News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

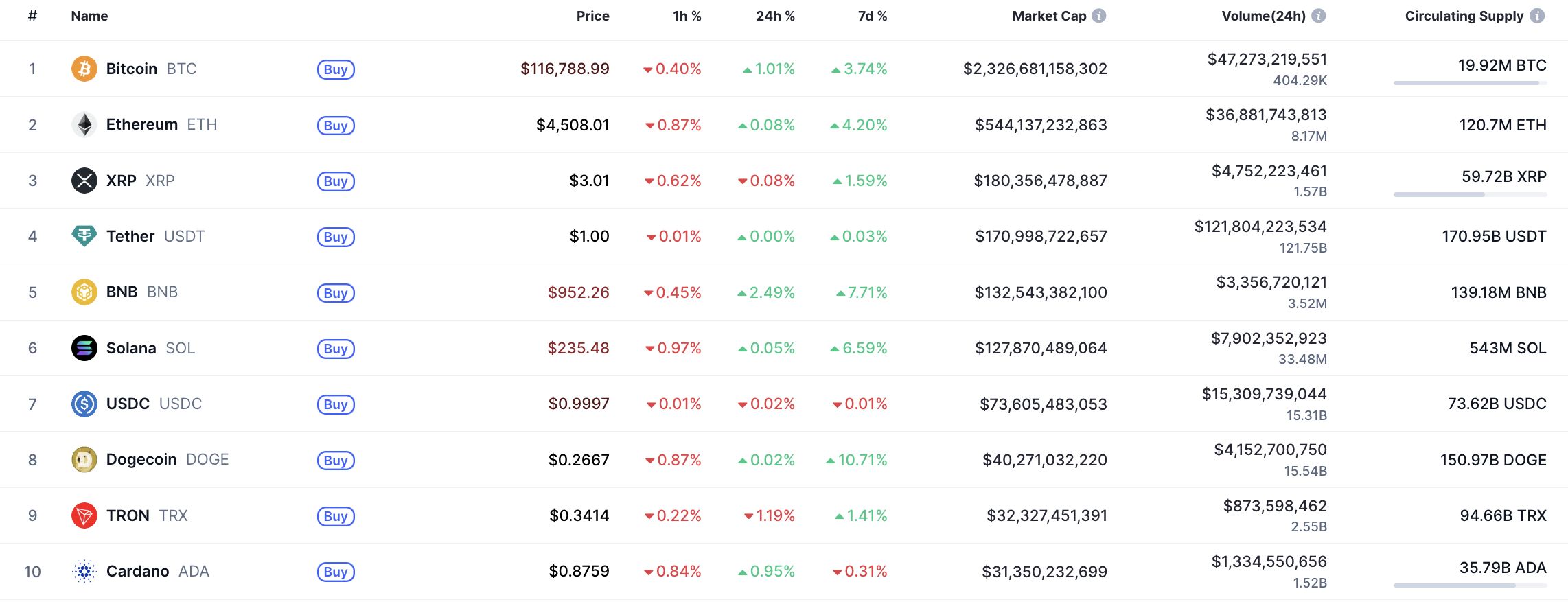

1Bitget Daily Digest(September 17)|Fed may announce 25 basis point rate cut at FOMC meeting; ZKsync to unlock 173 million tokens today; US and UK to deepen cooperation on crypto regulation2Bitcoin May Consolidate Around $115,000–$116,000 as Market Attempts to Stay Bullish, CoinStats Says3Cardano Shows Mixed Signals as Short-Term Charts Trend Bearish While Cycle Analysis Suggests Possible Early Bullish Phase

Solana Could Remain Rangebound Near $230–$240 After False Breakout, Possibly Testing $220–$230

Coinotag·2025/09/17 18:15

Midweek CoinStats: DOGE May Consolidate Near $0.27, Could Break Toward $0.30–$0.35

Coinotag·2025/09/17 18:15

SHIB May Remain Sideways Near $0.000013 After False Breakout, Could Test $0.00001290

Coinotag·2025/09/17 18:15

Bitcoin Could Trade Near $116K as Fed 25bp Cut Signals Possible Post‑LTCM Easing

Coinotag·2025/09/17 18:15

Solana (SOL) Holds Recent Gains – Key Levels Before Another Surge

Newsbtc·2025/09/17 18:12

Circle Expands USDC Stablecoin to Hyperliquid Network

In Brief Circle integrates native USDC onto Hyperliquid augmenting its digital currency footprint. Investment in HYPE signifies Circle’s influential stake within the Hyperliquid ecosystem. The roll-out of USDH poses potential challenges for Circle's reserve income streams.

Cointurk·2025/09/17 17:58

3 Altcoins That Could Deliver 50x Gains

Cryptonewsland·2025/09/17 17:54

Experts Pick Three Altcoins Primed for Big Gains: XRP, DOGE, and ADA

Cryptonewsland·2025/09/17 17:54

PEPE Price Holds $0.00001073 Support, Faces $0.00001118 Resistance as 1.5-Year Consolidation Meets FOMC Decision

Cryptonewsland·2025/09/17 17:54

Flash

- 19:15Fitch: The Federal Reserve is fully supporting employment and will tolerate higher inflation in the short termAccording to Golden Ten Data, Olu Sonola, Head of U.S. Economic Research at Fitch, stated that the Federal Reserve is now fully supporting the labor market and has made it clear that it will enter a decisive and aggressive rate-cutting cycle in 2025. The message is very clear: growth and employment are the top priorities, even if this means tolerating higher inflation in the short term.

- 19:08Powell: The Federal Reserve Shifts Policy Focus from Inflation to EmploymentAccording to ChainCatcher, citing Golden Ten Data, Federal Reserve Chairman Powell emphasized that, given signs that the labor market is "truly cooling," the Fed is inclined to achieve "maximum employment" in its dual mandate. He pointed out that since April, the risk of persistently high inflation has decreased, partly due to a slowdown in job growth. At the same time, downside risks in the labor market have increased, and the number of new jobs appears to be below the "breakeven rate" needed to maintain the unemployment rate.

- 18:59Powell: The Tension Between Slowing Economic Growth and High InflationChainCatcher news, according to Golden Ten Data, Federal Reserve Chairman Powell discussed the factors behind the Fed's 25 basis point rate cut at a press conference. He pointed out that economic growth slowed in the first half of this year, while inflation has risen and remains at a high level. Powell also mentioned that downside risks to employment have increased and described the labor market as "lackluster and weak."