News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 16)|Crypto market sees $508 million in long liquidations over 24 hours; Hassett faces opposition from Trump-aligned senior figures in Fed chair contest2Bitget US Stock Morning Report | US Stocks Fluctuate and Retreat, Tesla Hits New High for the Year, Fed Shows Strong Economic Confidence, Non-farm Payrolls to be Released Tonight, Commodity Prices Fluctuate Violently3Bitcoin sees ‘pure manipulation’ as US sell-off liquidates $200M in an hour

Solana Weathers Massive 6 Tbps DDoS Attack With Zero Downtime, Co-Founder Says

Coinspeaker·2025/12/16 11:39

Analyst: XRP Is Repeating a Pattern I’ve Only Seen Once Before

·2025/12/16 11:33

Stunning Prediction: Bitcoin All-Time High Inevitable for 2025 as 4-Year Cycle Shatters

Bitcoinworld·2025/12/16 11:27

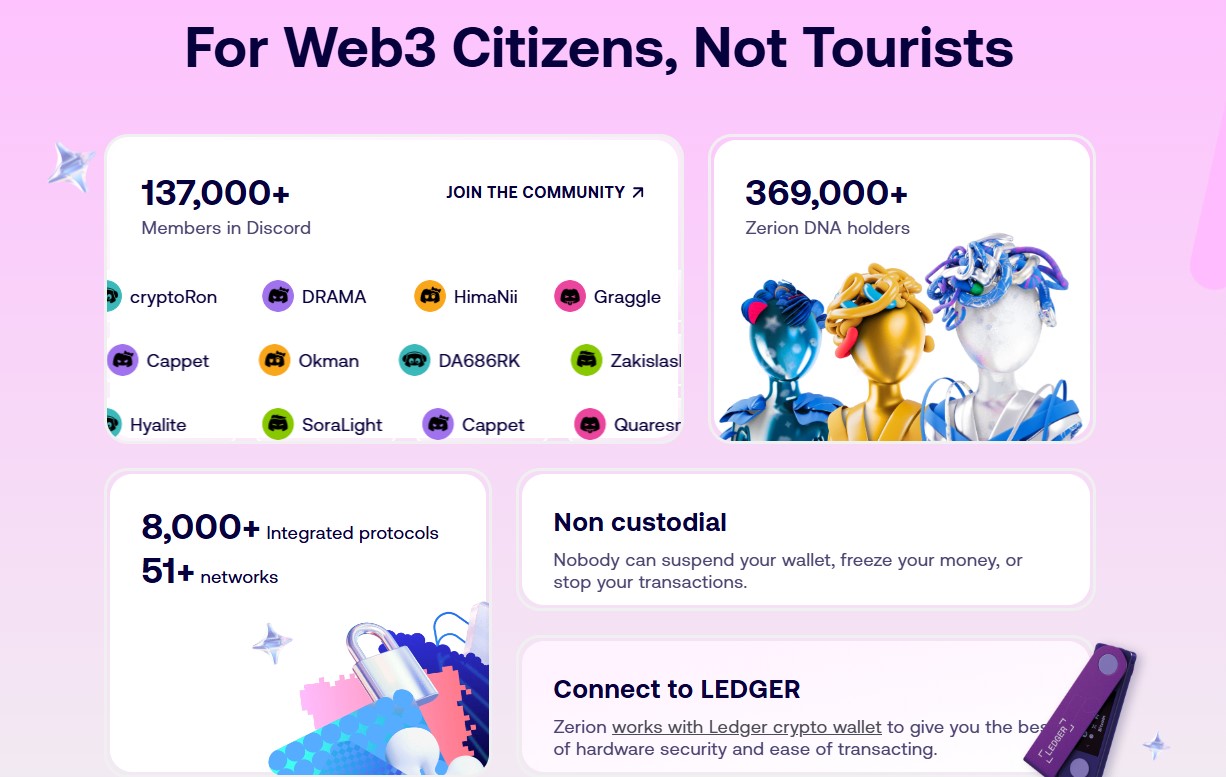

Zerion wallet feed launches early access today: Is a token launch imminent?

币界网·2025/12/16 11:23

Pi Network stock price consolidates as analysts closely watch the next move

币界网·2025/12/16 11:15

StraitsX Stablecoins Unleash Power: XSGD and XUSD Launch on Solana’s Blazing Network in 2025

Bitcoinworld·2025/12/16 11:12

Flash

- 11:47Matador Technologies plans to raise an additional $75 million to further increase its bitcoin holdings.Jinse Finance reported that Matador Technologies, a Canada-listed Bitcoin treasury company, announced it has amended its previously announced $100 million convertible note financing agreement. The disclosure revealed that the company has signed a registration rights agreement with investors, allowing it to raise a total of $75 million through the issuance of additional notes. The related funds will be used to purchase Bitcoin for Matador's balance sheet. However, Matador Technologies has removed the previously announced plan to "hold 6,000 Bitcoins by 2027" from its latest information disclosure.

- 11:47The Trump Family-Linked Mining Firm ABTC Breaks Into Top 20 Bitcoin Holdings Among Crypto Treasury CompaniesBlockBeats News, December 16, according to the Associated Press, the Trump family-affiliated mining company American Bitcoin (ABTC) as of December 14, 2025, held approximately 5,098 bitcoins in its strategic reserve, ranking it among the top 20 publicly listed Bitcoin Treasury Reserve Trust (TRT) companies. American Bitcoin Co-founder and Chief Strategy Officer Eric Trump said, "I am incredibly proud of the tremendous growth we have achieved. In just over three months since our listing on Nasdaq, ABTC's Bitcoin reserves have placed us among the top 20 publicly listed Bitcoin reserve companies globally, showcasing our explosive growth trajectory and robust expansion capabilities."

- 11:46Hong Kong SFC adds "Hong Kong Stablecoin Exchange" to the list of suspicious virtual asset trading platformsChainCatcher news, the Hong Kong Securities and Futures Commission has announced that it has added the "Hong Kong Stablecoin Exchange" to the list of suspicious virtual asset trading platforms. The Hong Kong SFC stated that this entity claims to operate a virtual asset trading platform suspected of unlicensed activities and involvement in virtual asset-related fraudulent activities. The entity also falsely claims to have been jointly established by "HKEX, SEHK, and HKFE," but in fact, it has no connection with any of the three exchanges.

News