News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 16)|Crypto market sees $508 million in long liquidations over 24 hours; Hassett faces opposition from Trump-aligned senior figures in Fed chair contest2Bitget US Stock Morning Report | US Stocks Fluctuate and Retreat, Tesla Hits New High for the Year, Fed Shows Strong Economic Confidence, Non-farm Payrolls to be Released Tonight, Commodity Prices Fluctuate Violently3Bitcoin sees ‘pure manipulation’ as US sell-off liquidates $200M in an hour

Solana Weathers Massive 6 Tbps DDoS Attack With Zero Downtime, Co-Founder Says

Coinspeaker·2025/12/16 11:39

Analyst: XRP Is Repeating a Pattern I’ve Only Seen Once Before

·2025/12/16 11:33

Stunning Prediction: Bitcoin All-Time High Inevitable for 2025 as 4-Year Cycle Shatters

Bitcoinworld·2025/12/16 11:27

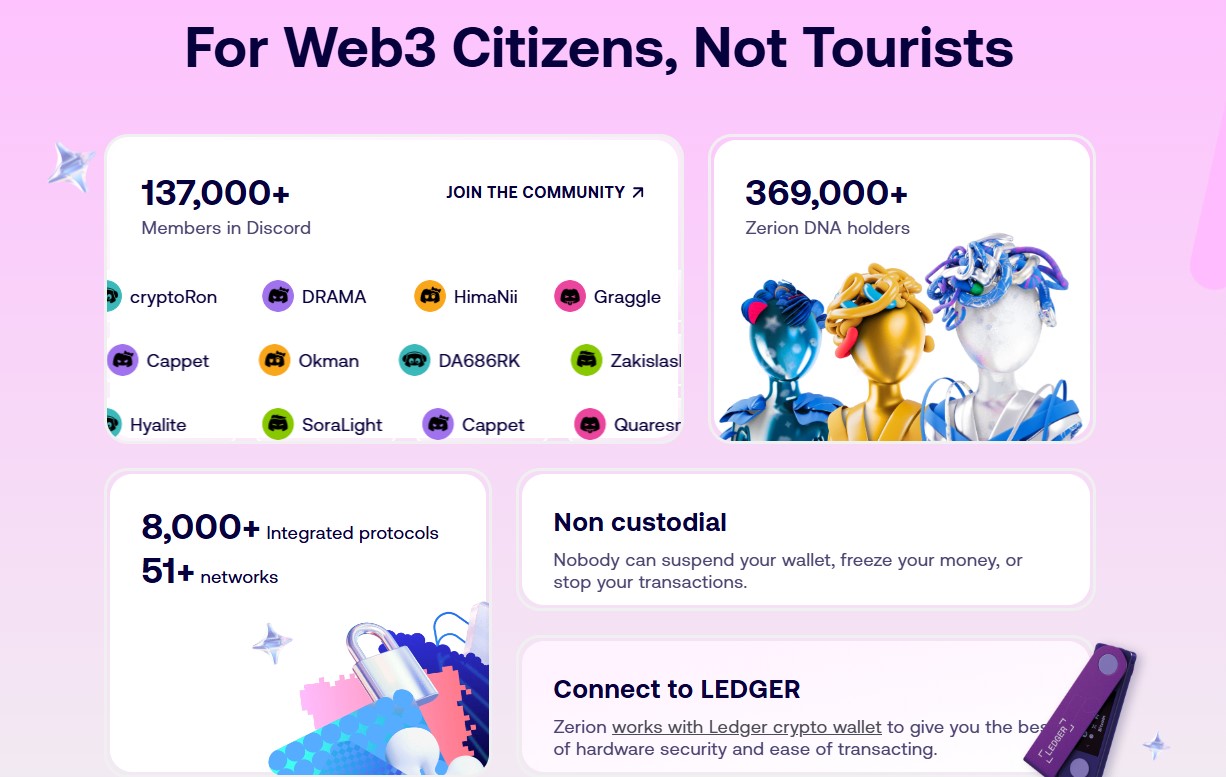

Zerion wallet feed launches early access today: Is a token launch imminent?

币界网·2025/12/16 11:23

Pi Network stock price consolidates as analysts closely watch the next move

币界网·2025/12/16 11:15

StraitsX Stablecoins Unleash Power: XSGD and XUSD Launch on Solana’s Blazing Network in 2025

Bitcoinworld·2025/12/16 11:12

Flash

- 11:52Famous Wall Street Bear Warns: US Stock Market May Collapse Completely in the Second Half of 2026, Fed Will Accelerate Rate Cuts to Save the MarketAccording to TechFlow, on December 16, as reported by Golden Ten Data, well-known Wall Street bear Peter Berezin stated that at the beginning of 2026, as investors shift from technology stocks to non-technology stocks and from growth stocks to value stocks, the stock market decline may still be limited. He expects that this series of factors will ultimately lead the S&P 500 index to close at 5,280 points in 2026, down 23% for the year, while the Nasdaq Composite Index will fall by 31%. In addition, as the US dollar weakens, the Japanese yen will appreciate significantly, with the USD/JPY exchange rate expected to reach 115 by year-end. Gold prices will hit new historical highs. Growing concerns about a US economic recession will prompt the Federal Reserve to accelerate the pace of interest rate cuts in the second half of 2026. By December 2026, the federal funds rate will fall to 2.25%, and the yield on 10-year US Treasury bonds will drop to 3.1%.

- 11:50Famous Wall Street bear Peter Berezin expects the Federal Reserve to accelerate interest rate cuts in the second half of 2026.According to Odaily, renowned Wall Street bear Peter Berezin stated that at the beginning of 2026, as investors shift from technology stocks to non-technology stocks and from growth stocks to value stocks, the decline in the stock market may still be limited. He expects that this series of factors will ultimately lead to the S&P 500 closing at 5,280 points in 2026, representing a 23% drop for the year, while the Nasdaq Composite Index will fall by 31%. In addition, as the US dollar weakens, the Japanese yen will appreciate significantly, with the USD/JPY exchange rate expected to reach 115 by year-end. Gold prices will hit new historical highs. Growing concerns about a US economic recession will prompt the Federal Reserve to accelerate interest rate cuts in the second half of 2026. By December 2026, the federal funds rate will drop to 2.25%, and the 10-year US Treasury yield will fall to 3.1%. (Golden Ten Data)

- 11:50Visa supports US financial institutions in settling with USDC on SolanaVisa has begun supporting US financial institutions in settling transactions using USDC on Solana, with Cross River Bank and Lead Bank being the first institutions to use this service. As a partner of Circle Arc blockchain, Visa will also provide support after Arc goes live.

News