News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 19)|Fed Holds Rates at 4.25%-4.50%; ~$23B Bitcoin Options Expire Next Friday, Volatility May Intensify2Bitget US Stock Morning Brief | CPI Cools Ahead of Expectations; AI Giants Join Genesis Initiative; NYSE Holiday Trading Unchanged (December 19, 2025)3Senate confirms CFTC Chair pick Michael Selig as agency takes larger role regulating crypto

'We are closer than ever': US crypto czar David Sacks says Clarity Act markup confirmed for January

The Block·2025/12/19 03:36

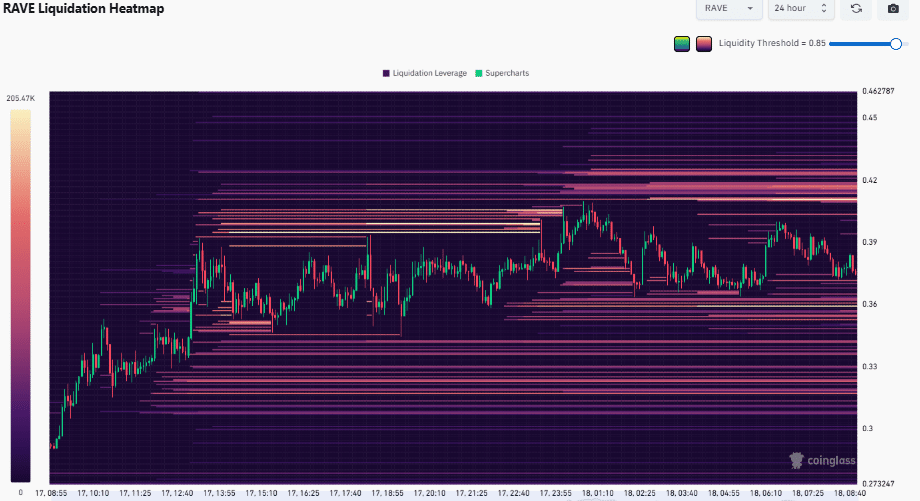

RAVE rallies 29%, but is the post-launch correction already over?

AMBCrypto·2025/12/19 03:03

Stability World AI and Cache Wallet Collaborate to Redefine Asset Recovery and Digital Ownership

BlockchainReporter·2025/12/19 03:00

Solana, Aptos Move to Harden Blockchains Against Future Quantum Attacks

Decrypt·2025/12/19 02:50

Revealed: Bitmain’s Massive $229.3 Million Ethereum Purchase Signals Bullish Confidence

Bitcoinworld·2025/12/19 02:42

Revolutionary aPriori Chainlink Partnership Unlocks Seamless Cross-Chain Trading

Bitcoinworld·2025/12/19 02:27

Revolutionary SportsFi Platform GolfN Drives Global Expansion with Major Brand Partnerships

Bitcoinworld·2025/12/19 02:15

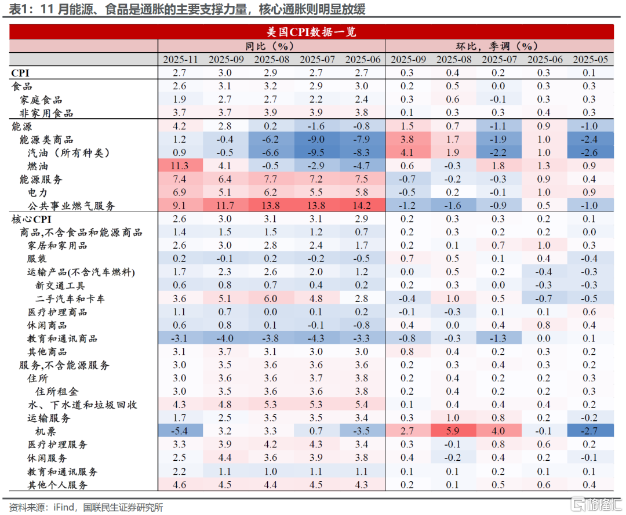

US CPI Surprises, Is There a Turning Point for the Doves?

AIcoin·2025/12/19 02:06

Flash

03:35

Japan Raises Interest Rates: Bitcoin Surges Over 2% in ResponseBlockBeats News, December 19th, according to an exchange market information, with market concerns about Japan's interest rate hike "shoe drop," Bitcoin rose by 2.19%, now trading at $87,489.

Earlier reports indicated that the Bank of Japan raised interest rates by 25 basis points as scheduled, while also stating that if the economic and price trends are in line with expectations and improve along with the economy and prices, they will continue to raise the policy rate.

03:31

The Bank of Japan has raised interest rates three times before, and each time Bitcoin has experienced a drop of over 20%.BlockBeats News, December 19th. According to market data, since 2024, the Bank of Japan has implemented interest rate hikes three times, in March and July of 24 and in January of this year. Over the past few decades, a significant portion of global capital market liquidity has actually come from Japan, not just the United States. Due to Japan's long-standing zero or even negative interest rate policy (NIRP), coupled with an extremely loose monetary environment, Japan has effectively served as a low-cost funding ATM for the global financial system.

Therefore, Japan's interest rate hikes have had a significant tightening effect on global liquidity. Bitcoin has experienced price declines after each of the three mentioned interest rate hikes, with decreases of 23.06%, 26.61%, and 31.89%, respectively.

However, the latest round of interest rate hikes in Japan was well anticipated, and the market has already responded proactively. Whether this round of rate hikes will lead to a similar Bitcoin price drop as seen before remains uncertain.

03:25

The US dollar surged nearly 60 points against the Japanese yen in the short term, breaking through 156.ChainCatcher News, according to Golden Ten Data, USD/JPY surged nearly 60 points in the short term, breaking through 156, with an intraday increase of 0.28%.

News