News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 15)|Hassett stresses Fed independence, says Trump’s views “carry no weight”; Bitcoin OG increases ETH long positions, total exposure reaches $676 million2Bitcoin will ‘dump below $70K’ thanks to hawkish Japan: Macro analysts3Bitcoin ‘extreme low volatility’ to end amid new $50K BTC price target

Crypto Coins Surge: Major Unlocks Impact Short-Term Market Dynamics

In Brief Crypto market anticipates large-scale unlocks, exceeding $309 million in total market value. Significant cliff-type unlocks involve ZK and ZRO, impacting market dynamics. RAIN, SOL, TRUMP, and WLD highlight notable linear unlocks within the same period.

Cointurk·2025/12/15 11:57

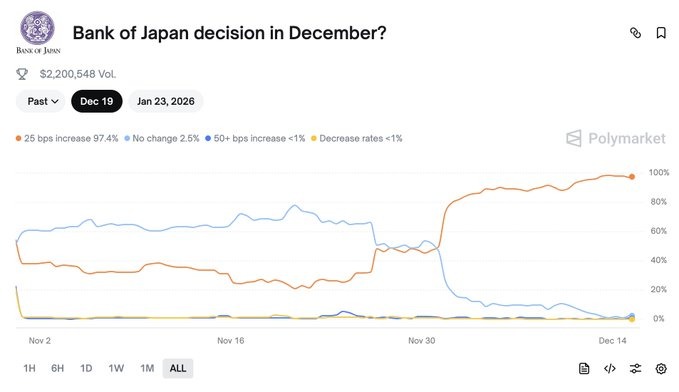

Bitcoin Stable But Fragile Ahead Of BoJ Decision

Cointribune·2025/12/15 11:51

BONK Remains Under Pressure as Bearish Structure Limits Recovery Attempts

Cointribune·2025/12/15 11:51

Bitcoin Short-Term Holders Capitulating: What This Critical Signal Means for BTC Price

BitcoinWorld·2025/12/15 11:42

SEC Crypto Lawsuits: The Stunning Halt in Legal Action Under New Leadership

BitcoinWorld·2025/12/15 11:42

Stark Bitcoin Price Prediction: Analyst Foresees a Drop to $40,000 by 2026

BitcoinWorld·2025/12/15 11:42

Revolutionary: JPMorgan’s Ethereum Tokenized Money Market Fund Signals Major Crypto Adoption

BitcoinWorld·2025/12/15 11:42

Ondo Price Prediction: A Stunning Forecast for 2025-2030 and the $10 Dream

BitcoinWorld·2025/12/15 11:42

Digital Asset Funds Achieve Stunning $864M Inflow Streak: Cautious Optimism Returns

BitcoinWorld·2025/12/15 11:42

Bitcoin Price To Crash Below $70K as Japan Rate Hike Looms

Coinpedia·2025/12/15 11:21

Flash

- 12:28Crypto fund C1 Fund announces acquisition of Consensys equityJinse Finance reported that crypto fund C1 Fund has announced the acquisition of equity in Consensys, the parent company of MetaMask, a self-custody crypto wallet and infrastructure provider for the Ethereum ecosystem. The specific purchase amount and equity ratio have not yet been disclosed. It is reported that C1 Fund previously announced a public offering of $60 million, aiming to increase its investment in the digital asset technology sector, and has also acquired equity in Ripple and Chainalysis.

- 12:28Bitdeer mined 526 bitcoins in November, a year-on-year increase of 251%On December 15, according to Globe Newswire, cryptocurrency exchange mining and AI cloud services company Bitdeer Technologies Group (NASDAQ: BTDR) released its November operational data. In November, the company mined 526 bitcoins, representing a year-on-year increase of 251% and a month-on-month increase of 3%. The company's proprietary mining hash rate reached 45.7 EH/s.

- 12:13Juventus shares surge nearly 14% after rejecting Tether's acquisition offerChainCatcher news, according to Reuters, shares of Serie A football club Juventus (JUVE.MI) surged nearly 14% on Monday after Italy's Agnelli family rejected a takeover bid of over 1 billion euros (about $1.2 billion) from crypto group Tether last Saturday. Previously, Agnelli family holding company Exor (EXOR.AS) stated that despite Tether's offer representing a 21% premium over Friday's closing price, it had no intention of selling any stake in the club. Equita analyst Martino De Ambroggi pointed out that, based on Friday's market value, Juventus accounts for about 2% of Exor's net assets. If the sale were completed, Exor's net debt could be reduced by about 650 million euros to around 1.6 billion euros. However, the Juventus club is an asset that has helped Exor absorb about 600 million euros in capital increases over the past six years.

News