News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Shocking Closure: Shima Capital Shuts Down After SEC Fraud Lawsuit

Bitcoinworld·2025/12/17 02:27

Nonfarm payrolls are a "mixed bag"—whose forecast should we trust for next year's rate cuts?

AIcoin·2025/12/17 02:23

HashKey Holdings Soars: Shares Jump 3% in Stunning Hong Kong Trading Debut

Bitcoinworld·2025/12/17 02:12

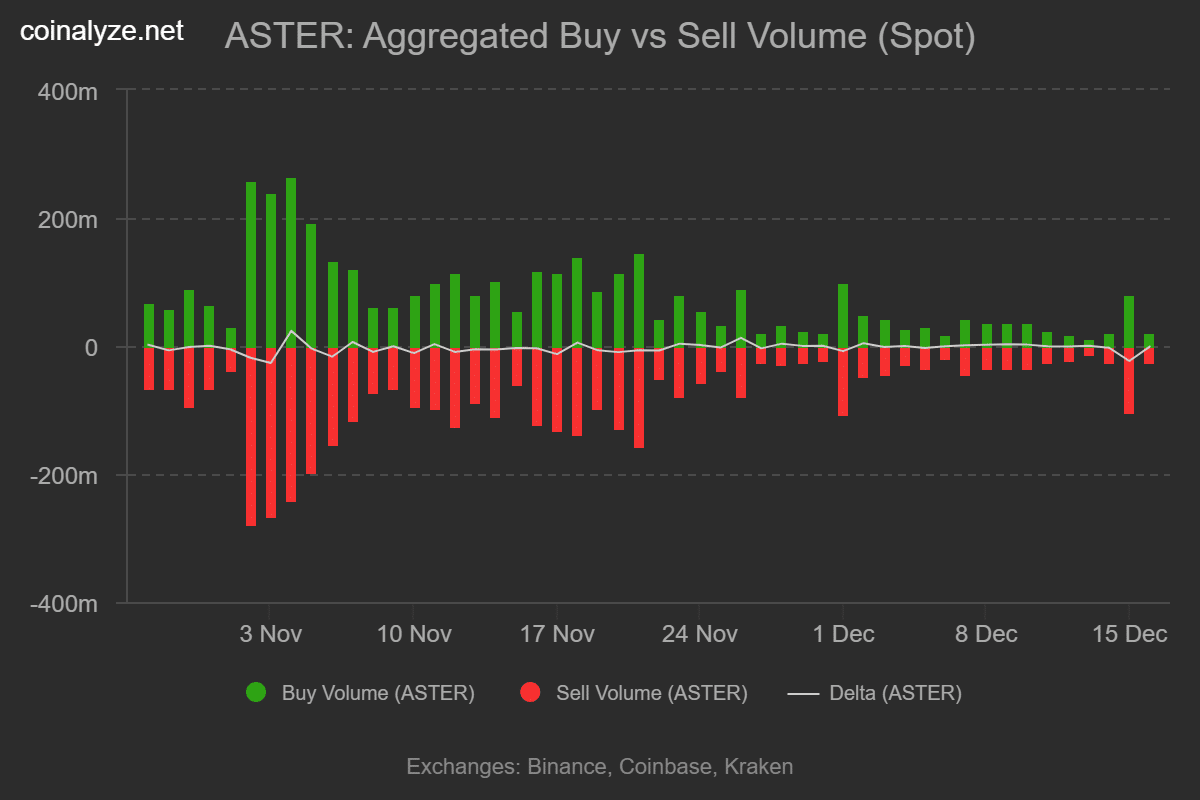

Astar DEX's Shield Mode is live, but the bears haven't given up yet.

币界网·2025/12/17 02:11

Aster Dex’s Shield Mode goes live, but bears aren’t giving up yet

BlockBeats·2025/12/17 02:03

24-hour cryptocurrency market update: Morpho, Monero, and Kaspa lead the gains

币界网·2025/12/17 01:54

Explosive Growth: Over 100 New Crypto ETPs Predicted for 2026

Bitcoinworld·2025/12/17 01:48

Flash

- 02:27Current mainstream CEX and DEX funding rates indicate the market is slightly returning to neutrality.Current Mainstream CEX and DEX Funding Rates Indicate Market Slightly Returning to Neutral 2025-12-17 02:25 BlockBeats News, December 17, according to Coinglass data, the current funding rates on mainstream CEX and DEX platforms show that after a rebound over the past two days, the BTC contract funding rate on a certain exchange has returned from a previous negative rate to neutral. The specific funding rates for mainstream tokens are shown in the attached chart. BlockBeats Note: Funding rates are fees set by cryptocurrency trading platforms to maintain the balance between contract prices and the underlying asset prices, usually applied to perpetual contracts. It is a mechanism for capital exchange between long and short traders. The trading platform does not charge this fee; it is used to adjust the cost or profit of holding contracts, so that the contract price remains close to the underlying asset price. When the funding rate is 0.01%, it represents the benchmark rate. When the funding rate is greater than 0.01%, it indicates that the market is generally bullish. When the funding rate is less than 0.005%, it indicates that the market is generally bearish. Report Correction/Report This platform is now fully integrated with the Farcaster protocol. If you already have a Farcaster account, you can log in to comment

- 02:26Current mainstream CEX and DEX funding rates indicate the market is slightly returning to neutralityBlockBeats News, December 17th, according to Coinglass data, currently, mainstream CEX and DEX funding rates show that after a rebound in the market in the past 2 days, the funding rate on an exchange BTC perpetual contract has returned from a negative rate to neutral. The specific funding rates for mainstream coins are shown in the attached image. BlockBeats Note: Funding Rate is a fee set by cryptocurrency trading platforms to maintain the balance between the contract price and the underlying asset price, usually applicable to perpetual contracts. It is a mechanism for fund exchange between long and short traders, and the trading platform does not charge this fee. It is used to adjust the cost or profit of traders holding contracts to keep the contract price close to the underlying asset price. When the funding rate is 0.01%, it represents the baseline rate. When the funding rate is greater than 0.01%, it indicates a generally bullish market sentiment. When the funding rate is less than 0.005%, it indicates a generally bearish market sentiment.

- 02:24The crypto sector sees widespread gains, with BTC surpassing $87,000, while only the AI and NFT sectors are declining.According to SoSoValue data, the crypto market has generally rebounded, with Bitcoin (BTC) rising by 2.01% and breaking through $87,000. Meanwhile, Ethereum (ETH) increased by 0.12%, still fluctuating narrowly around $2,900. Notably, MAG7.ssi rose by 1.79%, DEFI.ssi increased by 0.34%, and MEME.ssi climbed by 1.28%. Other standout sectors include: the SocialFi sector, which rose by 3.53% in the past 24 hours, with Toncoin (TON) up 4.08%; the PayFi sector increased by 2.62%, with Telcoin (TEL) up 5.11% within the sector; the RWA sector rose by 2.58%, and MANTRA (OM) surged by 12.90%. In other sectors, the Layer1 sector rose by 1.53%, with Sui (SUI) up 3.70%; the CeFi sector increased by 1.52%, with a certain exchange up 3.20% within the sector; the Layer2 sector rose by 1.14%, with Zora (ZORA) up 9.83%; the DeFi sector increased by 0.57%, with Uniswap (UNI) up 3.88%; the Meme sector rose by 0.41%, with SPX6900 (SPX) up 5.86%. In addition, the AI sector fell by 1.37%, but Fartcoin (FARTCOIN) bucked the trend and rose by 10.30%; the NFT sector dropped by 1.68%, with APENFT (NFT) down 10.83%. Crypto sector indices reflecting historical sector performance show that the ssiGameFi, ssiSocialFi, and ssiRWA indices rose by 4.42%, 3.99%, and 3.18% respectively.

News