News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1 Bitget Daily Digest (Dec. 18)|U.S. SEC issues a Statement on the Custody of Crypto Asset Securities by Broker-Dealers; LayerZero (ZRO) to unlock ~25.71 million tokens on Dec. 202Bitget US Stock Morning Brief | S&P 500 Four-Day Decline; Oracle AI Financing Stalls; Energy & Precious Metals Rally; Micron Crushes Guidance, Surges After Hours (December 18, 2025)3SEC says broker-dealers need to maintain crypto private keys to comply with customer protection rules

Crypto ETP Liquidations: The Looming Wave of Failed Investment Products Predicted for 2026

Bitcoinworld·2025/12/18 04:48

Is VC "dead"? No, the brutal reshuffling of Web3 has just begun.

Odaily星球日报·2025/12/18 04:42

Bitcoin ETFs Surge: $459 Million Flood Reverses Outflow Trend with Stunning Momentum

Bitcoinworld·2025/12/18 04:27

Strategic Move: TORICO’s $3 Million Plan to Purchase ETH Signals Major Institutional Shift

Bitcoinworld·2025/12/18 04:18

Cathie Wood's Ark Invest scoops up more BitMine shares at discount

The Block·2025/12/18 03:45

Revolutionary Ondo Bridge Launches: Unlocking 100+ Real-World Asset Tokens Across Chains

Bitcoinworld·2025/12/18 03:42

Unmissable: Quack AI’s Builder Night Seoul Summit Unites AI and Web3 Leaders on Dec 22

Bitcoinworld·2025/12/18 03:06

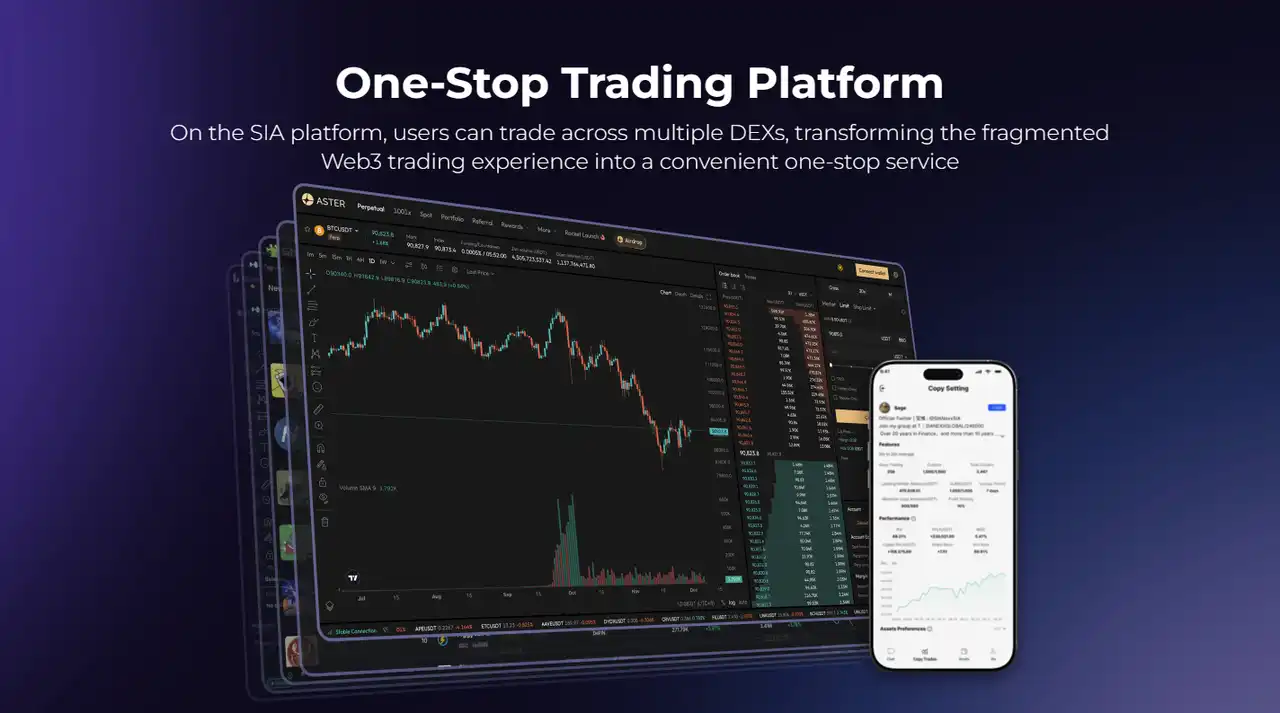

SIA: From a super AI trading platform to a functional on-chain AI ecosystem

BlockBeats·2025/12/18 03:02

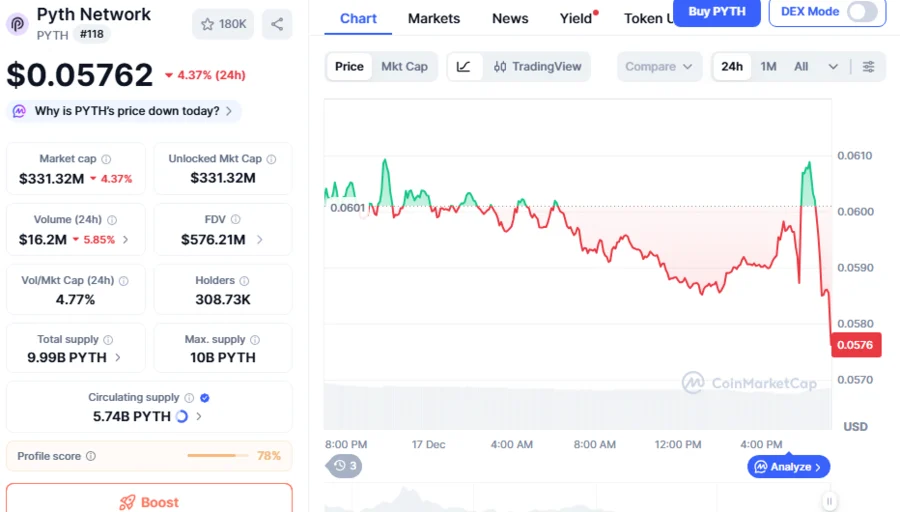

PYTH Drops 76% As Crypto Weakness Persists, Can New PYTH Network Reserve Trigger Market Rally?

BlockchainReporter·2025/12/18 03:00

Flash

04:49

Tokyo Stock Exchange-listed company TORICO announces ETH treasury strategy, raising 470 million yen to be fully used for purchasing EthereumAccording to TechFlow, on December 18, CoinDesk reported that TSE-listed company TORICO (operator of "漫画全巻ドットコム") has entered into a capital and business partnership with Web3 gaming platform Mint Town, raising approximately 470 million yen, all of which will be used to purchase Ethereum (ETH). Mint Town has become TORICO's largest shareholder, holding about 23.36% of the shares, and its CEO Hirotake Kunimitsu will serve as TORICO's "Treasury Strategy Advisor" and is expected to join the board of directors in June 2026. Kunimitsu defines this strategy as "Treasury (DAT) 2.0," emphasizing that ETH, as "digital oil," not only has practical value but can also generate cash flow through staking and DeFi operations, forming a differentiated investment strategy from Bitcoin, which is regarded as "digital gold." TORICO plans to begin phased purchases of ETH starting January 2026.

04:46

VivoPower and Lean Ventures seek $300 million Ripple Labs equity stakeVivoPower is partnering with Lean Ventures to acquire shares in Ripple Labs, indirectly providing investors with exposure to nearly $1 billion worth of XRP. This joint venture aims to seek $300 million in Ripple Labs equity for Korean institutional and qualified retail investors. VivoPower expects to earn $75 million over three years from management fees and performance incentives, without using its own capital.

04:44

Shield Protocol: A whale user's multi-signature wallet was hacked due to a private key leak, resulting in a loss of $23.7 million.BlockBeats News, December 18, According to PeckShield monitoring, a whale user's multi-signature wallet was hacked due to a private key leak, resulting in a loss of approximately $27.3 million.

The hacker has already laundered $12.6 million through TornadoCash (equivalent to 4100 ETH) and holds about $2 million in liquid assets. Moreover, the attacker has taken control of the victim's multi-signature wallet. This wallet has a leveraged long position on the Aave platform: it deposited $25 million worth of ETH as collateral and borrowed 12.3 million DAI.

News