News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Nonfarm payrolls are a "mixed bag"—whose forecast should we trust for next year's rate cuts?

AIcoin·2025/12/17 02:23

HashKey Holdings Soars: Shares Jump 3% in Stunning Hong Kong Trading Debut

Bitcoinworld·2025/12/17 02:12

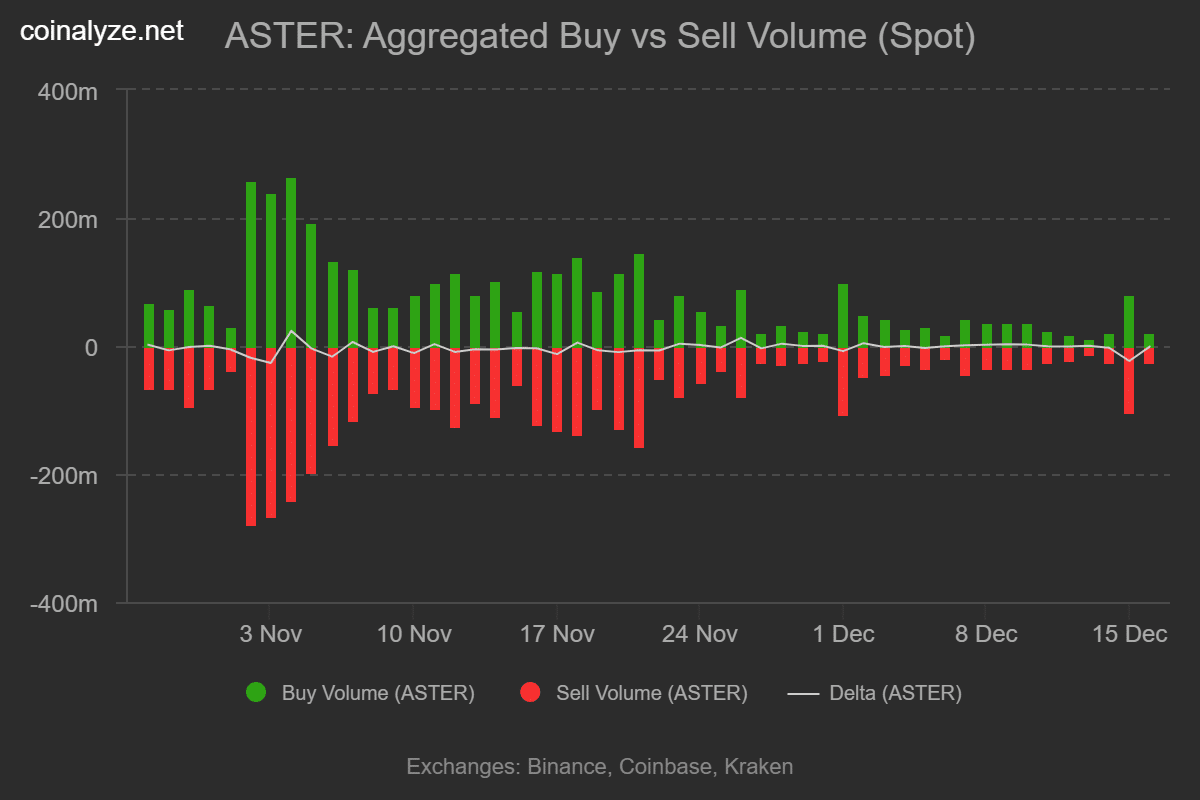

Astar DEX's Shield Mode is live, but the bears haven't given up yet.

币界网·2025/12/17 02:11

Aster Dex’s Shield Mode goes live, but bears aren’t giving up yet

BlockBeats·2025/12/17 02:03

24-hour cryptocurrency market update: Morpho, Monero, and Kaspa lead the gains

币界网·2025/12/17 01:54

Explosive Growth: Over 100 New Crypto ETPs Predicted for 2026

Bitcoinworld·2025/12/17 01:48

Revealed: Why Younger Generations Invest 3x More in Crypto for Future Wealth

Bitcoinworld·2025/12/17 01:42

Flash

- 02:27Current mainstream CEX and DEX funding rates indicate the market is slightly returning to neutrality.Current Mainstream CEX and DEX Funding Rates Indicate Market Slightly Returning to Neutral 2025-12-17 02:25 BlockBeats News, December 17, according to Coinglass data, the current funding rates on mainstream CEX and DEX platforms show that after a rebound over the past two days, the BTC contract funding rate on a certain exchange has returned from a previous negative rate to neutral. The specific funding rates for mainstream tokens are shown in the attached chart. BlockBeats Note: Funding rates are fees set by cryptocurrency trading platforms to maintain the balance between contract prices and the underlying asset prices, usually applied to perpetual contracts. It is a mechanism for capital exchange between long and short traders. The trading platform does not charge this fee; it is used to adjust the cost or profit of holding contracts, so that the contract price remains close to the underlying asset price. When the funding rate is 0.01%, it represents the benchmark rate. When the funding rate is greater than 0.01%, it indicates that the market is generally bullish. When the funding rate is less than 0.005%, it indicates that the market is generally bearish. Report Correction/Report This platform is now fully integrated with the Farcaster protocol. If you already have a Farcaster account, you can log in to comment

- 02:24The crypto sector sees widespread gains, with BTC surpassing $87,000, while only the AI and NFT sectors are declining.According to SoSoValue data, the crypto market has generally rebounded, with Bitcoin (BTC) rising by 2.01% and breaking through $87,000. Meanwhile, Ethereum (ETH) increased by 0.12%, still fluctuating narrowly around $2,900. Notably, MAG7.ssi rose by 1.79%, DEFI.ssi increased by 0.34%, and MEME.ssi climbed by 1.28%. Other standout sectors include: the SocialFi sector, which rose by 3.53% in the past 24 hours, with Toncoin (TON) up 4.08%; the PayFi sector increased by 2.62%, with Telcoin (TEL) up 5.11% within the sector; the RWA sector rose by 2.58%, and MANTRA (OM) surged by 12.90%. In other sectors, the Layer1 sector rose by 1.53%, with Sui (SUI) up 3.70%; the CeFi sector increased by 1.52%, with a certain exchange up 3.20% within the sector; the Layer2 sector rose by 1.14%, with Zora (ZORA) up 9.83%; the DeFi sector increased by 0.57%, with Uniswap (UNI) up 3.88%; the Meme sector rose by 0.41%, with SPX6900 (SPX) up 5.86%. In addition, the AI sector fell by 1.37%, but Fartcoin (FARTCOIN) bucked the trend and rose by 10.30%; the NFT sector dropped by 1.68%, with APENFT (NFT) down 10.83%. Crypto sector indices reflecting historical sector performance show that the ssiGameFi, ssiSocialFi, and ssiRWA indices rose by 4.42%, 3.99%, and 3.18% respectively.

- 02:24Top Whale Moves Overview: "$45M in Losses Unmoved by 'BTC OG Insider Whale,' Swing Whale 'pension-usdt.eth' Goes Short on ETH"BlockBeats News, December 17th, according to Coinbob Popular Address Monitor, the "BTC OG Insider Whale" is facing a large unrealized loss and has not made any position adjustments yet. The swing trader whale "pension-usdt.eth" closed its BTC long position yesterday and then opened a short position in ETH. The specific information is as follows: "pension-usdt.eth": In the past 11 hours, this address completely closed its BTC long position, realizing a profit of approximately $1.04 million. It subsequently opened a 3x leveraged ETH short position with a position size of around $74.1 million and an average price of $2929. "BTC OG Insider Whale": The account still maintains a significant unrealized loss of over $45 million, with no position adjustments made today. The current unrealized loss on the ETH long position is $39.5 million (-35%), with an average price of $3167 and a position size of approximately $564 million. It also holds unrealized losses on BTC long and SOL long positions, with the total account position size now around $684 million, making it the top ETH long position on Hyperliquid. "Ultimate Short": Closed a BTC short position of around $8.6 million yesterday, realizing a profit of approximately $2.37 million, and then withdrew around $5 million. The current BTC short position size is approximately $63.27 million, with an unrealized gain of $17.08 million (539%) and a liquidation price reduced to $97,000. "Paul Wei": Adjusted the BTC long and short order trigger range, set around $84,300 to $90,100. Accumulated a profit of $3,100 since November 16th. The current BTC long position's unrealized loss has narrowed to 2%, accounting for 17% of the total $100,000 capital, with most of the funds still in pending orders. "Calm Order Placer": The total position size of BTC, ETH, and SOL long positions is $6.8 million, with an overall unrealized profit of around $26,000. Recorded a profit of about $63,000 in the past 24 hours, with the current account funds still below $300,000.

News