News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 17)|U.S. seasonally adjusted nonfarm payrolls for November increased by 64,000; BlackRock transferred approximately $140 million worth of ETH to a CEX2Bitget US Stock Morning Brief | Fed Independence Reaffirmed; NFP Beats Expectations; Tech Rally Lifts Market (December 17, 2025)

Which Is the Best Presale Crypto Right Now? A Closer Look at Four Leading Contenders

BlockchainReporter·2025/12/17 17:00

"Bitcoin is severely oversold": Tom Lee hints at the next move

币界网·2025/12/17 16:54

Bitcoin miner Hut 8 secures $7 billion Google-backed AI data center lease

币界网·2025/12/17 16:51

Shiba Inu Price Prediction: CoinGecko Attributes Meme Coin Volatility to Political Tokens as DeepSnitch AI Eyes Major Upswing

BlockchainReporter·2025/12/17 16:50

DTCC begins limited onchain Treasury test on Canton Network after SEC greenlight

The Block·2025/12/17 16:48

Aave to Enter 2026 With a Master Plan, SEC Ends 4-Year Investigation

Coinspeaker·2025/12/17 16:42

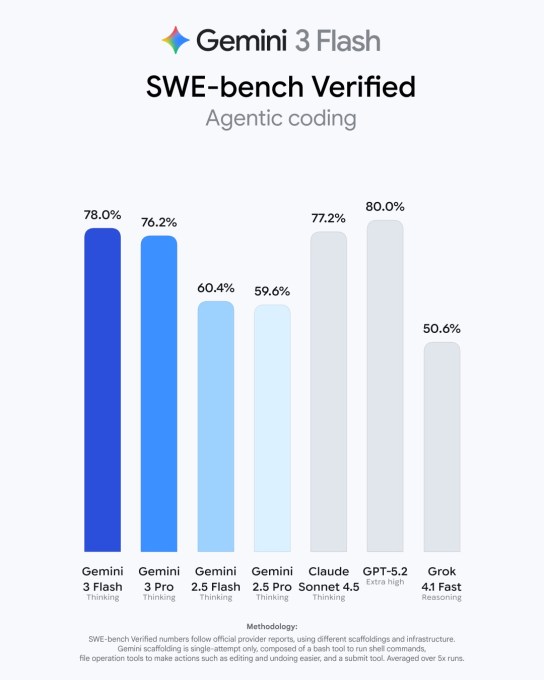

Google launches Gemini 3 Flash, makes it the default model in the Gemini app

TechCrunch·2025/12/17 16:33

Michael Saylor says quantum will “harden” Bitcoin, but he’s ignoring the 1.7 million coins already at risk

CryptoSlate·2025/12/17 16:30

Flash

16:52

Vitalik: Improving protocol comprehensibility is a key direction for trustlessness, and Ethereum needs to further simplify its designAccording to Odaily, Ethereum co-founder Vitalik Buterin stated that an important but long-underestimated form of "trustlessness" is enabling as many people as possible to truly understand the entire operation of the protocol from start to finish. If only a very small number of people possess complete understanding, the system still faces implicit risks of trust centralization. Vitalik pointed out that Ethereum still has room for improvement in this regard. In the future, it will be necessary to enhance overall comprehensibility by simplifying protocol design and reducing system complexity. This will not only help expand the group of people who can participate in and audit the protocol, but will also strengthen the transparency, security, and long-term resilience of the Ethereum ecosystem.

16:49

A major whale’s heavy long positions were partially liquidated, with related addresses holding nearly $300 million in long positions cumulatively.BlockBeats News, December 18, according to MLM monitoring, a certain whale address, after previously holding a large number of long positions worth tens of millions of dollars, recently experienced partial liquidation. The liquidated assets included 431,000 HYPE (approximately 11.1 million USD) and 1,960 ETH (approximately 5.6 million USD). Currently, this wallet still holds long positions: 1.726 million HYPE (approximately 44.6 million USD) and 7,841 ETH (approximately 22.3 million USD); in addition, it also holds nominal long positions worth about 230 million USD in XRP and ETH in another account.

16:48

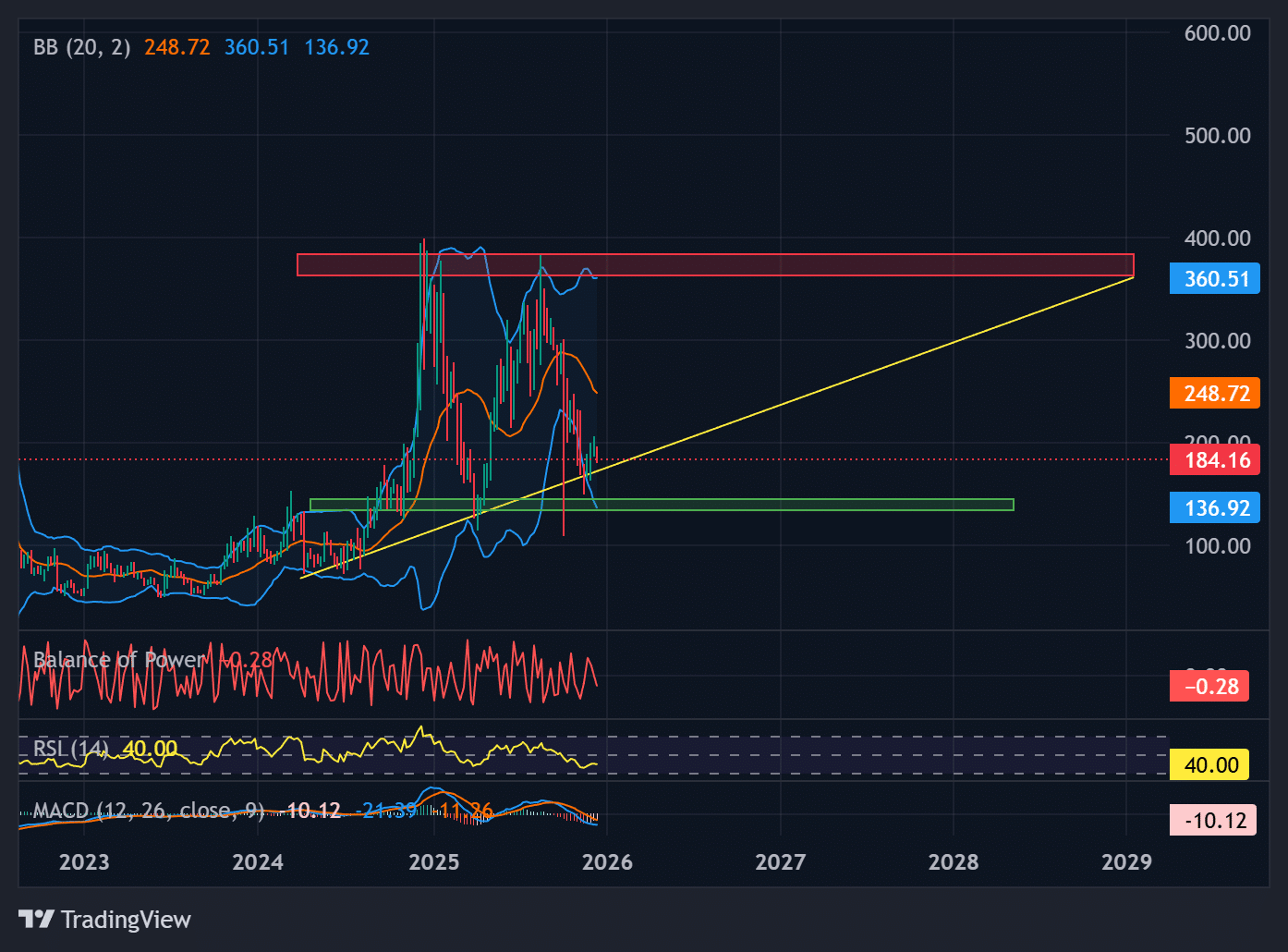

Oracle's AI Halo Fades as Stock Price Nearly Halves from September HighJinse Finance reported that the American financial website investinglive stated that after Oracle (ORCL.N) released its September financial report, its stock price once soared to $345, briefly making founder Ellison the world's richest person. Ellison positioned Oracle as "the backend infrastructure provider for the entire AI revolution," and investors fervently chased Remaining Performance Obligations (RPO), which became the core of bullish sentiment. However, two major factors completely shattered this bubble. The first is the reassessment of capital expenditure. In its Q2 financial report, the company raised its capital expenditure guidance for fiscal year 2026 to $50 billion, making investors realize that building data centers by issuing tens of billions in debt is not a "free lunch," and the market expressed concerns about its debt risk. The second is the delay in data center delivery. There are reports that the delivery time for the data center Oracle is building for OpenAI may be delayed until 2028. Previous optimism about Oracle was all based on speed, and if the speed advantage no longer exists, its high valuation loses support. The stock price of a certain exchange fell another 5% today, closing at $177, a plunge of nearly 50% from the September high.

News