News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1 Bitget Daily Digest (Dec. 18)|U.S. SEC issues a Statement on the Custody of Crypto Asset Securities by Broker-Dealers; LayerZero (ZRO) to unlock ~25.71 million tokens on Dec. 202Bitget US Stock Morning Brief | S&P 500 Four-Day Decline; Oracle AI Financing Stalls; Energy & Precious Metals Rally; Micron Crushes Guidance, Surges After Hours (December 18, 2025)3SEC says broker-dealers need to maintain crypto private keys to comply with customer protection rules

How to Buy DeepSnitch AI Before It Launches?

BlockchainReporter·2025/12/18 19:21

Critical Bitcoin 2026 Forecast: Fidelity Executive Predicts Market Struggles

Bitcoinworld·2025/12/18 19:00

Revolutionary Move: Forward Industries to Tokenize Its Shares, Unlocking 6.8M SOL Treasury

Bitcoinworld·2025/12/18 18:57

Digital Euro Breakthrough: ECB Completes Crucial Technical Preparations, Lagarde Reveals

Bitcoinworld·2025/12/18 18:42

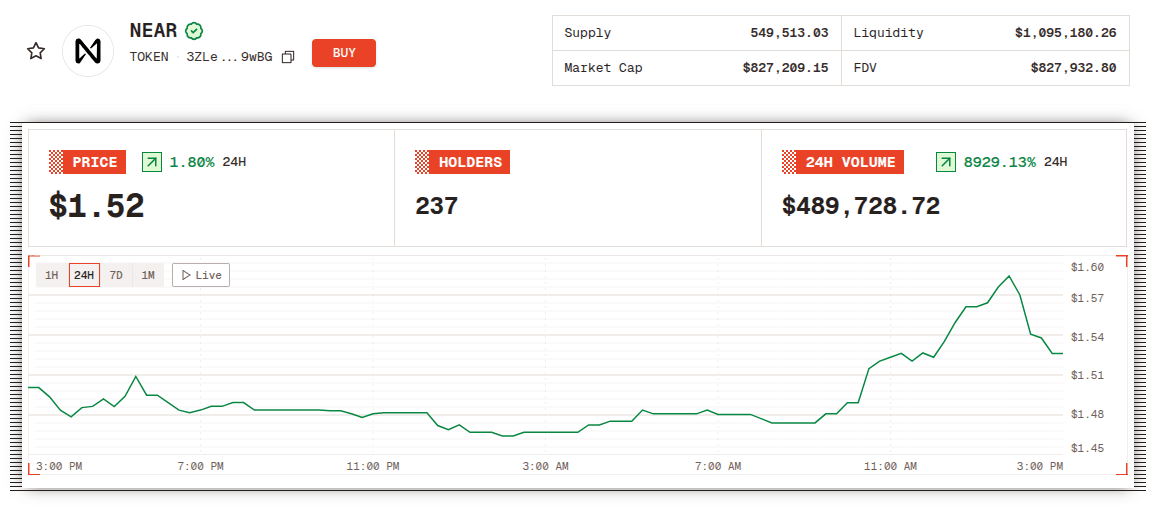

NEAR Is Now Live on Solana as “Attention Is All You Need” Post Goes Viral

Coinspeaker·2025/12/18 18:39

Market Strategist: Everyone Gave Up On XRP. Here’s Why

TimesTabloid·2025/12/18 18:09

Best Crypto Presales: New Crypto Coins Set to Lead the Market Recovery

Cryptonomist·2025/12/18 18:03

Tezos Art Ecosystem Growth in 2025: Flagship Events, Institutional Programs, and Artist Sales

BlockchainReporter·2025/12/18 18:00

Urgent Warning: Japan’s Crippling Crypto Tax Reform Risks Global Irrelevance

Bitcoinworld·2025/12/18 17:57

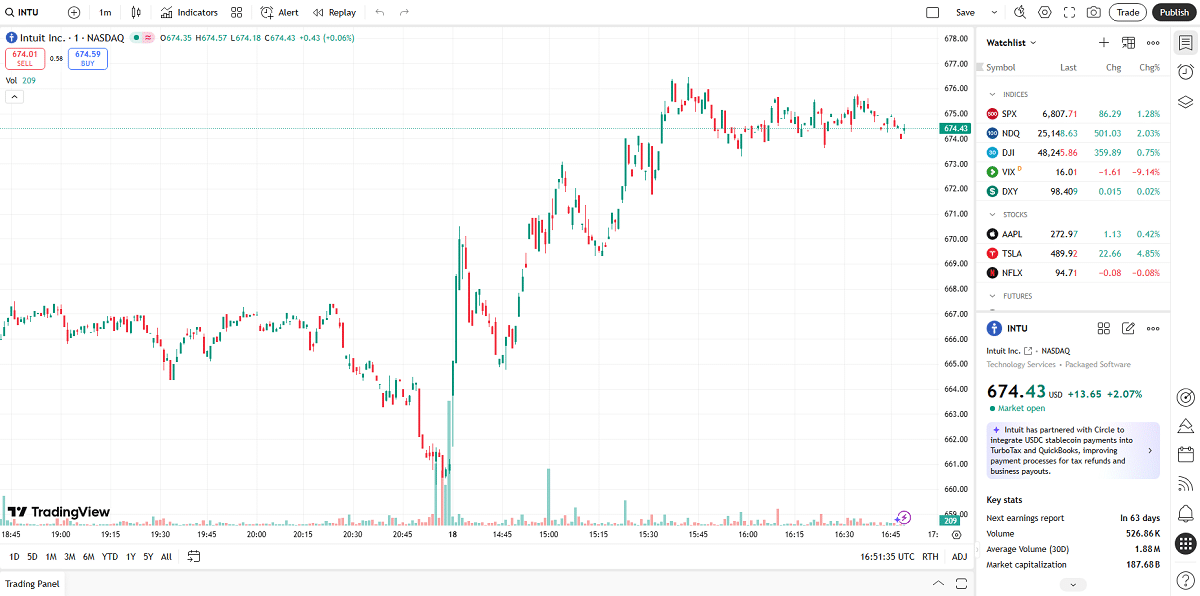

Circle Partners Intuit to Bring Stablecoin Services to Credit Karma, Turbotax, Quickbooks

Coinspeaker·2025/12/18 17:48

Flash

18:35

Platinum prices hit a 17-year highPlatinum prices have reached a 17-year high, becoming the third precious metal to break records this year after gold and silver.

18:27

ECB completes digital euro preparations, expected to launch in the second half of 2026The ECB has completed preparations for the digital euro and is now awaiting action from political institutions. ECB President Lagarde emphasized that interest rate decisions are made using a data-driven approach, and inflation is expected to reach the 2% target by 2028. The digital euro is prioritized as a strategic financial tool and is expected to be launched in the second half of 2026.

18:24

Data: 20.0002 million POL transferred from an anonymous address, worth approximately $2.13 millionChainCatcher reported, according to Arkham data, at 02:17, 20,000,240.35 POL (worth approximately $2.13 million) were transferred from one anonymous address (starting with 0x171c...) to another anonymous address (starting with 0x8e54...).

News