News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

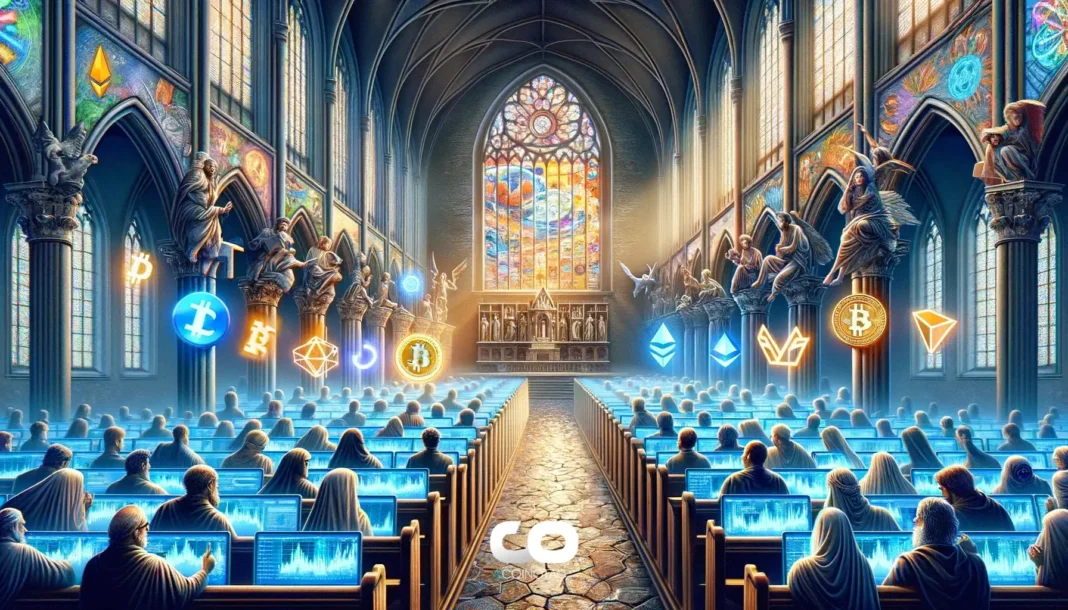

Who would be the best choice for the crypto market?

The story begins with a blank page and a search box. Its next chapter might be a ledger unseen by all but used by everyone.

A review of major market crashes in the history of cryptocurrency.

President Trump's announcement, U.S. unemployment data, and an altcoin golden cross are simultaneously impacting the market. Here’s how they are connected—and what it could mean for the altcoin season in Q4.

The Federal Reserve, as the core institution of the global financial system, has been actively responding to the rapid development of digital technology. On October 21, 2025, the Federal Reserve will hold an important conference in Washington, D.C. with the theme of "Payment Innovation," chaired by Federal Reserve Governor Christopher Waller.

- 17:57Federal Reserve's Goolsbee: No decision has been made yet on the September interest rate decisionJinse Finance reported that Federal Reserve official Goolsbee stated that no decision has been made yet regarding the interest rate decision in September. The Federal Reserve's responsibilities regarding inflation must be considered.

- 17:33The Federal Reserve's overnight reverse repurchase agreement (RRP) usage was $2.0997 billion on Friday.Jinse Finance reported that the Federal Reserve's overnight reverse repurchase agreement (RRP) usage was $2.0997 billion on Friday, compared to $2.0128 billion in the previous trading day.

- 17:23US Employment Data Strengthens Rate Cut Expectations, Spot Gold Surpasses $3,600 for the First TimeJinse Finance reported that the latest US non-farm employment data is likely to be the decisive factor for the Federal Reserve to cut interest rates at its next meeting in two weeks. Gold prices continue to rise, with spot gold surging above $3,600 per ounce. Data released by the US Department of Labor on Friday showed that 22,000 new jobs were added in August, lower than economists' expectations of 75,000. Barbara Lambrecht, an analyst at Commerzbank Research, said: "Gold prices have finally broken through the upper limit of the trading range that has persisted for months." Concerns about the Federal Reserve's independence and increased geopolitical risks driving safe-haven demand have also contributed to this round of gains. After rising 27% in 2024, gold has soared more than 37% so far this year, mainly driven by a weaker dollar, central bank gold purchases, a looser monetary policy environment, and heightened geopolitical and economic uncertainty. Independent metals trader Tai Wong said: "Gold is hitting new highs, and bulls are watching for the clear trend of weakening employment to translate into multiple rate cuts. In the short and even medium term, concerns about the labor market outweigh concerns about inflation, and the outlook for gold is undoubtedly bullish. But unless there is a major market dislocation, I think gold prices are still far from $4,000."