News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 16)|Crypto market sees $508 million in long liquidations over 24 hours; Hassett faces opposition from Trump-aligned senior figures in Fed chair contest2Bitget US Stock Morning Report | US Stocks Fluctuate and Retreat, Tesla Hits New High for the Year, Fed Shows Strong Economic Confidence, Non-farm Payrolls to be Released Tonight, Commodity Prices Fluctuate Violently3Bitcoin sees ‘pure manipulation’ as US sell-off liquidates $200M in an hour

Bitget Integrates Monad, Letting Users Trade Monad Assets Directly with USDC

BlockchainReporter·2025/12/16 23:00

FTC Compels Nomad Operator to Repay Users After $186M Crypto Bridge Hack in 2022

Decrypt·2025/12/16 22:45

Bitcoin Treasury KindlyMD faces Nasdaq delisting, stock price drops 99%.

币界网·2025/12/16 22:26

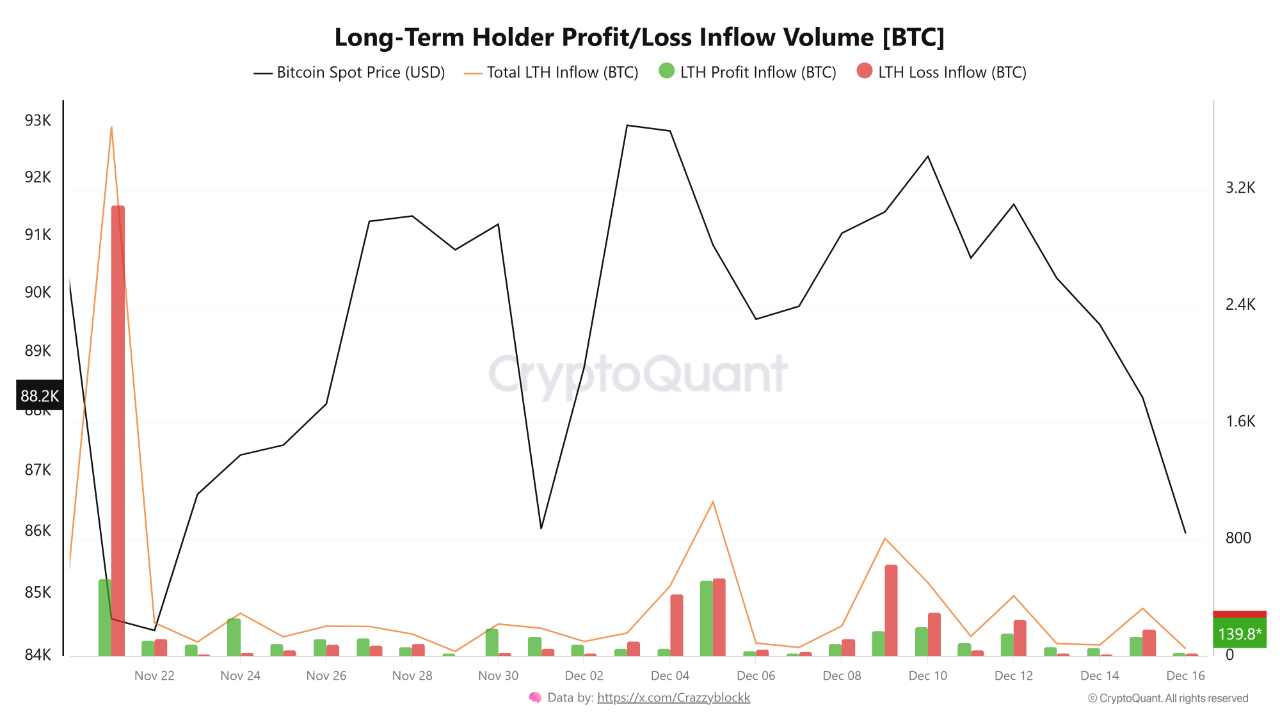

Who are the real dip sellers? On-chain data reveals the true sellers of bitcoin

币界网·2025/12/16 22:14

Ethereum Faces Pressure After Failing to Hold $3,400—What Happens Next?

币界网·2025/12/16 22:11

Elizabeth Warren Sounds Alarm on Trump's Crypto Dealings, PancakeSwap

Decrypt·2025/12/16 21:56

Why is the Bank of Japan so important to Bitcoin?

币界网·2025/12/16 21:52

Flash

- 23:12The US FDIC proposes rules to establish a stablecoin application framework to advance the implementation of the GENIUS Act.ChainCatcher news, according to The Block, the U.S. Federal Deposit Insurance Corporation (FDIC) is moving forward with implementing parts of the stablecoin bill that became law this summer.

- 23:07US FTC orders Nomad operators to compensate users $186 million after 2022 crypto bridge hackJinse Finance reported that the U.S. Federal Trade Commission (FTC) stated on Tuesday that it has proposed a settlement to Nomad cryptocurrency bridge operator Illusory Systems Inc., related to the 2022 hacking incident that resulted in nearly all funds on the platform being stolen. According to the proposed settlement, Illusory will be prohibited from misrepresenting its security measures and will be required to implement a formal information security program, undergo independent security assessments every two years, and return any recovered funds not yet reimbursed to affected users. The agency stated that the breach resulted in the theft of approximately $186 million in digital assets, causing losses of over $100 million to consumers.

- 23:00South Korean audit finds over $15 million in relief funds mistakenly issued to crypto investorsJinse Finance reported that South Korean audit authorities have discovered that approximately 269 individual crypto traders received a total debt reduction of over $15 million from the government’s “New Start Fund” established for small and medium-sized enterprises after the pandemic. Among them, one beneficiary, after receiving a $62,000 reduction and a 77% debt cut, still held about $307,000 in crypto assets. Regulators stated that under the current system, it is difficult to verify crypto assets unless voluntarily declared. Legislative amendments have already been promoted, aiming to grant Korea Asset Management Corporation (KAMCO) the authority to inquire about beneficiaries’ unlisted stocks and crypto assets without consent, in order to prevent similar situations from occurring again.

News