News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

![Reasons for the rise of Movement [MOVE] cryptocurrency—L1 migration, buybacks, and more!](/news-static/client/media/cover-placeholder.101bcc72032a7c4f0a397f15f3252c92.svg)

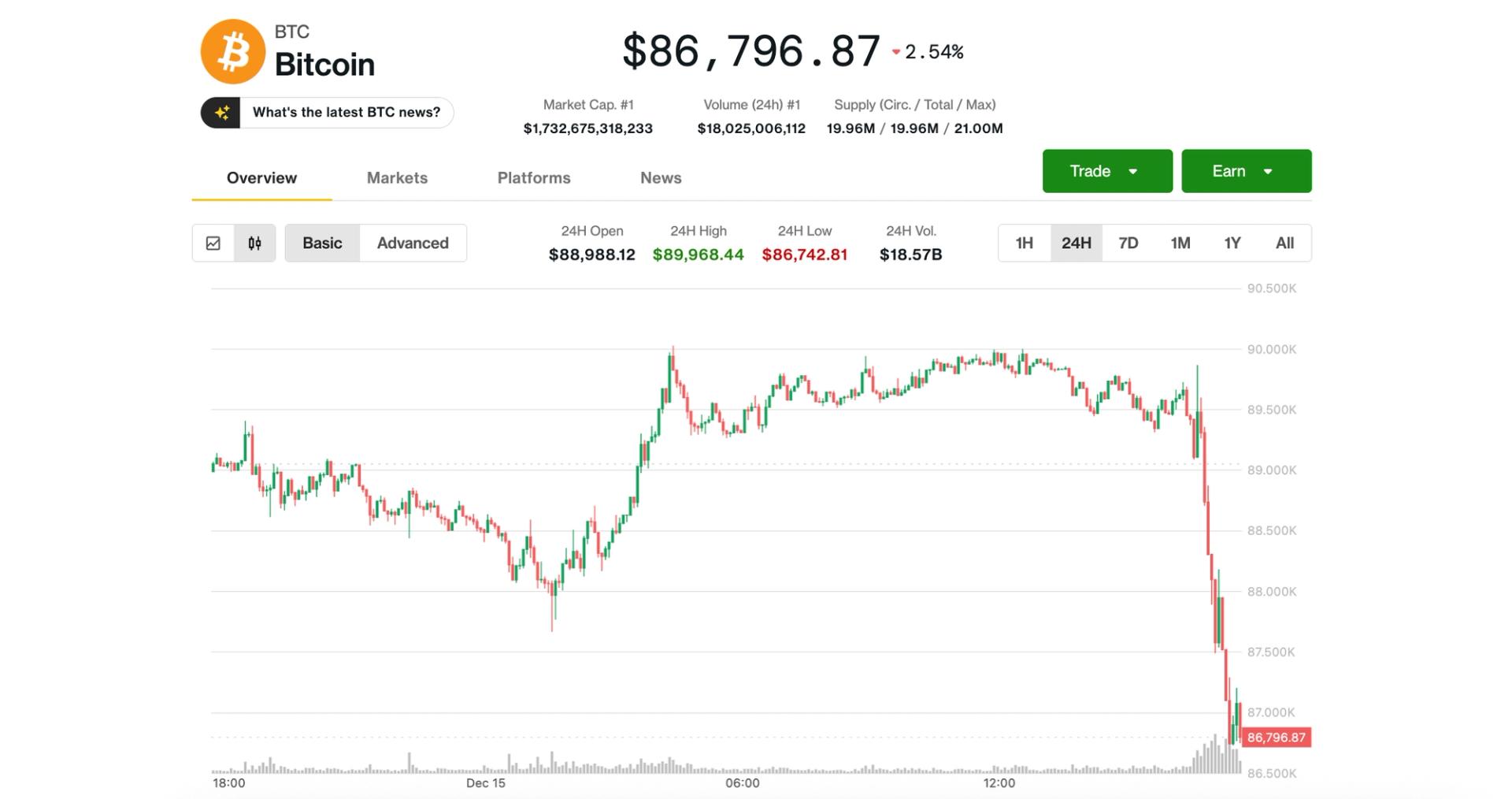

The recent decline in bitcoin prices is primarily driven by expectations of a rate hike by the Bank of Japan, uncertainty regarding the US Federal Reserve's rate cut trajectory, and systemic de-risking by market participants. Japan's potential rate hike may trigger the unwinding of global arbitrage trades, leading to a sell-off in risk assets. At the same time, increased uncertainty over US rate cuts has intensified market volatility. In addition, selling by long-term holders, miners, and market makers has further amplified the price drop. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

The crypto industry is replacing Wall Street's privileged status within the American right-wing camp.

The market is transitioning from an emotion-driven cycle of speculation to a phase of structural differentiation driven by regulatory channels, long-term capital, and fundamental-based pricing.

- 09:16Bank of America: The U.S. banking industry is moving towards an on-chain futureBank of America pointed out that faster US stablecoin and charter regulations are bringing cryptocurrencies into the regulated banking system, driving banks toward an on-chain future. As the OCC grants conditional national trust bank charters to five digital asset companies, US cryptocurrency rulemaking will accelerate. Bank of America expects the FDIC and Federal Reserve to follow up with stablecoin capital, liquidity, and approval rules based on the GENIUS Act. The report suggests that banks should embrace blockchain, citing JPMorgan and DBS's tokenized deposit pilots on both public and permissioned blockchains.

- 09:16Anchorage Digital acquires cryptocurrency platform Securitize For AdvisorsAccording to Odaily, crypto bank Anchorage Digital has announced the acquisition of Securitize For Advisors, a cryptocurrency platform for Registered Investment Advisors (RIA), from Securitize. The specific financial details of this acquisition have not been disclosed. Currently, Anchorage Digital Bank already custodies 99% of Securitize For Advisors' client assets. (CoinDesk)

- 09:13Market Analysis: The US Dollar and US Treasury Yields Are the Main Drivers of Gold Prices This WeekAccording to Jinse Finance, analyst Fawad Razaqzada stated that this week’s gold trend will mainly depend on U.S. Treasury yields and the U.S. dollar exchange rate. “If bond prices fall further, or yields rise, it could put pressure on low-yield and zero-yield assets such as gold,” he said. Meanwhile, “if the U.S. dollar rebounds this week (with a dense schedule of data releases and speeches by Federal Reserve officials), gold may lose some of its appeal.” Last week, the U.S. dollar came under pressure as the Federal Reserve left the door open for further rate cuts next year. Currently, the market’s focus is on Tuesday’s release of the November non-farm payroll report and Thursday’s consumer price data.