News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(September 15)|EDCON 2025 Ethereum Developer Conference Set to Open Soon; Major Token Unlocks Scheduled This Week; Tether Launches New USD Stablecoin for US Market2Chainlink Could See Further Gains After SBI Partnership, Bitwise ETF Filing and Large Exchange Outflows3Ethereum Co-Founder Says AI-Led Governance Could Be Exploited, Urges Info-Finance Oversight

Tether plans stablecoin for the US market (USAT)

CryptoValleyJournal·2025/09/15 22:57

Polymarket is booming: An overview of 10 ecosystem projects

A range of third-party ecosystems has emerged around Polymarket, including data/dashboards, social experiences, front-end/terminal, insurance, and AI agents.

链捕手·2025/09/15 22:53

Symbiotic, Chainlink, and Lombard launch industry-first layer for cross-chain Bitcoin transfers

Cryptobriefing·2025/09/15 22:33

Brazil Explores Bitcoin Reserve with Parliamentary Hearing

Theccpress·2025/09/15 22:03

Brazil Considers National Bitcoin Reserve Proposal

Theccpress·2025/09/15 22:03

Bitcoin price drop to $113K might be the last big discount before new highs: Here’s why

Cointelegraph·2025/09/15 21:45

Trump Predicts a "Significant Rate Cut" by the Federal Reserve!

AICoin·2025/09/15 21:08

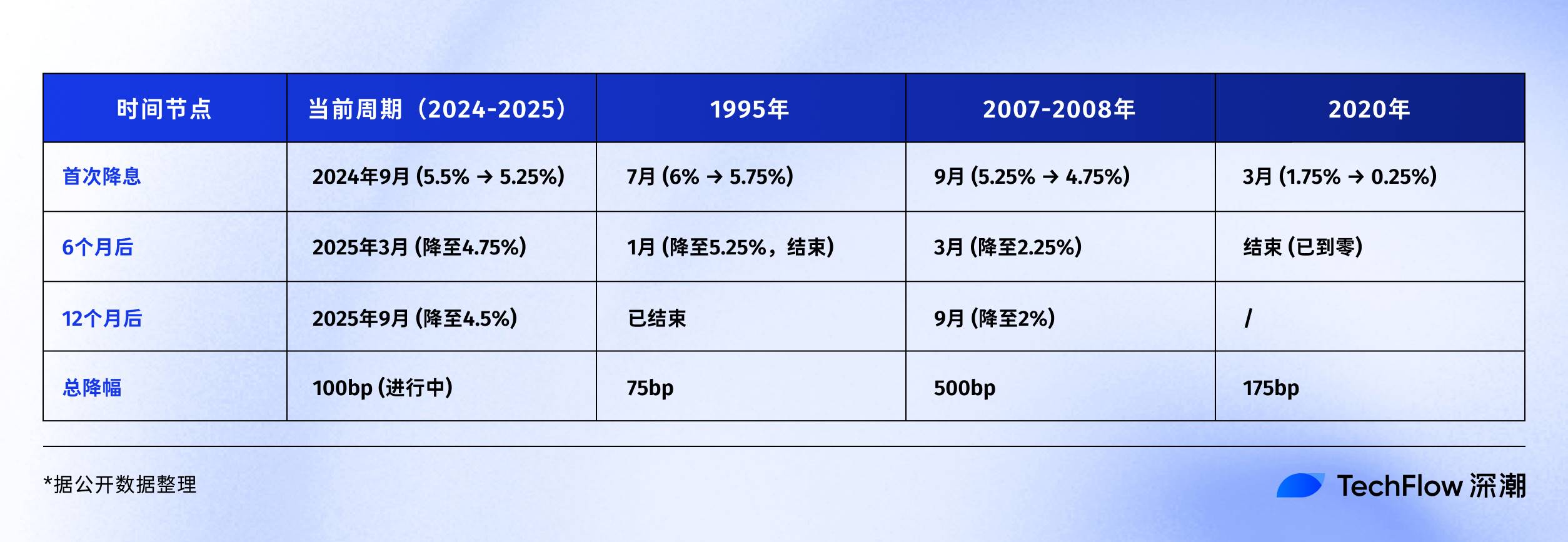

Reviewing the Fed's rate-cutting cycle: What’s next for Bitcoin, the stock market, and gold?

If history rhymes, the next 6-12 months could be a critical window.

深潮·2025/09/15 20:59

Will Tesla and xAI merge? Hedge fund tycoon: It feels inevitable

Positive remarks from SkyBridge Capital founder Anthony Scaramucci have further fueled expectations of a possible merger between Tesla and xAI.

ForesightNews·2025/09/15 20:43

Capital B Expands Bitcoin Holdings to 2,249 BTC, Yield Hits 1,536%

coinfomania·2025/09/15 20:12

Flash

- 01:15Yunfeng Financial, indirectly held by Jack Ma, raises HK$1.17 billion through share placement to support the launch of virtual asset trading and related investment management services.Jinse Finance reported that Yunfeng Financial, indirectly held by Jack Ma, announced the placement and issuance of a total of 191 million new shares through a top-up placement at a price of HK$6.1 per share, raising approximately HK$1.17 billion. The purpose of this placement is to expand the company's shareholder and capital base, and to increase the liquidity of the company's shares in the market. The funds raised will mainly be used for the Group's system facility upgrades, talent recruitment, and related capital requirements, including but not limited to the launch of comprehensive virtual asset trading services and virtual asset-related investment management services.

- 01:05Citigroup expects the price of Ethereum to drop to $4,300 by the end of the yearJinse Finance reported, citing CoinDesk, that Wall Street giant Citigroup has released a new Ethereum price forecast, predicting its price will reach $4,300 by the end of the year, representing a decline from its current price. However, this is only the base case scenario. The bank's comprehensive assessment covers a wide range, with an optimistic scenario projecting Ethereum's price at $6,400, and a pessimistic scenario at $2,200. Citibank analysts stated that network activity remains a key driver of Ethereum's value, but most recent growth has occurred on Layer 2 networks, and the "value transfer" to Ethereum's base layer remains unclear. Citi assumes that only 30% of Layer 2 network activity contributes to Ethereum's valuation, which means the current price is higher than its activity-based model predicts. This may be due to strong capital inflows and market enthusiasm driven by tokenization and stablecoins. Citi expects that, given Ethereum's relatively small market capitalization and lower recognition among new investors, capital inflows will remain limited. Macroeconomic factors are considered to provide only limited support. As the stock market is already close to the bank's S&P 500 target of 6,600 points, analysts expect that risk assets will not see a significant rally.

- 00:59French, Austrian, and Italian regulators urge the EU to strengthen coordination of cryptocurrency regulationChainCatcher news, according to Bloomberg, after discovering differences in the implementation of cryptocurrency regulations among countries, financial regulators in France, Austria, and Italy have urged the EU's top regulatory body to directly supervise large cryptocurrency companies and tighten related rules. The EU will implement the Markets in Crypto-Assets Regulation (MiCA) at the end of 2024, requiring cryptocurrency companies to obtain a license in at least one EU member state in order to provide services across the entire EU. In a position paper released on Monday, the financial market regulators of the three countries stated that this approach exposes "significant differences" in the supervision of companies among countries, allowing companies to exploit loopholes. They suggested transferring the supervisory authority over the largest industry players to the European Securities and Markets Authority (ESMA). They also indicated that the initial implementation of MiCA has already shown limited regulatory convergence, making it difficult to ensure unified EU standards. An ESMA spokesperson responded that efforts are being made to ensure regulatory consistency, and that last year it was already considered necessary to reconsider areas where EU-level regulation should be strengthened. In addition, the three national regulators may take preventive measures to mitigate risks and have also called for strengthened regulation of global platforms, cybersecurity, and token issuance.