News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 17)|U.S. seasonally adjusted nonfarm payrolls for November increased by 64,000; BlackRock transferred approximately $140 million worth of ETH to a CEX2Bitget US Stock Morning Brief | Fed Independence Reaffirmed; NFP Beats Expectations; Tech Rally Lifts Market (December 17, 2025)

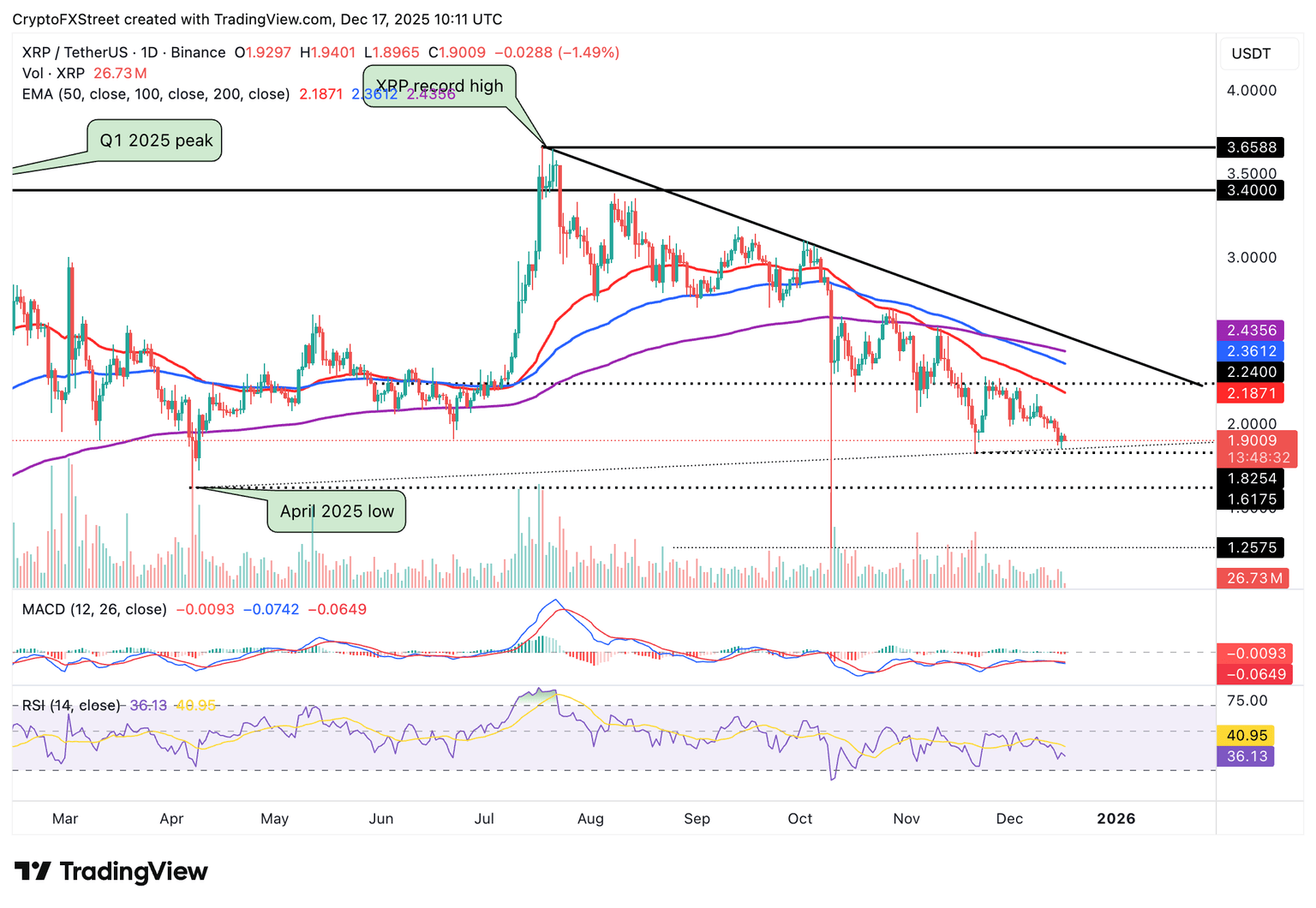

December 17 XRP Price Prediction: Can XRP Find a Bottom and Reach $3?

币界网·2025/12/17 12:48

Strategic Shift: Norway’s $1.6 Trillion Fund Boldly Backs Metaplanet’s Bitcoin Strategy

Bitcoinworld·2025/12/17 12:45

Opinion Labs Stuns Market: Hits $6.4B Trading Volume in Just 50 Days

Bitcoinworld·2025/12/17 12:42

Aave founder charts 'master plan' to trillion-dollar scale as DAO tensions mount, SEC ends 4-year probe

The Block·2025/12/17 12:39

Dogecoin Price Prediction 2025-2030: Will DOGE Finally Reach the Elusive $1 Milestone?

Bitcoinworld·2025/12/17 12:36

Grayscale calls 2026 the dawn of the institutional era for cryptocurrencies.

币界网·2025/12/17 12:33

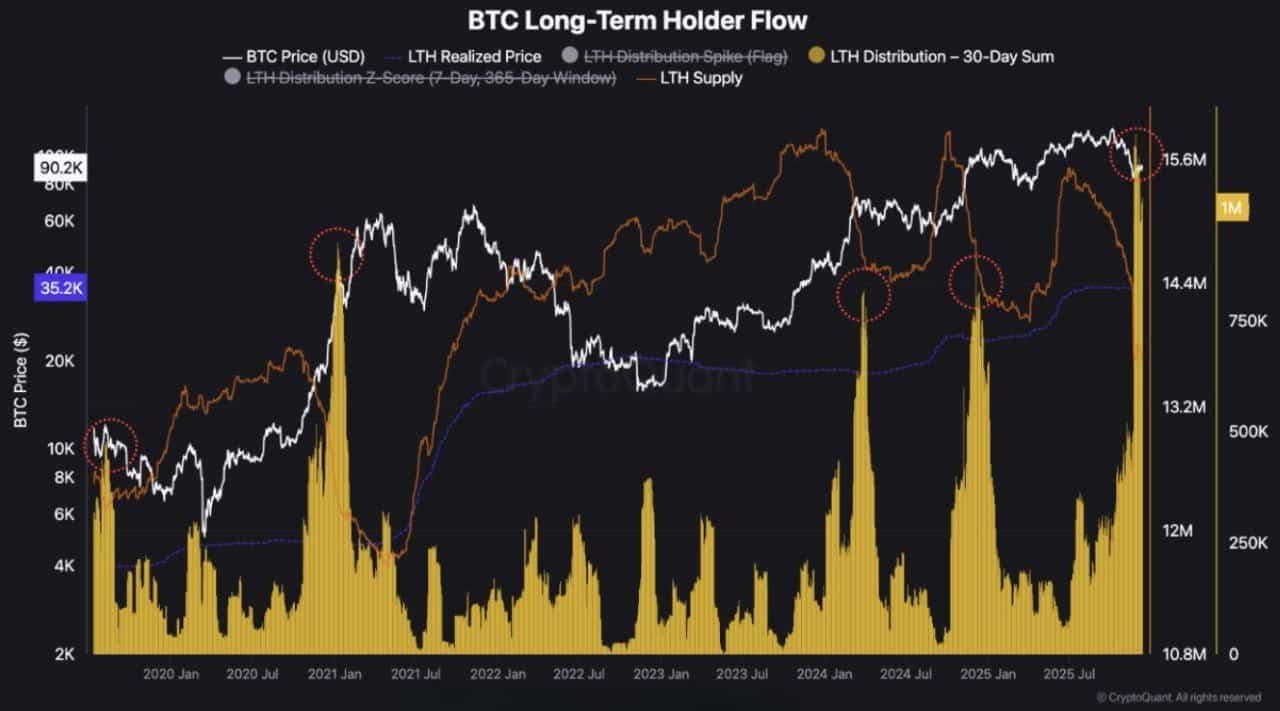

How did Bitcoin’s price react to ‘mixed’ U.S Jobs report?

AMBCrypto·2025/12/17 12:18

Bitcoin Cash Price Prediction: Will BCH Soar to $1000 by 2030?

Bitcoinworld·2025/12/17 12:15

Flash

12:42

Report: Central African Republic's Advancement of Cryptocurrency Initiatives Intensifies Elite Monopoly and External Crime RisksAccording to Odaily, the Global Initiative Against Transnational Organized Crime (GI-TOC) has released a report stating that the Central African Republic (CAR)'s push for cryptocurrency has not promoted financial inclusion, but rather benefited a small elite group and exposed the country to the influence of foreign criminal networks. The report notes that, amid severe shortages of electricity, internet, and regulation, CAR's crypto projects—from bitcoin legalization, Sango Coin, to national meme coins—primarily serve the interests of foreign investors and a few insiders. The report also criticizes the 2023 law allowing the tokenization of oil, gold, timber, and land, arguing that it may undermine national sovereignty. (Cointelegraph)

12:37

SBI Ripple Asia partners with Doppler Finance to explore XRP yield generation and RWA tokenizationBlockBeats News, December 17, SBI Ripple Asia has signed a memorandum of understanding with XRPL native protocol Doppler Finance, planning to jointly explore XRP-based yield products and real-world asset (RWA) tokenization on the XRP Ledger. This is the first time SBI Ripple Asia has cooperated with a native XRPL yield protocol. According to disclosures, both parties will focus on building compliant and transparent yield infrastructure for institutional clients, promoting the transformation of XRP from a payment asset to a yield-generating financial asset. Doppler Finance will provide the on-chain yield framework, while SBI Digital Markets, regulated by the Monetary Authority of Singapore, will serve as the institutional custodian, offering segregated custody services for client assets. This collaboration is seen as an important step in deepening institutional participation in the XRP Ledger. For a long time, XRPL has been relatively limited in on-chain yield and financialization applications. Leveraging the regulatory and ecosystem advantages of SBI Group and Ripple in Asia, both parties hope to accelerate the process of yield generation for XRP and RWA on-chain, in response to the demand for tokenized assets and blockchain yield products in regions with clearer regulatory environments such as Japan and Singapore.

12:32

Data: 180,000 LINK transferred from a certain exchange to B2C2 Group, worth approximately $2.29 millionAccording to ChainCatcher, citing Arkham data, at 20:20, 180,000 LINK (worth approximately $2.29 million) were transferred from an exchange to B2C2 Group.

News