News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

The yield-bearing product offers institutional investors exposure to bitcoin with staking rewards under UK regulatory oversight

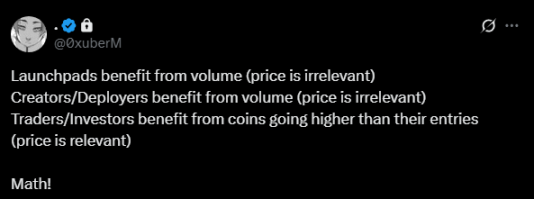

This game centered around "trading volume" and "short-term speculation" will continue to consume the chips of the "daredevil squads."

In-depth analysis of the impact of the lean roadmap on the Ethereum ecosystem.

To ensure efficient data management and secure validation, Ethereum has evolved from DA to DAS, ultimately introducing PeerDAS.

Tesla's humanoid robot project has sparked heated discussions again. An unknown pharmaceutical company made a high-profile announcement about a collaboration, but Elon Musk directly denied the authenticity of the on-site photos.

JPMorgan's analysis indicates that the U.S. stablecoin market may face zero-sum competition, where newly issued stablecoins merely redistribute market share rather than expand the market. Tether plans to launch the compliant stablecoin USAT, while Circle is consolidating USDC's position through the development of the Arc blockchain. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still in the process of iterative updates.

- 21:22glassnode: DVOL retreats after the Federal Reserve meeting, with the market expecting no significant volatility in the near termForesight News reported, according to glassnode analysis, DVOL integrates implied volatility across different strike prices and expiration dates, presenting a broader volatility landscape. After the Federal Reserve meeting, DVOL declined, confirming that the market does not expect significant volatility in the near term.

- 21:22Orderly now supports BNB as marginForesight News reported that Orderly has announced the expansion of its multi-collateral margin system to BNB Chain. Users can now use BNB as a trading collateral asset for more than 133 trading pairs, and BNB will soon be available as collateral on all DEXs that support Orderly.

- 21:21Ju.com launches JU buyback and burn program, with the first round totaling $20 millionForesight News reported that Ju.com has officially launched its first round of market buyback and burn operations. The total amount for the first buyback is $20 million, and the buyback will be conducted in batches on the open market starting from the announcement, in order to execute smoothly and minimize market impact. All funds for this buyback come from the platform's operating profits, and 100% of the repurchased JU will be burned. Among them, 500,000 JU (approximately $4 million) were burned at 22:00 on September 19, 2025 (UTC+8). In the future, mechanisms such as regular profit buybacks and capital introduction will be initiated through community governance and decided by a vote of all token holders.