News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 17)|U.S. seasonally adjusted nonfarm payrolls for November increased by 64,000; BlackRock transferred approximately $140 million worth of ETH to a CEX2Bitget US Stock Morning Brief | Fed Independence Reaffirmed; NFP Beats Expectations; Tech Rally Lifts Market (December 17, 2025)

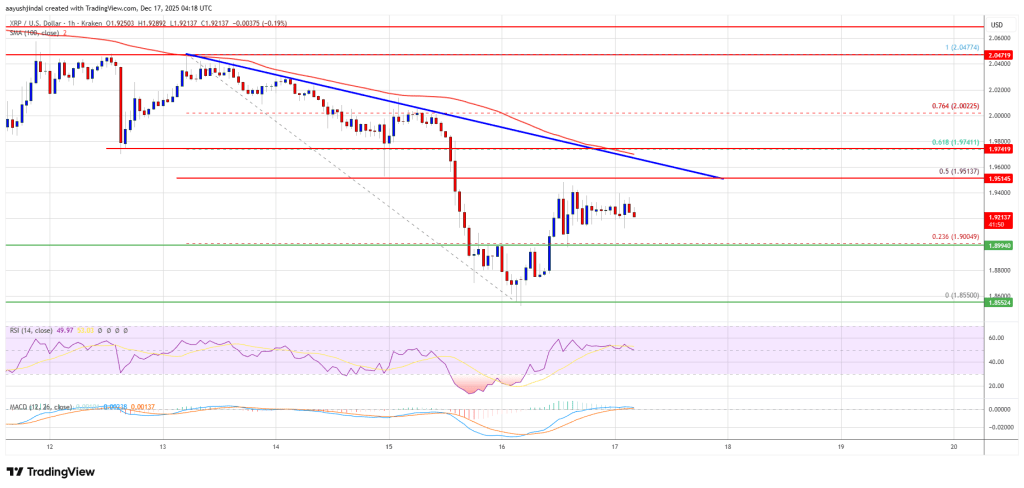

XRP Faces a Familiar Bearish Test

TimesTabloid·2025/12/17 06:03

Remarkable Surge: Bitcoin Lightning Network Capacity Hits Highest Level in Over a Year

Bitcoinworld·2025/12/17 05:57

Crypto lawyer: The SAFE crypto bill will make scammers tremble.

币界网·2025/12/17 05:48

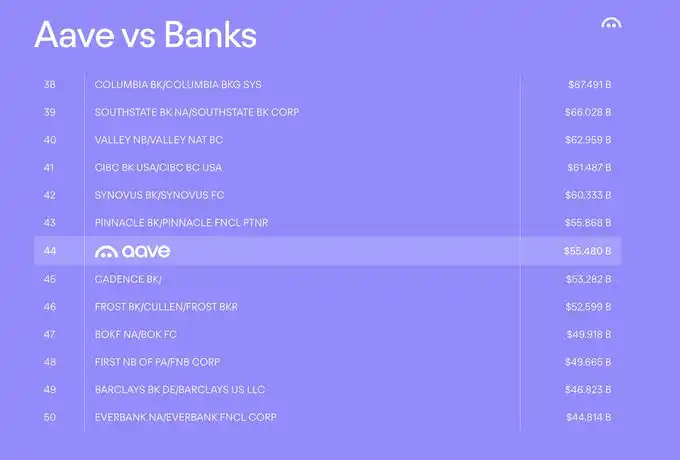

Aave founder outlines key focuses for 2026: Aave V4, Horizon, and mobile platforms

BlockBeats·2025/12/17 05:48

Explosive Theta Labs Lawsuit: Former Execs Accuse CEO of Fraud and Price Manipulation

Bitcoinworld·2025/12/17 05:27

Pi Network stock price remains under pressure, momentum weakens

币界网·2025/12/17 05:15

XRP price recovery appears fragile—can bulls break through the price ceiling?

币界网·2025/12/17 05:15

Pantera: 2025 will be a year of structural progress for the crypto market

币界网·2025/12/17 05:15

Flash

- 06:02Senior Policy Committee Member of the Takamatsu City Government: Bank of Japan Should Avoid Raising Interest Rates PrematurelyAccording to Odaily, former Deputy Governor of the Bank of Japan and government policy panel member Masazumi Wakatabe stated, "Japan must raise its neutral interest rate through fiscal policy and growth strategies. If Japan's neutral interest rate rises due to fiscal policy, it would be natural for the Bank of Japan to raise interest rates. However, at present, the Bank of Japan should avoid raising rates too early or excessively tightening monetary policy." Analyst Justin Low expressed reservations about this comment, noting that Wakatabe is a member of the government panel appointed by Japanese Prime Minister Sanae Takaichi. Therefore, his remarks and stance are aligned with the government and appear to oppose the Bank of Japan's intention to raise rates later this week. (Golden Ten Data)

- 05:44Analysis: Weaker U.S. employment data may prompt the Federal Reserve to cut interest rates earlier next yearAnalysis: Weakening US Employment Data May Prompt the Federal Reserve to Cut Rates Earlier Next Year 2025-12-17 05:42 BlockBeats news, December 17, the Canadian Imperial Bank of Commerce pointed out that non-farm payroll data reflects a further weakening of the US labor market. On the other hand, more resilient consumption indicates that demand conditions remain quite favorable. Overall, this may prompt Federal Reserve policymakers who dissented at the last meeting to reassess their positions, increasing the likelihood of an early rate cut in 2026. That said, Goolsbee and Schmid were the two main dissenters who advocated keeping rates unchanged last week, but next year they will step down from their voting seats, likely to be replaced by Harker and Logan, who may be more hawkish. Therefore, changing their minds and making them more determined to cut rates will be a challenging task. However, a cooling labor market will continue to weaken their resolve, as the balance of data evidence undermines the Federal Reserve's rationale for maintaining current rates. As a result, the likelihood of the Federal Reserve easing monetary policy earlier in 2026 is increasing. (Golden Ten Data) Report Correction/Report This platform has now fully integrated the Farcaster protocol. If you already have a Farcaster account, you can log in to post comments

- 05:44Canadian Imperial Bank of Commerce: Weakening U.S. employment data may prompt the Federal Reserve to cut rates earlierChainCatcher news, according to Golden Ten Data, the Canadian Imperial Bank of Commerce pointed out that the non-farm employment data reflects a further weakening of the U.S. labor market, while consumer resilience indicates that demand conditions remain favorable. This may prompt Federal Reserve policymakers to reassess their stance and increase the likelihood of an early rate cut in 2026. Although Goolsbee and Schmid were the main dissenters last week calling for rates to remain unchanged, next year they will step down from the FOMC voting seats and may be replaced by the more hawkish Harker and Logan. The cooling labor market will weaken their resolve and increase the possibility of the Federal Reserve easing monetary policy earlier.

News