News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 19)|Fed Holds Rates at 4.25%-4.50%; ~$23B Bitcoin Options Expire Next Friday, Volatility May Intensify2Bitget US Stock Morning Brief | CPI Cools Ahead of Expectations; AI Giants Join Genesis Initiative; NYSE Holiday Trading Unchanged (December 19, 2025)3Senate confirms CFTC Chair pick Michael Selig as agency takes larger role regulating crypto

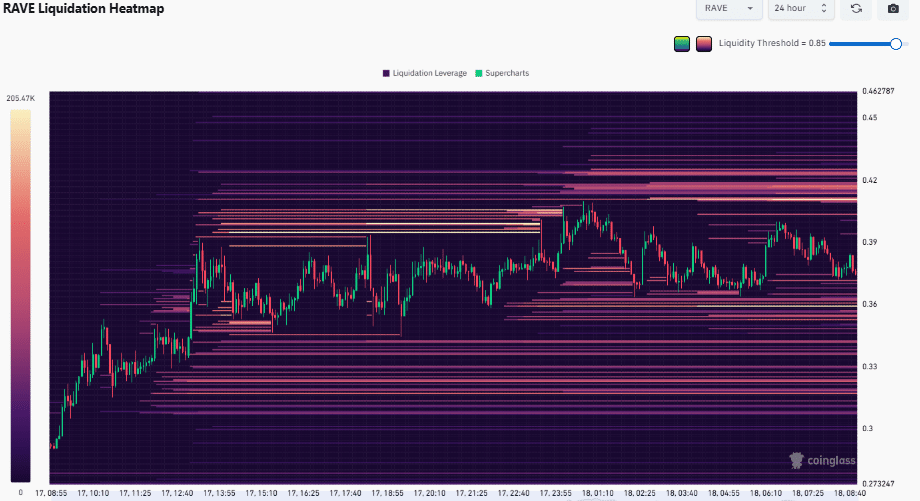

RAVE rallies 29%, but is the post-launch correction already over?

AMBCrypto·2025/12/19 03:03

Stability World AI and Cache Wallet Collaborate to Redefine Asset Recovery and Digital Ownership

BlockchainReporter·2025/12/19 03:00

Solana, Aptos Move to Harden Blockchains Against Future Quantum Attacks

Decrypt·2025/12/19 02:50

Revealed: Bitmain’s Massive $229.3 Million Ethereum Purchase Signals Bullish Confidence

Bitcoinworld·2025/12/19 02:42

Revolutionary aPriori Chainlink Partnership Unlocks Seamless Cross-Chain Trading

Bitcoinworld·2025/12/19 02:27

Revolutionary SportsFi Platform GolfN Drives Global Expansion with Major Brand Partnerships

Bitcoinworld·2025/12/19 02:15

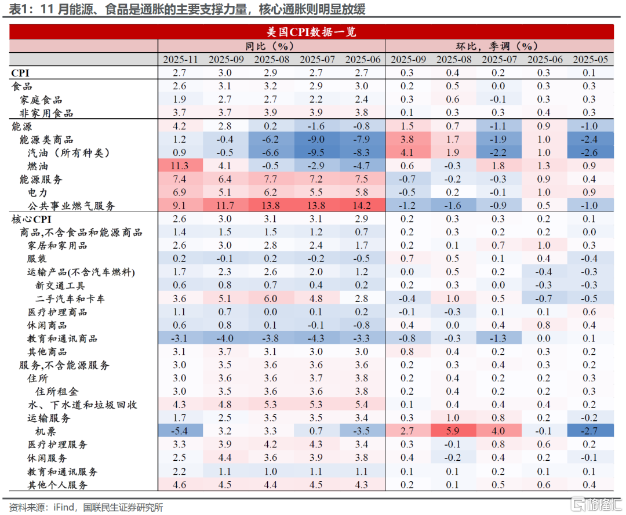

US CPI Surprises, Is There a Turning Point for the Doves?

AIcoin·2025/12/19 02:06

Game-Changing Appointment: Mike Selig Takes Helm as New CFTC Chairman

Bitcoinworld·2025/12/19 01:57

Flash

03:31

The Bank of Japan has raised interest rates three times before, and each time Bitcoin has experienced a drop of over 20%.BlockBeats News, December 19th. According to market data, since 2024, the Bank of Japan has implemented interest rate hikes three times, in March and July of 24 and in January of this year. Over the past few decades, a significant portion of global capital market liquidity has actually come from Japan, not just the United States. Due to Japan's long-standing zero or even negative interest rate policy (NIRP), coupled with an extremely loose monetary environment, Japan has effectively served as a low-cost funding ATM for the global financial system.

Therefore, Japan's interest rate hikes have had a significant tightening effect on global liquidity. Bitcoin has experienced price declines after each of the three mentioned interest rate hikes, with decreases of 23.06%, 26.61%, and 31.89%, respectively.

However, the latest round of interest rate hikes in Japan was well anticipated, and the market has already responded proactively. Whether this round of rate hikes will lead to a similar Bitcoin price drop as seen before remains uncertain.

03:23

Base has undergone a capacity upgrade, with the current gas limit increased to 375 million gas per block | PANewsPANews reported on December 19 that Base Build announced on the X platform that Base Chain has undergone a capacity upgrade, with the block gas limit now increased to 375 million gas per block. With increased activity, this means a burst capacity increase of approximately 25%, and an average throughput increase of about 4% to 5%. In addition, Base has raised the minimum base fee from 0.0002 gwei to 0.0005 gwei to enhance the chain's functionality. At the minimum base fee, the cost of a typical transaction is less than one-tenth of a cent (0.01 USD).

03:22

Bank of Japan raises interest rates by 25 basis points as expectedJinse Finance reported that the Bank of Japan has raised its benchmark interest rate from 0.5% to 0.75%, in line with market expectations. This interest rate level marks a 30-year high, and it is also the first rate hike by the Bank of Japan in 11 months since January 2025. (Golden Ten Data)

News