News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

For every $1,000 traded, a rebate of $0.03 is earned. It is precisely this seemingly small rebate that enabled the trader to grow from $6,800 to $1.5 million.

Heavy rain can't dampen the enthusiasm.

The Hong Kong Monetary Authority has released a consultation paper, CRP-1 "Crypto Asset Classification," aiming to establish a regulatory framework that balances innovation and risk control. The paper clarifies the definition and classification of crypto assets, as well as regulatory requirements for financial institutions, aligning with international standards set by the BCBS. Summary generated by Mars AI. The accuracy and completeness of this summary, generated by the Mars AI model, are still in the process of iterative improvement.

Could Ethereum become one of the most strategic assets of the next decade? Why do DATs offer a smarter, higher-yield, and more transparent way to invest in Ethereum?

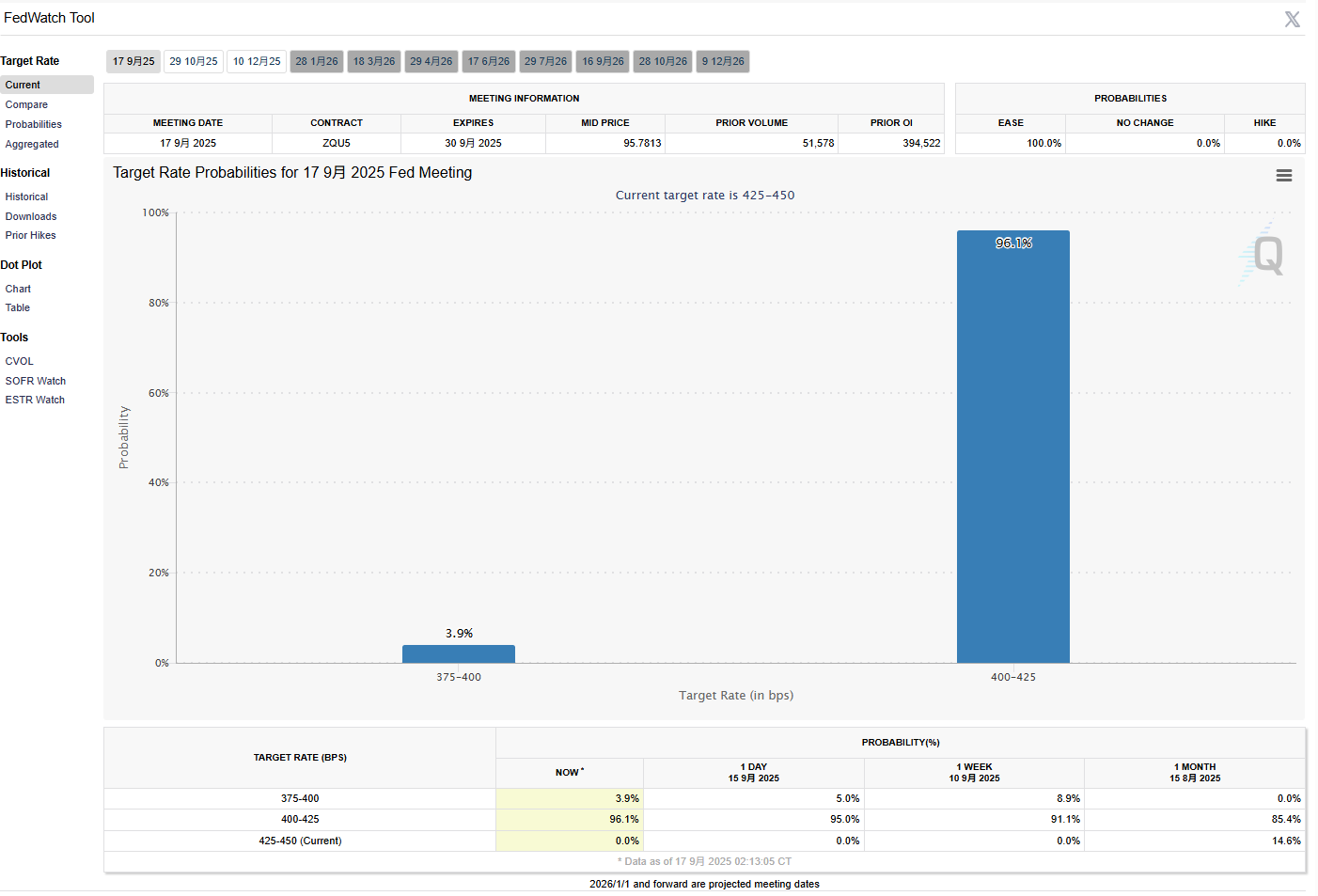

Any indication the FOMC is less dovish than anticipated could weigh on crypto, industry watcher says

- 16:50Media: Three Fed voting members may prefer to keep interest rates unchanged at this meetingJinse Finance reported, citing IFR, a media outlet under Reuters, that in this Federal Reserve decision, apart from a 25 basis point rate cut, the first headline that market participants may see is that three or more officials have dissented. Without a doubt, Waller, Bowman, and Mullan will be among the three, as they favor a larger rate cut, while other dissenters may include Goolsbee, Schmid, or Musalem, who wish to keep rates unchanged. However, what traders are truly focused on is the FOMC's dot plot—whether it predicts only one more rate cut in 2025 or possibly two more. Trump's strategy to remove Federal Reserve Governor Cook is likely aimed at ensuring that after today's rate cut, there will be two more rate cuts in 2025.

- 16:50Tether CEO: USDT Market Cap Surpasses $171 Billion, Setting New RecordJinse Finance reported that Paolo Ardoino, CEO of stablecoin issuer Tether, disclosed on the X platform that the market capitalization of USDT has surpassed 171 billions, setting a new record high. According to data from Coingecko, the current market capitalization of USDT has reached $171,015,303,284, with a 24-hour trading volume of $85,364,190,133.

- 16:40OpenVPP’s Claim of Cooperation with the US Government Denied by SEC OfficialJinse Finance reported that the crypto project OpenVPP ($OVPP) claimed this week to be cooperating with the US government on energy tokenization. Hester Pierce, a commissioner of the US Securities and Exchange Commission (SEC), responded by stating that she has not collaborated with or endorsed any private crypto project. Subsequently, OpenVPP hid her reply on social media. Some analysts have pointed out that most of the accounts promoting OpenVPP are well-known marketing accounts within the crypto community, indicating a clear promotional nature.