unlock ~25.71 million tokens on Dec. 202Bitget US Stock Morning Brief | S&P 500 Four-Day Decline; Oracle AI Financing Stalls; Energy & Precious Metals Rally; Micron Crushes Guidance, Surges After Hours (December 18, 2025)3SEC says broker-dealers need to maintain crypto private keys to comply with customer protection rules

Crypto ETP Liquidations: The Looming Wave of Failed Investment Products Predicted for 2026

Bitcoinworld·2025/12/18 04:48

Is VC "dead"? No, the brutal reshuffling of Web3 has just begun.

Odaily星球日报·2025/12/18 04:42

Bitcoin ETFs Surge: $459 Million Flood Reverses Outflow Trend with Stunning Momentum

Bitcoinworld·2025/12/18 04:27

Strategic Move: TORICO’s $3 Million Plan to Purchase ETH Signals Major Institutional Shift

Bitcoinworld·2025/12/18 04:18

Cathie Wood's Ark Invest scoops up more BitMine shares at discount

The Block·2025/12/18 03:45

Revolutionary Ondo Bridge Launches: Unlocking 100+ Real-World Asset Tokens Across Chains

Bitcoinworld·2025/12/18 03:42

Unmissable: Quack AI’s Builder Night Seoul Summit Unites AI and Web3 Leaders on Dec 22

Bitcoinworld·2025/12/18 03:06

SIA: From a super AI trading platform to a functional on-chain AI ecosystem

BlockBeats·2025/12/18 03:02

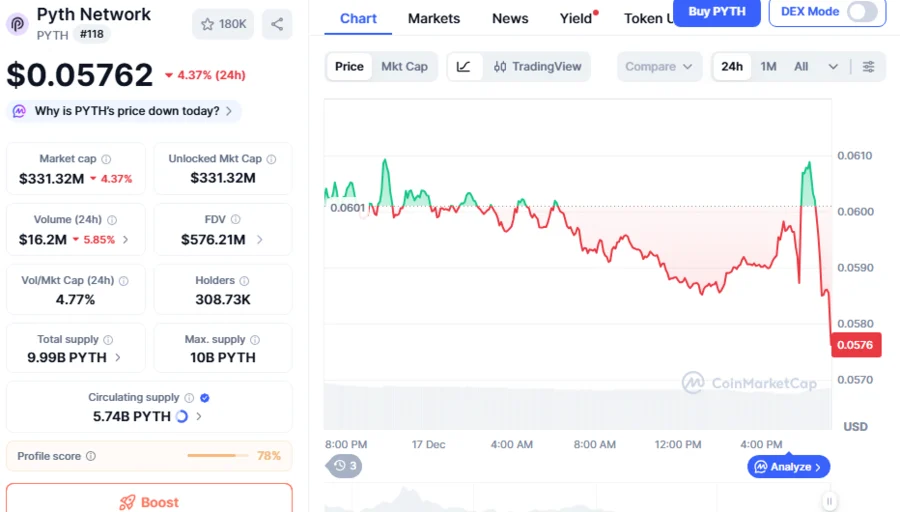

PYTH Drops 76% As Crypto Weakness Persists, Can New PYTH Network Reserve Trigger Market Rally?

BlockchainReporter·2025/12/18 03:00

Flash

05:08

US-listed company VivoPower plans to acquire Ripple Labs shares for $300 millionPANews, December 18 – According to an exchange report, Nasdaq-listed company VivoPower (stock code: VVPR) is expanding its Ripple-related strategy through a new joint venture. This joint venture aims to acquire hundreds of millions of dollars worth of Ripple Labs shares, providing investors with indirect exposure to nearly 1 billion dollars worth of underlying XRP assets. In an announcement released on Tuesday, the company stated that its digital asset division, Vivo Federation, has been commissioned by Korean asset management firm Lean Ventures to initially acquire 300 million dollars worth of Ripple Labs equity. Based on the current XRP price, VivoPower estimates that this equity represents approximately 450 million XRP tokens, valued at around 900 million dollars. However, this structure does not involve the direct purchase of XRP. Instead, Lean Ventures plans to establish a dedicated investment vehicle to hold the Ripple Labs shares acquired by Vivo Federation, targeting institutional and qualified individual investors in Korea. VivoPower stated that it has received approval from Ripple to purchase the initial batch of preferred shares and is in discussions with existing institutional shareholders for further acquisitions. Under this arrangement, VivoPower will not use its own balance sheet funds, but will generate revenue through management fees and performance sharing. If the initial 300 million dollar mandate is achieved, the company aims to realize a net economic return of 75 million dollars within three years.

05:00

The total net inflow of spot Bitcoin ETFs was $457 million yesterday, with Fidelity FBTC leading at a net inflow of $391 million.Foresight News reported, according to SoSoValue data, the total net inflow of spot bitcoin ETFs yesterday (Eastern Time, December 17) was $457 million. The spot bitcoin ETF with the highest single-day net inflow yesterday was the Fidelity ETF FBTC, with a single-day net inflow of $391 million. Currently, FBTC's historical total net inflow has reached $12.363 billion. The next highest was the Blackrock ETF IBIT, with a single-day net inflow of $111 million. Currently, IBIT's historical total net inflow has reached $62.632 billion. The spot bitcoin ETF with the highest single-day net outflow yesterday was the Ark Invest and 21Shares ETF ARKB, with a single-day net outflow of $36.9629 million. Currently, ARKB's historical total net inflow has reached $1.651 billion. As of press time, the total net asset value of spot bitcoin ETFs is $112.574 billion, with the ETF net asset ratio (market value as a percentage of total bitcoin market cap) reaching 6.57%. The historical cumulative net inflow has reached $57.727 billion.

04:58

Yesterday, the net inflow of spot BTC ETFs reached a nearly two-week high.According to AiCoin monitoring, the net inflow of US spot BTC ETFs reached $457 million yesterday, marking the highest single-day net inflow since November 28. Among them, the largest inflow was into FBTC, reaching $392 million; followed by IBIT, with an inflow of $111 million. According to the [Spot BTC ETF Tracking] live trading strategy developed by AiCoin, ETF capital inflows have a significant positive correlation with the price of BTC. Users can subscribe to the indicator to enable automated trading based on capital flows. Data is for reference only.

News