News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

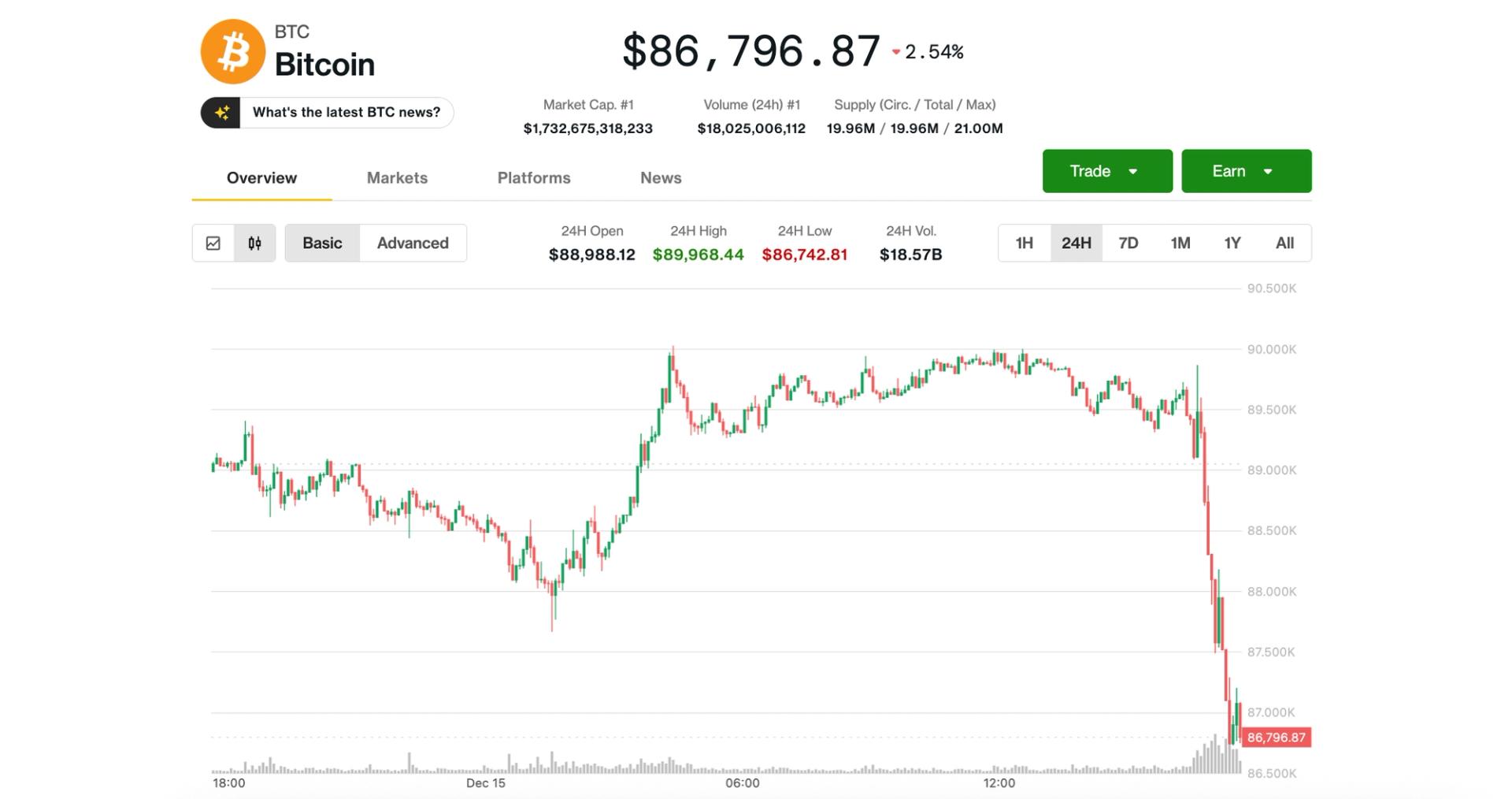

The recent decline in bitcoin prices is primarily driven by expectations of a rate hike by the Bank of Japan, uncertainty regarding the US Federal Reserve's rate cut trajectory, and systemic de-risking by market participants. Japan's potential rate hike may trigger the unwinding of global arbitrage trades, leading to a sell-off in risk assets. At the same time, increased uncertainty over US rate cuts has intensified market volatility. In addition, selling by long-term holders, miners, and market makers has further amplified the price drop. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

The crypto industry is replacing Wall Street's privileged status within the American right-wing camp.

The market is transitioning from an emotion-driven cycle of speculation to a phase of structural differentiation driven by regulatory channels, long-term capital, and fundamental-based pricing.

The market is down again, but this may not be a good buying opportunity this time.

SCOR announced today a major strategic partnership with creative director, cultural icon, and CLOT founder Edison Chen.

- 09:10CNBC: Hassett's Appointment as Federal Reserve Chairman Was Interfered With by Trump's Inner CircleBlockBeats News, December 15, according to CNBC citing sources, Kevin Hassett, once considered a "quasi-candidate" for Federal Reserve Chair by the market, has recently faced doubts from senior figures who can directly influence former President Trump’s decisions. The point of contention is: Hassett was initially seen as the strongest candidate to succeed current Chair Powell due to his close relationship with Trump, but now concerns are being raised for the same reason—being "too close to the president." This pressure may explain why the candidate interviews were rescheduled after being canceled in early December (at least for Warsh, the interview was completed last week). Trump previously told reporters that he had decided on a candidate for Federal Reserve Chair, but in an interview with The Wall Street Journal on Friday, he stated that former Federal Reserve Governor Kevin Warsh and Hassett had both become the final candidates, which surprised the market. On the Kalshi prediction market, Hassett’s probability of being selected dropped accordingly. "Both Kevins are excellent," Trump said. As of Monday, Hassett still led on the Kalshi platform with a 51% probability, but this was a sharp decline from over 80% earlier this month; Warsh’s probability rose from about 11% in early December to 44%. The current resistance is more about boosting Warsh rather than criticizing Hassett. JPMorgan CEO Jamie Dimon praised both candidates at an event on Thursday, but some of his remarks led the audience to believe he favored Warsh, the former Federal Reserve Governor.

- 07:10StraitX to launch Singapore Dollar and US Dollar stablecoins on Solana in early 2026ChainCatcher reported that recently, crypto infrastructure company StraitX announced on Tuesday its plan to launch the Singapore dollar stablecoin XSGD and the US dollar stablecoin XUSD on the Solana blockchain in early 2026. This will enable instant exchange between the two currencies on Solana, facilitating digital foreign exchange trading. For Solana, this will be the first Singapore dollar stablecoin, further expanding its role as a global payment chain. Currently, Solana already has 15.7 billions USD in stablecoins, but has always lacked a Singapore dollar option.

- 07:10PancakeSwap incubates on-chain prediction market Probable, set to launch on BNB ChainChainCatcher reported that PancakeSwap has announced the launch and incubation of Probable, a fully on-chain prediction market platform. The project is jointly supported by PancakeSwap and YZi Labs, and will be exclusively deployed on BNB Chain. According to the introduction, Probable is positioned as a user-centric on-chain prediction platform, featuring zero fees, fully on-chain settlement, and a simplified user experience. The platform will not charge any prediction fees in its initial phase. Leveraging BNB Chain’s low-cost and high-performance infrastructure, it will support users in predicting the trends of crypto assets, global events, sports competitions, and certain region-specific markets. In terms of mechanism, Probable adopts UMA’s Optimistic Oracle as the event adjudication tool, confirming results through a dispute-based verification method to enhance the transparency and censorship resistance of the prediction market. In addition, users can deposit with any token, and the system will automatically convert it to USDT on BNB Chain for participation in predictions, lowering the operational threshold. PancakeSwap stated that Probable is an independent project, and its team will advance product implementation and ecosystem expansion with the support of PancakeSwap and YZi Labs. The prediction market is expected to officially launch soon.