News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 17)|U.S. seasonally adjusted nonfarm payrolls for November increased by 64,000; BlackRock transferred approximately $140 million worth of ETH to a CEX2Bitget US Stock Morning Brief | Fed Independence Reaffirmed; NFP Beats Expectations; Tech Rally Lifts Market (December 17, 2025)

Unlocking Potential: Animoca Brands Japan & Babylon Labs Forge Strategic Bitcoin Staking Partnership

Bitcoinworld·2025/12/17 03:57

Paradigm Bets on Brazil: The New Battleground for Stablecoins Is Not in the United States

BlockBeats·2025/12/17 03:49

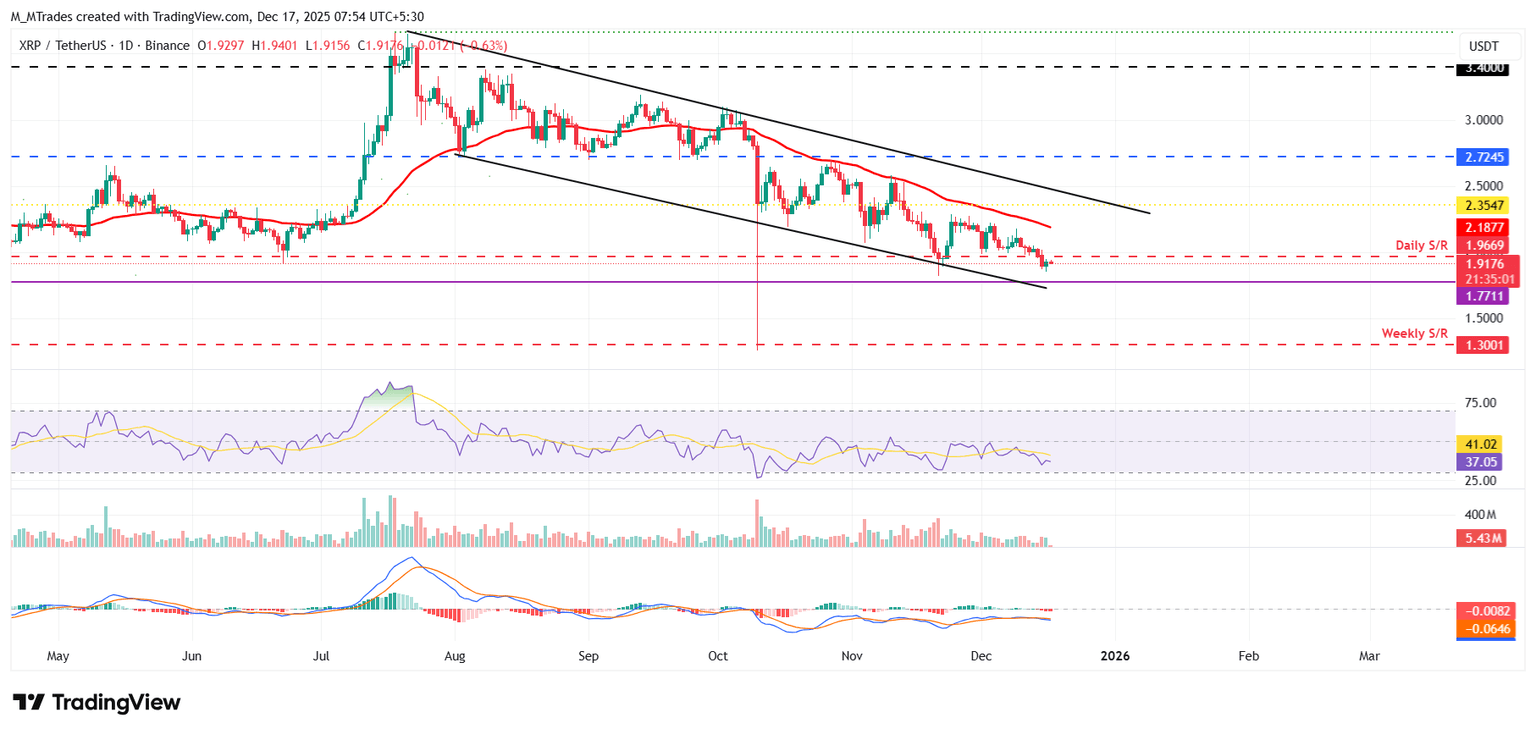

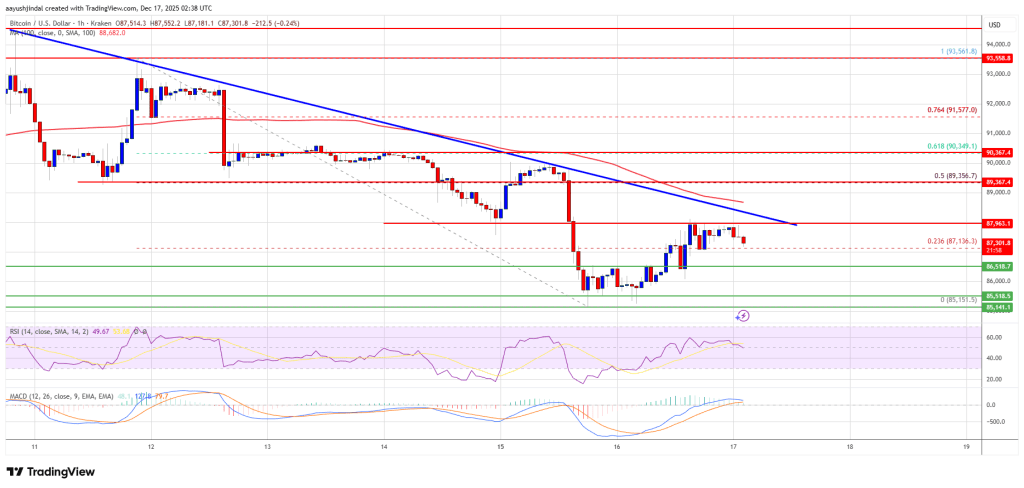

Bitcoin price regroups after decline—Is a directional breakout imminent?

币界网·2025/12/17 03:17

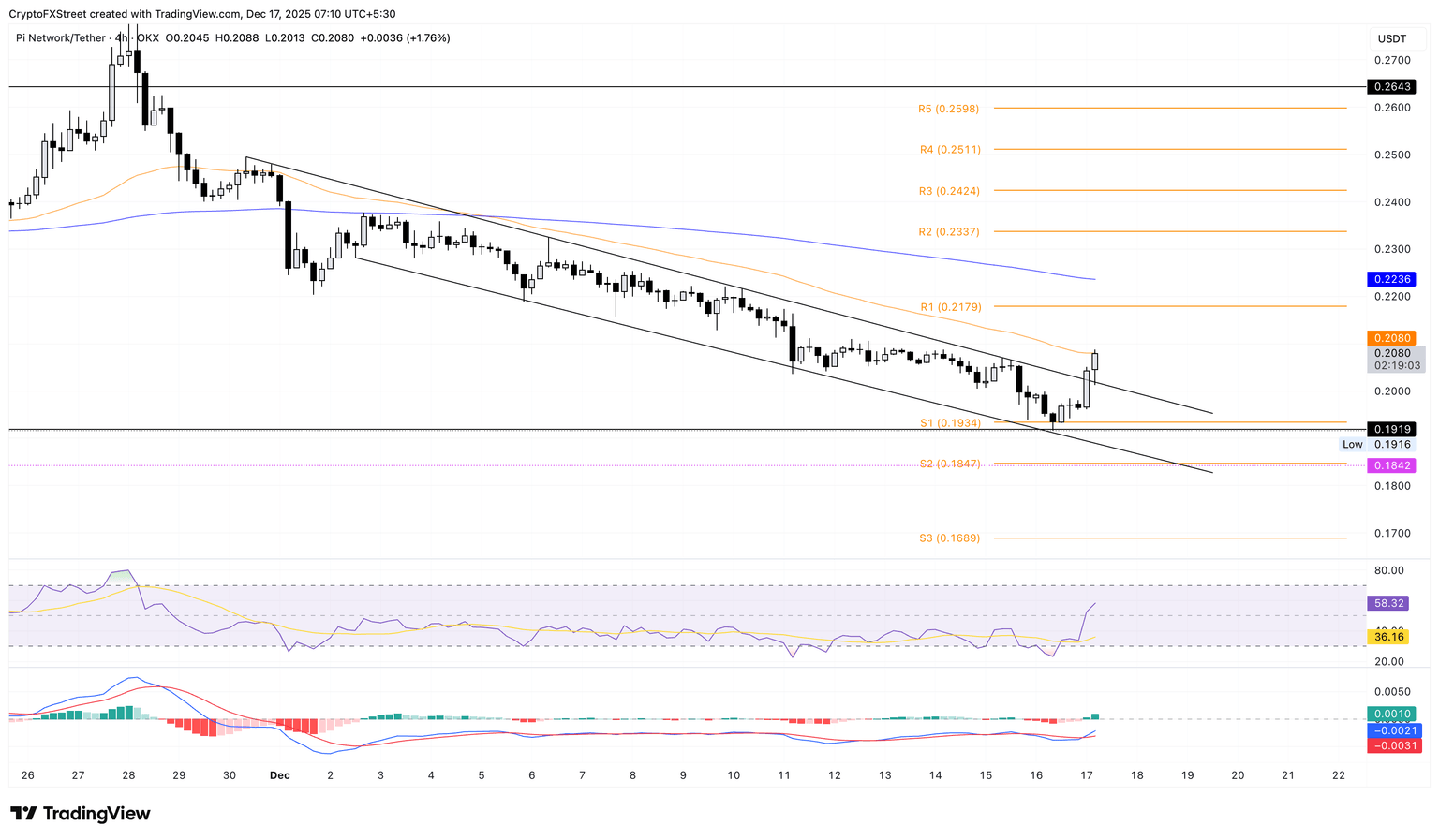

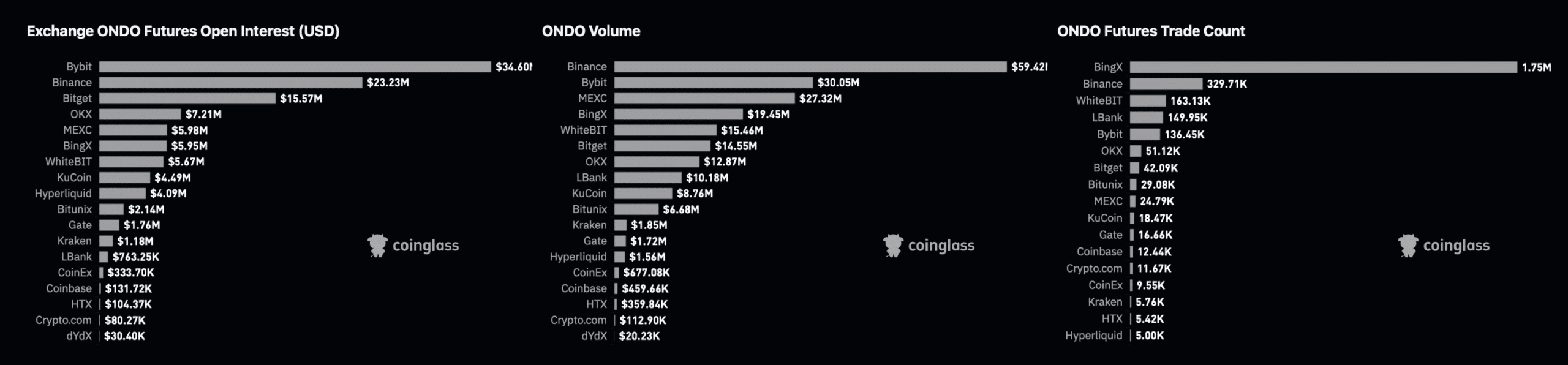

Two main reasons why the current decline of ONDO is only temporary.

币界网·2025/12/17 03:14

Mapping 2 reasons why ONDO’s current dip is only temporary

BlockBeats·2025/12/17 03:03

Flash

- 04:14Data: 74.99 WBTC transferred out from an exchange, routed through an intermediary, and sent to another anonymous addressAccording to ChainCatcher, data from Arkham shows that at 12:07 (UTC+8), 74.99 WBTC (worth approximately $6.529 million) were transferred from an exchange to an anonymous address (starting with 0xD338...). Three minutes later, this address transferred 69.93 WBTC to another anonymous address (starting with 0xa8b7...).

- 04:11Yesterday, Bitcoin ETF saw a net outflow of $277 million.According to TechFlow, on December 17, monitored by Trader T, the net outflow of bitcoin ETF reached $277 million yesterday. Among them, BlackRock's IBIT saw an outflow of $210 million, Fidelity's FBTC had an inflow of $26.72 million, Bitwise's BITB saw an outflow of $50.93 million, Ark Invest's ARKB had an outflow of $16.87 million, VanEck's HODL saw an outflow of $17.96 million, and Grayscale Mini's BTC had an outflow of $7.37 million. Invesco's BTCO, Franklin's EZBC, Valkyrie's BRRR, WisdomTree's BTCW, and Grayscale's GBTC had no capital movement on the day.

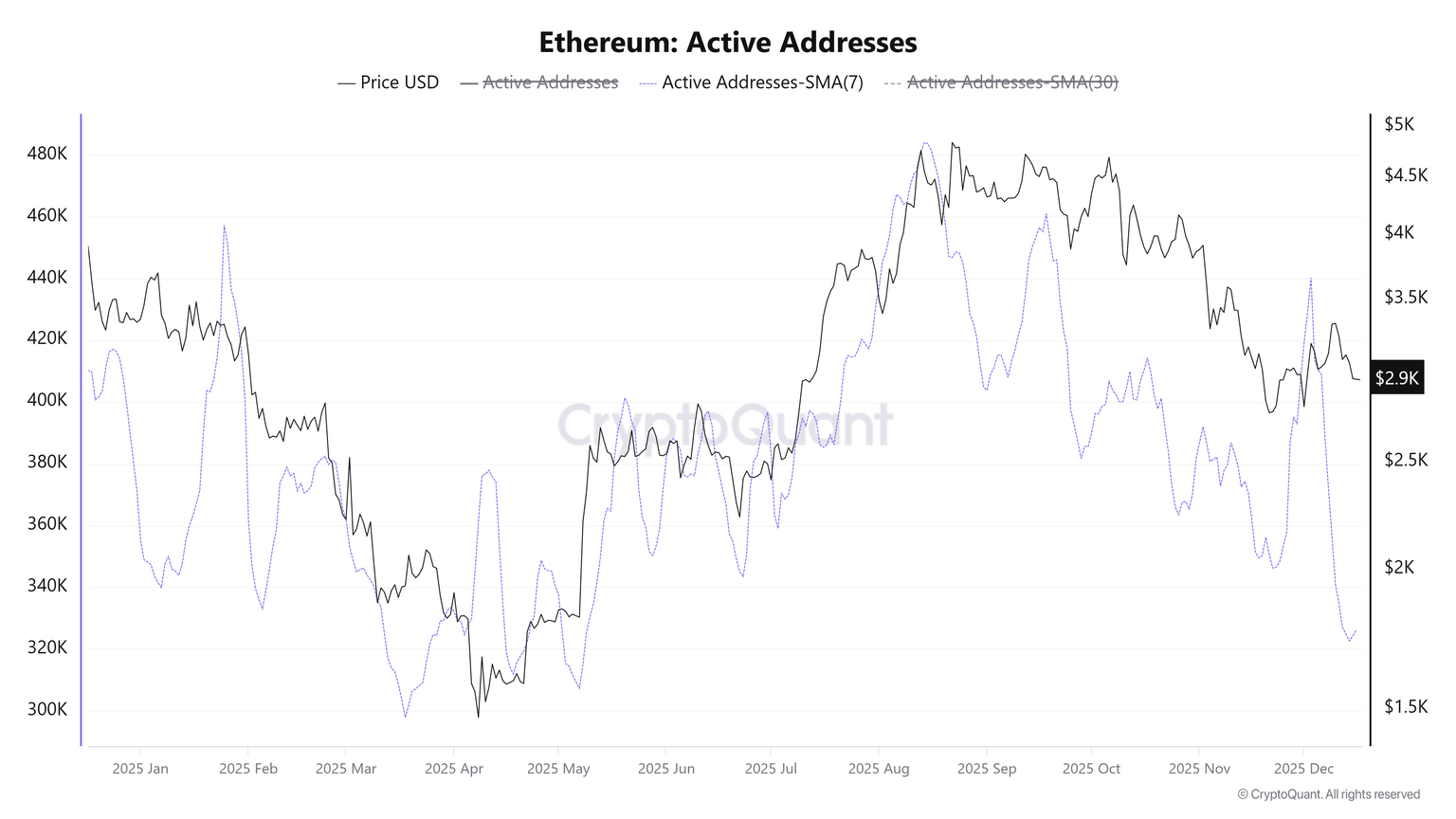

- 04:04「Abraxas Capital」 has closed approximately $240 million worth of ETH short positions, marking a 90% decrease in the size of this short position compared to the previous period.BlockBeats News, December 17th, according to HyperInsight monitoring, it was reported that an address recently identified as Abraxas Capital (0x5b5) has been continuously closing ETH short positions. In the past 20 hours, this address has been continuously closing approximately $9.7 million worth of ETH shorts at $2,932. The position size has decreased from $51.57 million last week to $26.54 million, with an average entry price of $3,471, an unrealized profit of $4.69 million (176%), and this short position has realized a profit of $13.74 million through funding rate settlements. According to the monitoring, Abraxas Capital's ETH short positions were opened in May and the address was previously the largest whale in Hyperliquid's contract funding pool. Starting from November, the address has been consistently taking profits on its ETH short positions. The position size was approximately $267 million, and it has currently closed about $240 million, part of which has been used to increase its spot HYPE holdings. The current HYPE spot holdings amount to around $47.5 million.

News