News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

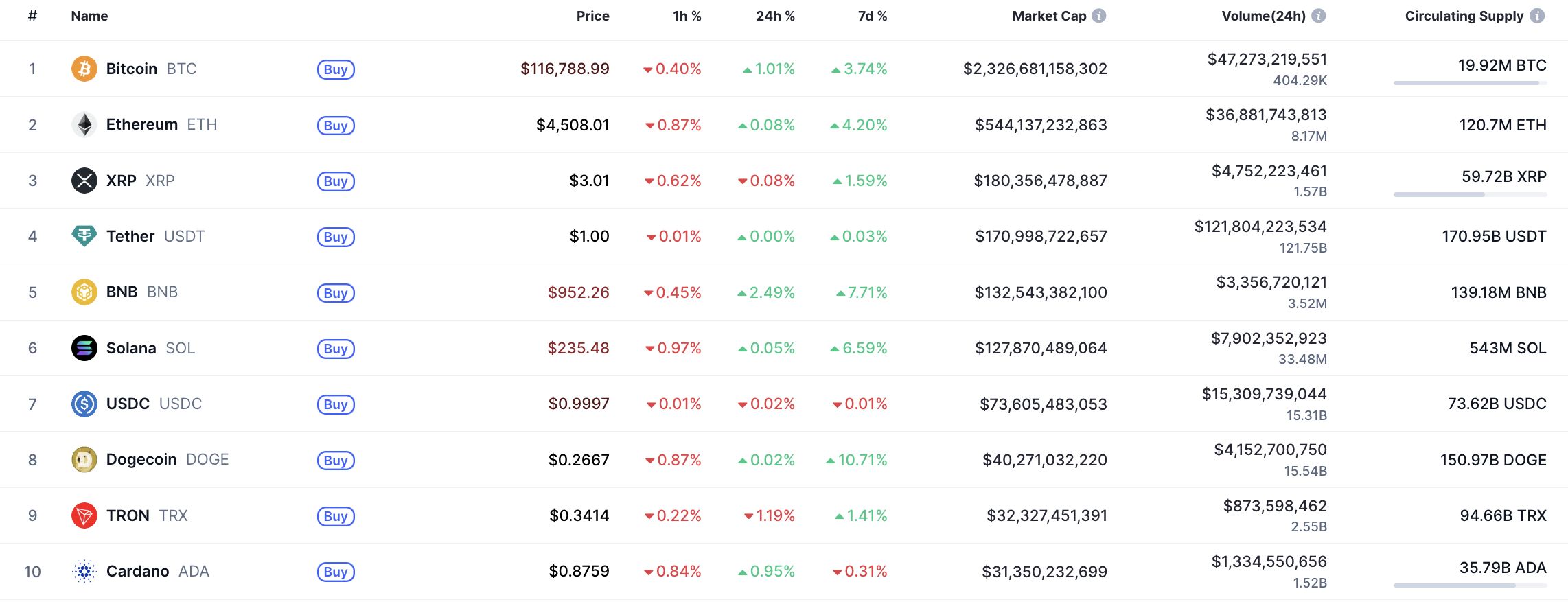

1Bitget Daily Digest(September 17)|Fed may announce 25 basis point rate cut at FOMC meeting; ZKsync to unlock 173 million tokens today; US and UK to deepen cooperation on crypto regulation2Bitcoin May Consolidate Around $115,000–$116,000 as Market Attempts to Stay Bullish, CoinStats Says3Cardano Shows Mixed Signals as Short-Term Charts Trend Bearish While Cycle Analysis Suggests Possible Early Bullish Phase

Is Ethereum Currently Undervalued At $4,700? NVT Reading Suggests So As New Crypto Shines Alongside ETH

TheCryptoUpdates·2025/09/17 21:06

Solana Could Remain Rangebound Near $230–$240 After False Breakout, Possibly Testing $220–$230

Coinotag·2025/09/17 18:15

Midweek CoinStats: DOGE May Consolidate Near $0.27, Could Break Toward $0.30–$0.35

Coinotag·2025/09/17 18:15

SHIB May Remain Sideways Near $0.000013 After False Breakout, Could Test $0.00001290

Coinotag·2025/09/17 18:15

Bitcoin Could Trade Near $116K as Fed 25bp Cut Signals Possible Post‑LTCM Easing

Coinotag·2025/09/17 18:15

Solana (SOL) Holds Recent Gains – Key Levels Before Another Surge

Newsbtc·2025/09/17 18:12

Circle Expands USDC Stablecoin to Hyperliquid Network

In Brief Circle integrates native USDC onto Hyperliquid augmenting its digital currency footprint. Investment in HYPE signifies Circle’s influential stake within the Hyperliquid ecosystem. The roll-out of USDH poses potential challenges for Circle's reserve income streams.

Cointurk·2025/09/17 17:58

3 Altcoins That Could Deliver 50x Gains

Cryptonewsland·2025/09/17 17:54

Experts Pick Three Altcoins Primed for Big Gains: XRP, DOGE, and ADA

Cryptonewsland·2025/09/17 17:54

Flash

- 20:28Mitsubishi UFJ: The Federal Reserve Has Not Entered Rate-Cut Sprint ModeAccording to ChainCatcher, citing Golden Ten Data, George Goncalves, Head of US Macro Strategy at Mitsubishi UFJ, stated that this Federal Reserve decision is the most dovish stance and has added one more rate cut in the dot plot forecast. He pointed out that the Fed has not entered a rate cut sprint mode, but rather has restarted the rate cut process due to the labor market underperforming expectations. This is also the reason why risk assets have reacted mildly. The Fed may cut rates by 25 basis points each in October and December, and a 50 basis point rate cut may not necessarily be favorable for credit. Risk Warning

- 20:28KPMG: The Federal Reserve Maintaining Current Policies Until Next Year May Lead to OverstimulationAccording to ChainCatcher, citing Golden Ten Data, KPMG Chief Economist Diane Swonk stated that the Federal Reserve is attempting to lift some restrictions to boost the labor market. However, if this policy continues into next year, when the Federal Reserve will undergo major leadership changes, there could be a risk of overstimulation. This may result in a more harmful self-fulfilling prophecy, where consumers and businesses expect higher inflation.

- 20:28Meghan Robson: The Federal Reserve will prioritize growth, which may lead to an “overheating” economyAccording to ChainCatcher, citing Jinse Finance, Meghan Robson, Head of US Credit Strategy at BNP Paribas, stated that today's Federal Reserve decision suggests a priority on economic growth over inflation, which could lead to the economy "overheating" until the inflation trajectory becomes clearer. She believes that this policy approach should currently support credit spreads.