News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

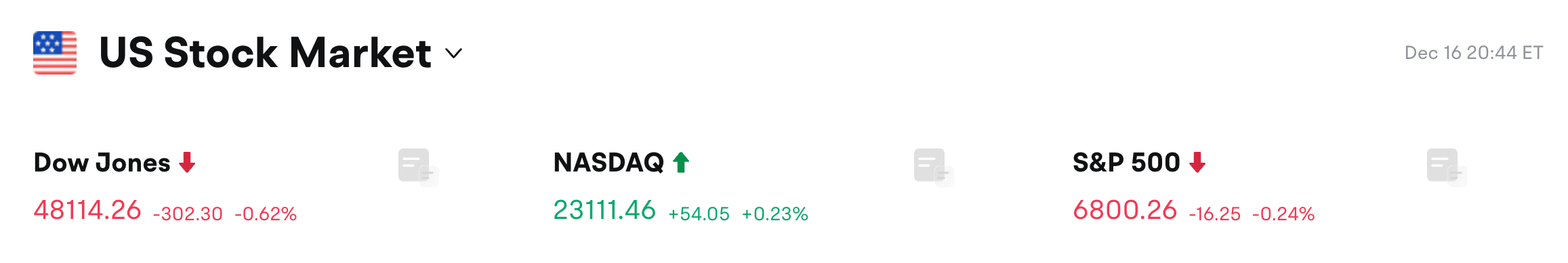

1Bitget Daily Digest (Dec. 17)|U.S. seasonally adjusted nonfarm payrolls for November increased by 64,000; BlackRock transferred approximately $140 million worth of ETH to a CEX2Bitget US Stock Morning Brief | Fed Independence Reaffirmed; NFP Beats Expectations; Tech Rally Lifts Market (December 17, 2025)

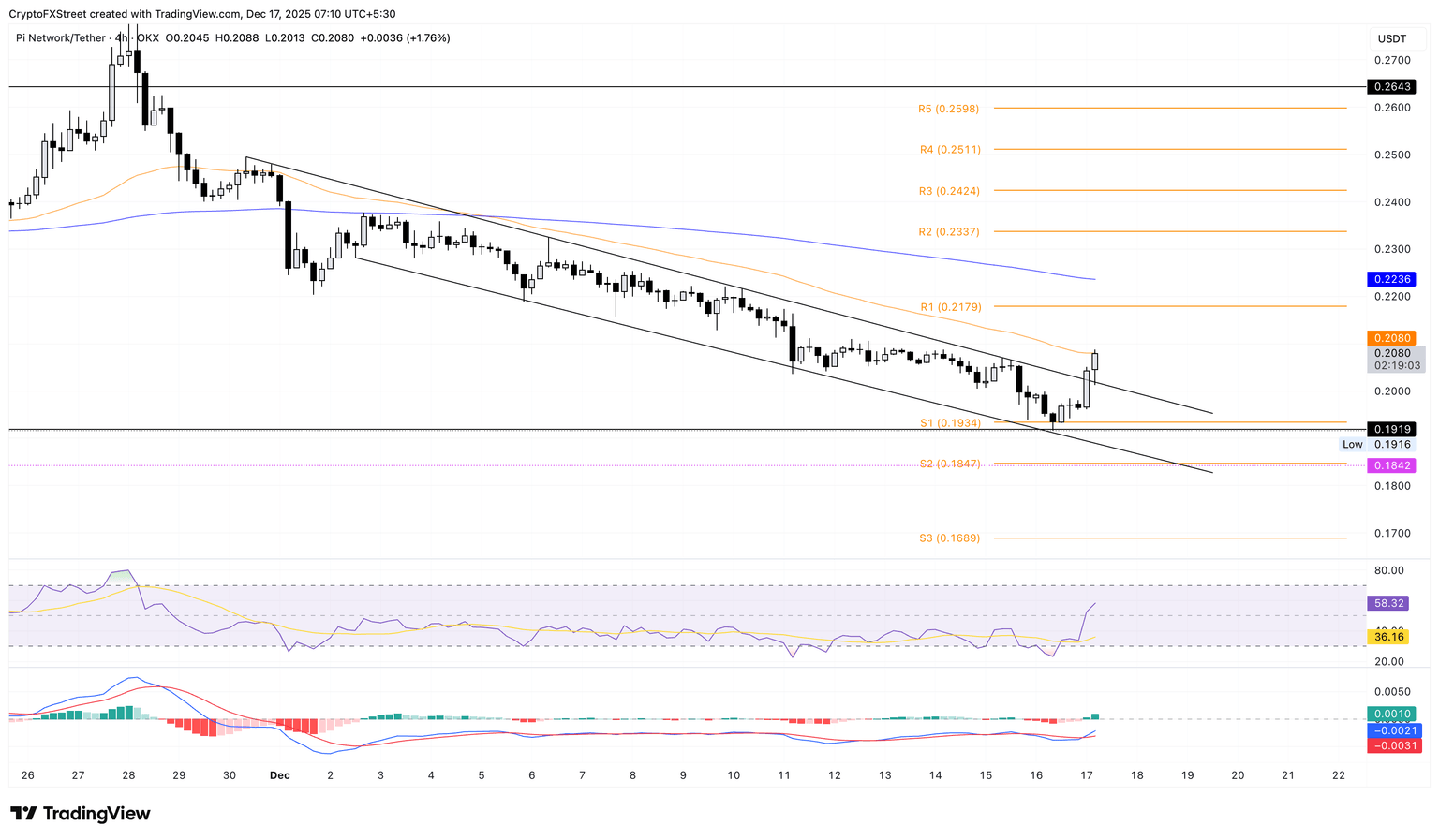

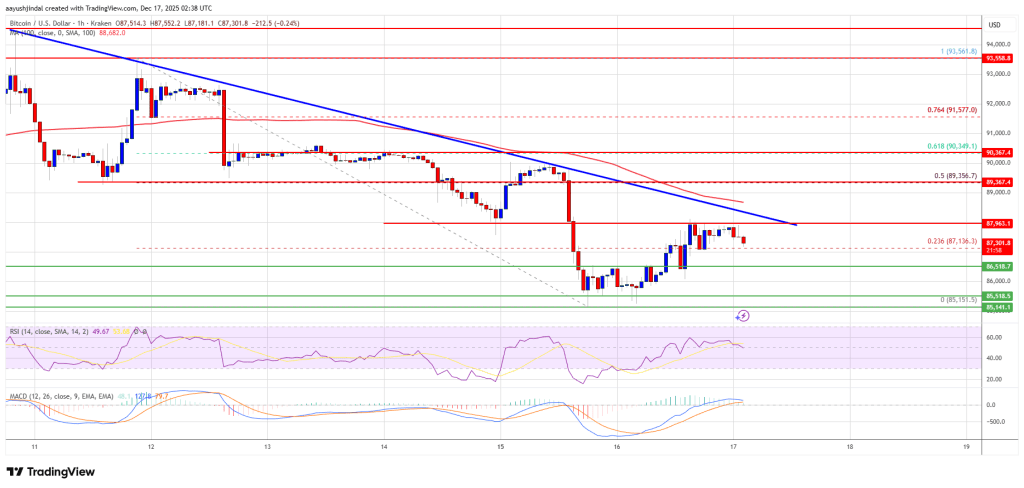

Bitcoin price regroups after decline—Is a directional breakout imminent?

币界网·2025/12/17 03:17

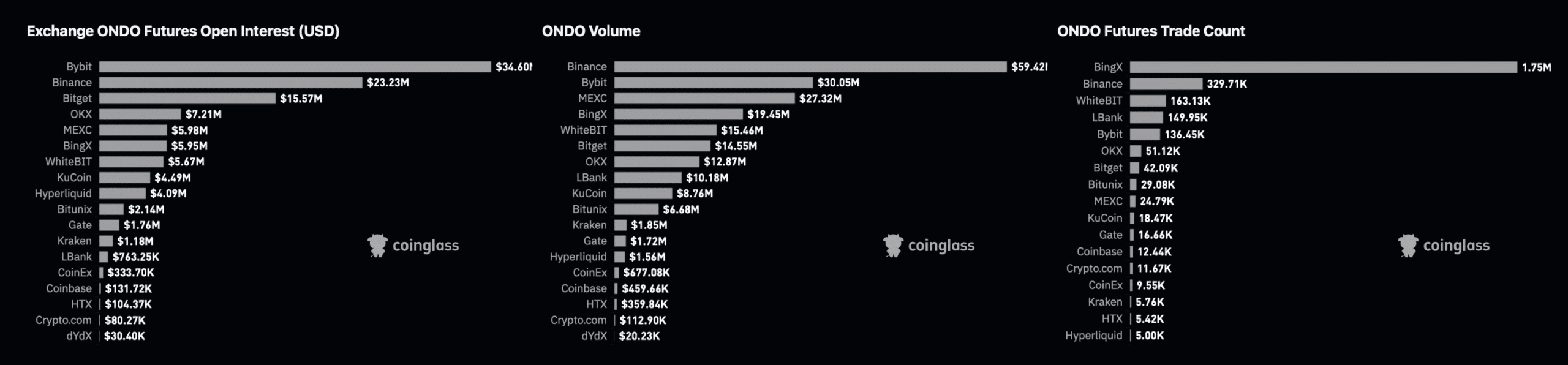

Two main reasons why the current decline of ONDO is only temporary.

币界网·2025/12/17 03:14

Mapping 2 reasons why ONDO’s current dip is only temporary

BlockBeats·2025/12/17 03:03

How much capital can Hyperliquid’s major move "Portfolio Margin" bring?

BlockBeats·2025/12/17 02:48

Won-Dollar Exchange Rate Soars: Hits Critical 1480 Level for First Time in 8 Months

Bitcoinworld·2025/12/17 02:42

The real impact of quantitative easing policies on cryptocurrencies

币界网·2025/12/17 02:36

Flash

- 03:30Hyperliquid Relief Fund holds 37.114 million HYPE, approximately 13.7% of the current circulating supply.BlockBeats News, December 17th, on-chain data shows that the Hyperliquid Assistance Fund holds 37.114 million HYPE, equivalent to about 1.02 billion US dollars, accounting for approximately 13.7% of the current circulating supply. The total supply of HYPE is 1 billion tokens, with the current HYPE market capitalization reaching 7.406 billion US dollars and the FDV reaching 27.35 billion US dollars. Previously reported, the Hyper Foundation posted on social media proposing a validator vote to formally acknowledge that the HYPE held by the Assistance Fund has been burned and permanently removed these tokens from circulation and total supply.

- 03:26Bitcoin's decline was driven by derivatives liquidation.according to on-chain data, the recent decline in Bitcoin prices is mainly driven by forced liquidations in the derivatives market, rather than sell-offs in the spot market. The root cause lies in the accumulation of highly leveraged long positions in the futures market. When the price falls below a key level, these positions hit the maintenance margin requirements and are forcibly liquidated. Liquidations are executed as market sell orders, increasing sudden selling pressure and further pushing prices down. The key point is that liquidations are not only a result of price declines but also an "amplifier." Even a slight initial drop can trigger a chain of forced sell-offs, with one liquidation causing the next. Therefore, this round of decline should be seen as a structural deleveraging event rather than a collapse in fundamental demand.

- 03:23SlowMist: Crypto exchange an exchange has a potentially serious vulnerability.SlowMist sent a security notice to the crypto exchange ICRYPEX Global, stating that a potential serious vulnerability was discovered. SlowMist reminded ICRYPEX Global to contact them as soon as possible to coordinate the next steps.

News