News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 17)|U.S. seasonally adjusted nonfarm payrolls for November increased by 64,000; BlackRock transferred approximately $140 million worth of ETH to a CEX2Bitget US Stock Morning Brief | Fed Independence Reaffirmed; NFP Beats Expectations; Tech Rally Lifts Market (December 17, 2025)

Revolutionary Open-Source Password Manager: Tether’s Bold Leap into Cybersecurity with PearPass

Bitcoinworld·2025/12/17 12:51

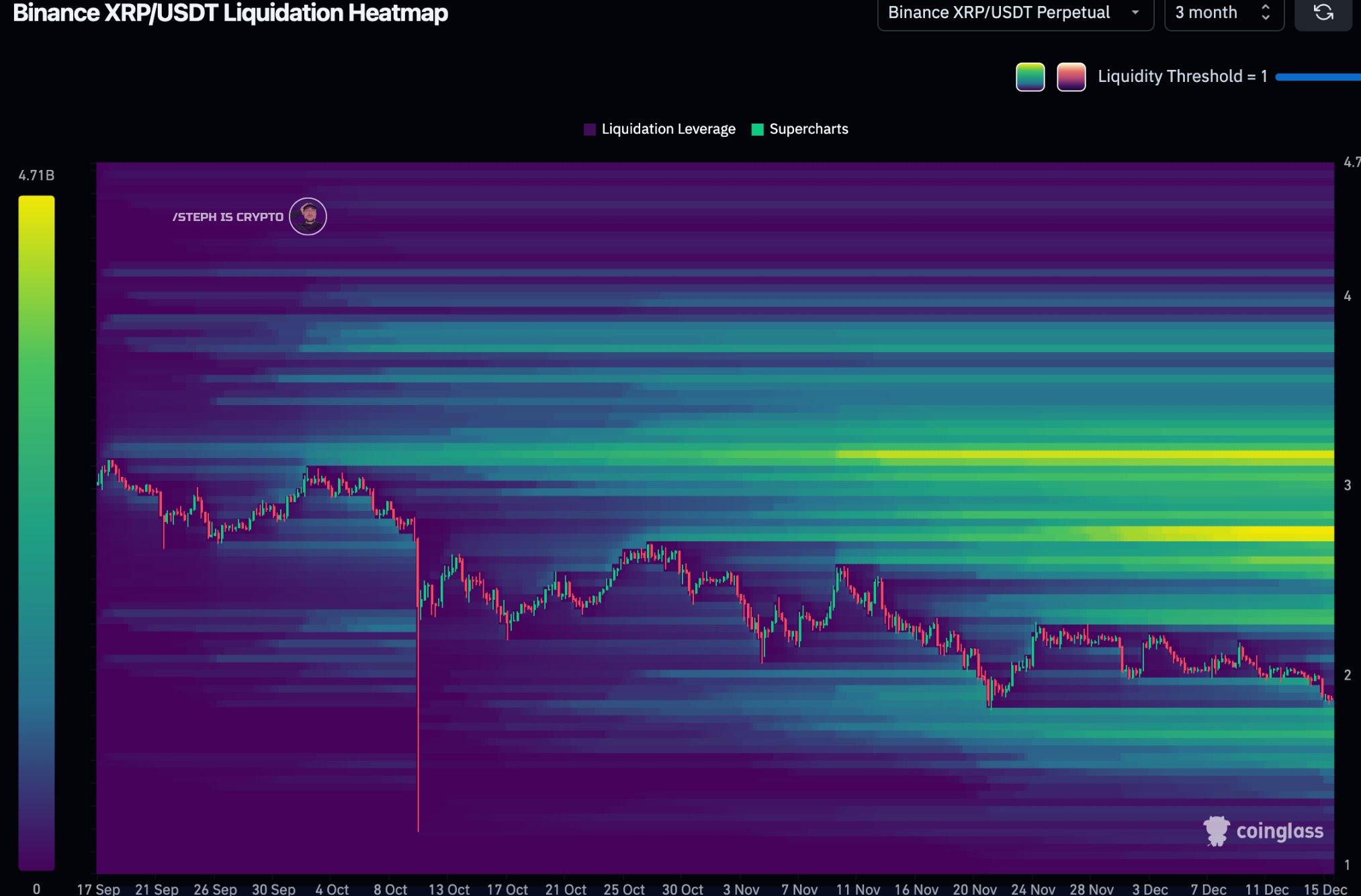

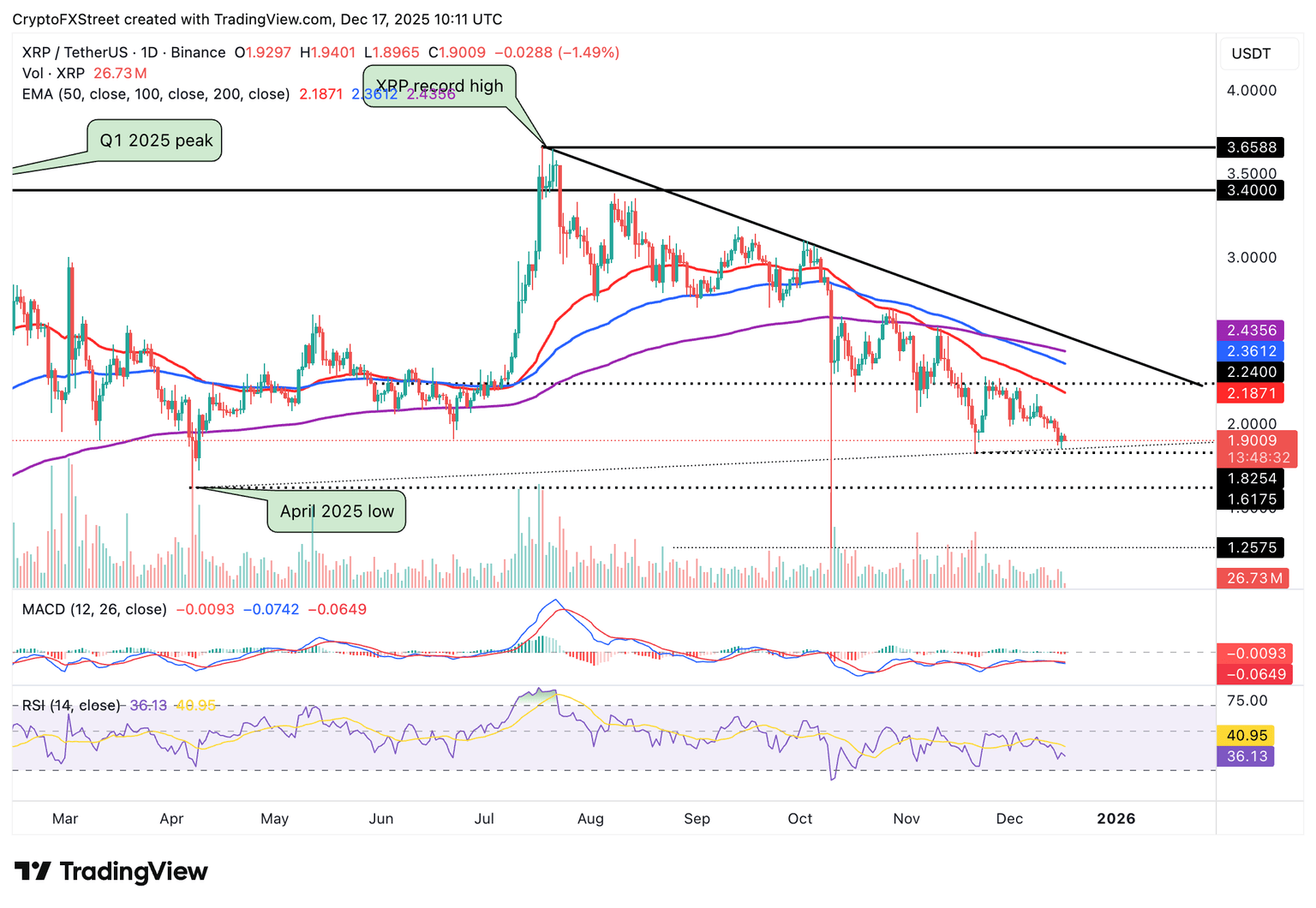

December 17 XRP Price Prediction: Can XRP Find a Bottom and Reach $3?

币界网·2025/12/17 12:48

Strategic Shift: Norway’s $1.6 Trillion Fund Boldly Backs Metaplanet’s Bitcoin Strategy

Bitcoinworld·2025/12/17 12:45

Opinion Labs Stuns Market: Hits $6.4B Trading Volume in Just 50 Days

Bitcoinworld·2025/12/17 12:42

Aave founder charts 'master plan' to trillion-dollar scale as DAO tensions mount, SEC ends 4-year probe

The Block·2025/12/17 12:39

Dogecoin Price Prediction 2025-2030: Will DOGE Finally Reach the Elusive $1 Milestone?

Bitcoinworld·2025/12/17 12:36

Grayscale calls 2026 the dawn of the institutional era for cryptocurrencies.

币界网·2025/12/17 12:33

Flash

13:00

Messari: BNB Chain market cap increased by 51.6% quarter-on-quarter in Q3 to $140.4 billionAccording to the latest report from Odaily, Messari stated that in Q3 2025, BNB Chain's market capitalization increased by 51.6% quarter-on-quarter to $140.4 billion, ranking fifth in the crypto market. The total value locked (TVL) in DeFi grew by 30.7% to $7.8 billion, surpassing Tron and rising to third place. The stablecoin market capitalization increased by 32.3% to $13.9 billion, with USDT accounting for 57.4%. USDe surged more than tenfold quarter-on-quarter to $430 million, and USDF increased to $360 million.

13:00

Arthur Hayes' address has received a total of 32.42 million USDC from CEX and OTC platforms in the past two days.BlockBeats News, December 17, according to lookonchain monitoring, Arthur Hayes' address has received a total of $32.42 million USDC in the past two days from an exchange, Galaxy Digital, Wintermute, and several other platforms.

12:58

Federal Reserve joint survey: 2% inflation target unlikely to be achieved quickly next yearAccording to Odaily, a survey jointly conducted by the Richmond and Atlanta Federal Reserve Banks and Duke University's Fuqua School of Business shows that corporate financial executives still regard tariffs as a primary concern and, on average, expect prices to rise by about 4% next year. This result may intensify the Federal Reserve's concerns about current price pressures, which could prevent it from achieving its 2% inflation target soon. The survey interviewed 548 chief financial officers between November 11 and December 1. Results indicate that respondents' confidence in both their own companies and the overall U.S. economy has declined. The U.S. overall economic optimism index dropped from 62.9 (out of 100) in the third quarter to 60.2, also below the recent high of 66 reached after President Trump won his current term at the end of 2024. Overall, respondents expect moderate growth in employment and the economy by 2026, with the median company expecting employment to grow by 1.7% (similar to recent surveys), and the annual economic growth rate is expected to be about 1.9%. Less than half (40%) of companies reported hiring for new positions, slightly less than 20% said they were not hiring at all, and about 9% of companies expect to lay off employees. (Golden Ten Data)

News