News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 4) | Solana Mobile to Launch the SKR Token; Ethereum Mainnet Successfully Activates the Fusaka Upgrade; U.S. Initial Jobless Claims to Be Released Today at 13:302Ethereum treasury demand collapses: Will it delay ETH’s recovery to $4K?3Bitcoin’s strongest trading day since May cues possible rally to $107K

2025 Crypto Prediction Review: 10 Institutions, Who Got It Wrong and Who Became Legends?

We can consider these predictions as indicators of industry sentiment. If you use them as an investment guide, the results could be disastrous.

深潮·2025/12/04 18:35

SEC launches innovative exemption policy—Has U.S. crypto regulation entered a new era?

The door to exploration has just opened.

深潮·2025/12/04 18:35

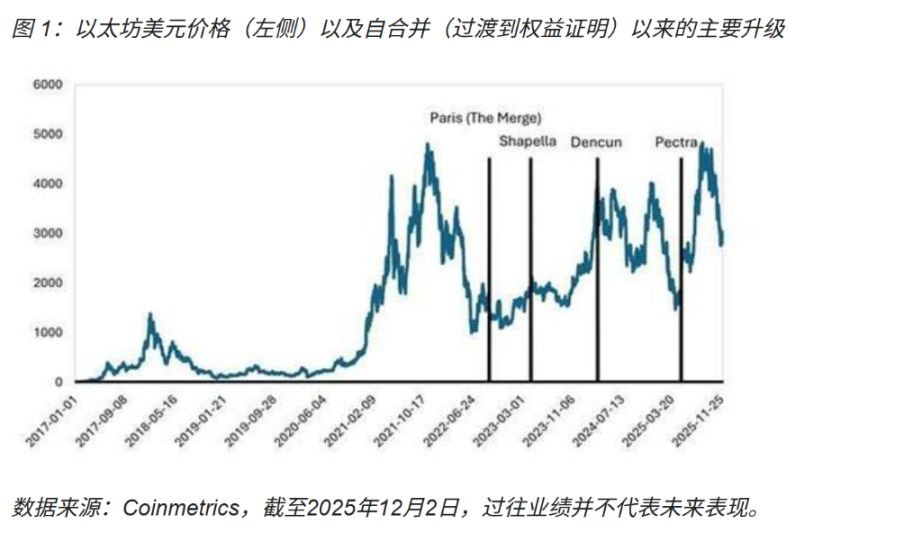

Ethereum undergoes "Fusaka upgrade" to continue "scaling and improving efficiency," strengthening on-chain settlement capabilities

The Fusaka upgrade will consolidate its position as a settlement layer and drive Layer-2 competition towards improvements in user experience and ecosystem depth.

深潮·2025/12/04 18:35

Space Review|Inflation Rebounds vs Market Bets on Rate Cuts: How to Maintain a Prudent Crypto Asset Allocation Amid Macroeconomic Volatility?

In the face of macro volatility, the TRON ecosystem offers a balanced asset allocation model through stablecoin settlements, yield-generating assets, and innovative businesses.

深潮·2025/12/04 18:35

Polymarket Opens Waitlist Access as US Relaunch Gains Momentum

Cointribune·2025/12/04 18:12

BitMine invests $150M in Ether and aims to control 5% of all Ethereum

Cointribune·2025/12/04 18:12

Crypto M&A Activity Soars in 2025, Surpassing $8.6 Billion

Cointribune·2025/12/04 18:12

Crypto: The SEC Slows Down 3x–5x Leveraged ETFs

Cointribune·2025/12/04 18:12

XRP Spot ETF Achieves Stunning 13-Day Inflow Streak, Nears $1 Billion Milestone

BitcoinWorld·2025/12/04 18:09

Flash

- 18:41Data: If ETH falls below $2,998, the cumulative long liquidation intensity on major CEXs will reach $1.376 billionsAccording to ChainCatcher, citing data from Coinglass, if ETH falls below $2,998, the cumulative long liquidation volume on major CEXs will reach $1.376 billions. Conversely, if ETH breaks above $3,311, the cumulative short liquidation volume on major CEXs will reach $1.317 billions.

- 18:41Data: If BTC breaks $96,913, the total short liquidation intensity on major CEXs will reach $1.952 billions.According to ChainCatcher, citing Coinglass data, if BTC breaks through $96,913, the cumulative short liquidation intensity on major CEXs will reach $1.952 billions. Conversely, if BTC falls below $88,213, the cumulative long liquidation intensity on major CEXs will reach $1.363 billions.

- 18:29Traders hedge the risk of multiple Fed rate cuts through mid-2026 using SOFR optionsJinse Finance reported that on December 4, the SOFR options market continued to see a recent trend: traders are focusing on various structured trades for the first two quarters of next year to hedge against multiple rate cuts by the Federal Reserve, and even the possibility of a single 50 basis point rate cut. Fed-dated OIS (Overnight Index Swaps) currently price the effective rate for the June meeting next year at about 3.30%, which is approximately 60 basis points lower than the current effective rate set by the Federal Reserve. The ongoing theme over the past few trading days has been buying upside structures in SOFR options for January, March, and June, aiming to hedge against a greater rate cut premium than what is currently priced in by the swap market.

News