News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 5) | 21Shares Launches 2x Leveraged SUI ETF on Nasdaq; U.S. Treasury Debt Surpasses $30 Trillion; JPMorgan: Strategy’s Resilience May Determine Bitcoin’s Short-Term Trend2Bitcoin looks increasingly like it did in 2022: Can BTC price avoid $68K?3The Chainlink ETF Disappoints Despite $41 Million Inflows — Why?

OpenAI Ordered to Hand Over 20M ChatGPT Logs in NYT Copyright Case

Cointime·2025/12/05 09:45

Unprecedented "burn rate"! Wall Street estimates: Before turning profitable, OpenAI will have accumulated losses of $140 billion.

According to data cited by Deutsche Bank, OpenAI may accumulate losses exceeding 140 billions USD before reaching profitability, with computing power expenses far surpassing revenue expectations.

ForesightNews·2025/12/05 09:22

Bitget·2025/12/05 09:00

Morning Brief | Ethereum completes Fusaka upgrade; Digital Asset raises $50 million; CZ's latest interview in Dubai

Overview of major market events on December 4.

Chaincatcher·2025/12/05 08:31

BitsLab gathers ecosystem partners in San Francisco to host the x402 Builders Meetup

San Francisco x402 Builders Meetup

Chaincatcher·2025/12/05 08:30

The trend of the United States embracing the crypto economy is now irreversible.

The K-shaped growth of the US economy, Wall Street's irreversible embrace of the crypto trend, and the stablecoin B-side becoming the main battleground.

Chaincatcher·2025/12/05 08:30

Will Trump become the most financially powerful president in U.S. history?

AICoin·2025/12/05 08:24

BTC mining faces short-term pressure, why does JPMorgan have a high target of $170,000?

AICoin·2025/12/05 08:24

The US CFTC officially approves cryptocurrency spot products, reshaping the regulatory landscape from the "crypto sprint" to 2025

US crypto regulation is gradually becoming clearer.

ForesightNews 速递·2025/12/05 08:22

Controversial Strategy: The Dilemma of BTC Faith Stocks After a Sharp Decline

金色财经·2025/12/05 07:51

Flash

- 10:04Glassnode: Short-term holders bore most of the losses during this BTC correctionAccording to a report by Jinse Finance, Glassnode data shows that the recent BTC correction has triggered the largest surge in realized losses since the FTX collapse at the end of 2022. Short-term holders (STH) accounted for the majority of the losses, while long-term holders (LTH) experienced relatively limited losses, indicating that the pressure is mainly concentrated among recent buyers.

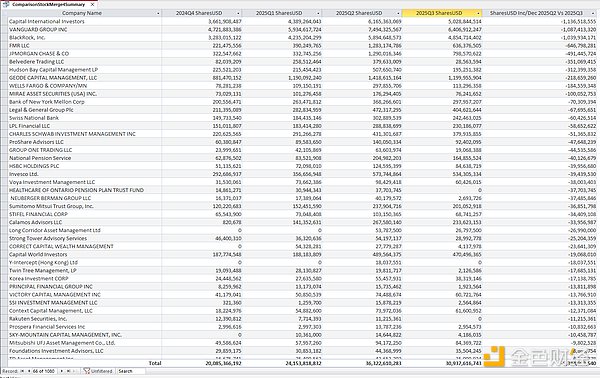

- 09:53Morgan Stanley expects the Federal Reserve to cut interest rates by 25 basis points to 3% - 3.25% in 2026ChainCatcher news, according to Golden Ten Data, Morgan Stanley expects the Federal Reserve to cut interest rates by 25 basis points in January and April 2026, with the final target rate range at 3% - 3.25%.

- 09:52Matrixport: Bitcoin's current rebound is more reflected in position structure rather than price itselfForesight News reported that Matrixport tweeted, "Bitcoin's current rebound is more reflected in the position structure rather than the price itself: the overall positions of ETH and BTC have fallen back to a low range. A similar light position pattern earlier this year pushed prices up by about 38% within a few days. In this near 'position vacuum' environment, any new exposure could drive the price up much faster than most traders expect. At the same time, Ethereum's major upgrade has substantially changed its economic structure, but the market's response to this remains relatively conservative. During the last upgrade cycle, Ethereum experienced a strong rally under the combined influence of several positive factors; whether this round can repeat that performance remains to be seen, especially as Treasury-related buying is no longer as stable as before." Even with the above uncertainties, ETH's price and position performance have remained strong since May: ETH has risen significantly within a few days, and futures open interest doubled from $8 billions to $16 billions in just a few days. Last week, about 35.8% of options traded were call option buys, and traders are quietly adding back bullish positions."

News