News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 16)|Crypto market sees $508 million in long liquidations over 24 hours; Hassett faces opposition from Trump-aligned senior figures in Fed chair contest2Bitget US Stock Morning Report | US Stocks Fluctuate and Retreat, Tesla Hits New High for the Year, Fed Shows Strong Economic Confidence, Non-farm Payrolls to be Released Tonight, Commodity Prices Fluctuate Violently3Bitcoin sees ‘pure manipulation’ as US sell-off liquidates $200M in an hour

SLX will launch on Legion on December 22, the Winter Solstice.

BlockBeats·2025/12/16 10:07

Alarming Surge: South Korean Crypto Exchanges Face Record 1.15 Million Hacking Attempts

Bitcoinworld·2025/12/16 10:01

CMTA Adopts Chainlink Interoperability Standard for Cross-Chain Tokenized Assets

BlockchainReporter·2025/12/16 10:01

Unshakable Conviction: Why LD Capital’s Founder Sees Strong ETH Fundamentals Amid Market Volatility

Bitcoinworld·2025/12/16 09:57

Bank of America predicts that banks’ transition to blockchain will take years

币界网·2025/12/16 09:52

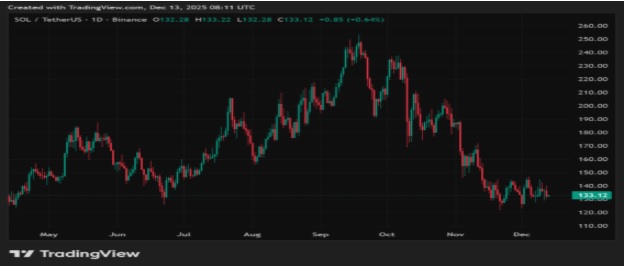

Solana December 16 Price Prediction: Key Level for SOL Price Recovery

币界网·2025/12/16 09:51

MetaMask adds native Bitcoin support, accelerating its multi-chain strategy

币界网·2025/12/16 09:51

APRO: A Rising Star in AI-Enhanced Decentralized Oracles

币界网·2025/12/16 09:49

Flash

- 09:43Morgan Stanley: Stablecoin Companies Increase Gold Purchases, Posing Upside Risk for GoldMorgan Stanley: Stablecoin Companies Increase Gold Purchases, Gold Faces Upside Risk 2025-12-16 09:29 BlockBeats news, on December 16, Morgan Stanley published an analysis stating that as expectations for interest rate cuts persist and the US Dollar Index is expected to weaken again, gold is likely to continue receiving macro-level support, with prices potentially rising to $4,800 per ounce by the fourth quarter of 2026. "We believe that due to central banks increasing gold purchases to new highs, concerns over global growth, and stablecoin companies ramping up gold buying, gold faces upside risk." Investment demand for silver is likely to remain dominant, and with inventories at low levels, there is a possibility of a physical short squeeze. (Golden Ten Data) Report Correction/Report This platform has now fully integrated the Farcaster protocol. If you already have a Farcaster account, you can log in to post comments

- 09:42Morgan Stanley: Gold is expected to rise to $4,800 per ounce by Q4 2026Jinse Finance reported that Morgan Stanley stated: As expectations for interest rate cuts persist and the US Dollar Index is expected to weaken again, gold is likely to continue receiving macro-level support and may rise to $4,800 per ounce by the fourth quarter of 2026.

- 09:41Yi Lihua once again "bullish" on Ethereum, remains confident in its fundamentals, current fluctuations are within the normal rangeBlockBeats News, December 16, Liquid Capital (formerly LD Capital) founder Yi Lihua posted on social media, stating, "I remain firmly optimistic about the fundamentals of ETH, but since the major crash on October 11, market liquidity has significantly decreased. The derivatives market now dominates rather than the spot market. The current fluctuations are all within a normal range, especially with the four-year cycle resonance and the upcoming Christmas holiday. However, for spot investors, it is not always necessary to buy at the lowest price; it is also an appropriate investment price range." From a medium- to long-term investment perspective, especially in the new era of on-chain finance, ETH is the core investment asset, and WLFI and others are core allocation investments. Our investment and data logic have not changed from our previous research reports."

News