News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(September 16)|Fed rate cut probability reaches 95.9%;Spot Gold Price Surpasses $3,680/oz;South Korea lifts restrictions on virtual asset trading and brokerage services2XRP 4H Golden Cross Could Reflect ETF Optimism as Shiba Inu Netflows Crash and Dogecoin May Face Death Cross3Dogecoin Could Rally if It Breaks $0.29 Resistance, Analyst Says

SEC's Quantum Security Framework Signals

Cointribune·2025/09/17 00:57

Nakamoto Holdings Crashes 54% as Market Loses Faith in Its Bitcoin Model

Cointribune·2025/09/17 00:57

Memecoin news: Pump.fun flips Hyperliquid in revenue, DOGE ETF expected this week

Coinjournal·2025/09/17 00:57

Immutable (IMX) price rebounds sharply after deep correction: here’s why

Coinjournal·2025/09/17 00:57

US and UK to Announce New Crypto Cooperation Deal: A Turning Point for Digital Assets?

Cryptoticker·2025/09/17 00:45

Solana Sees 2.25 Billion USDC Minted In September

Quick Take Summary is AI generated, newsroom reviewed. Solana recorded $2.25 billion USDC Mint during September 2025 Institutions prefer Solana for speed, liquidity, and regulatory clarity GENIUS Act rules boost compliance trust for institutional stablecoin adoption Public companies increasingly use Solana treasuries for staking and yield Circle expands USDC Mint globally under MiCA and e-money frameworksReferences $2.25B $USDC Minted on Solana This Month

coinfomania·2025/09/16 23:03

Forward Industries to tokenize company stock and operate fully on Solana blockchain

Cryptobriefing·2025/09/16 22:18

Get Your Bitcoin and Ethereum via PayPal: P2P Payments Have Just Entered the Cryptocurrency Space

PayPal has launched peer-to-peer payments for Bitcoin and Ethereum, allowing users to send and receive cryptocurrencies directly through its platform more easily than before.

Cryptoticker·2025/09/16 21:59

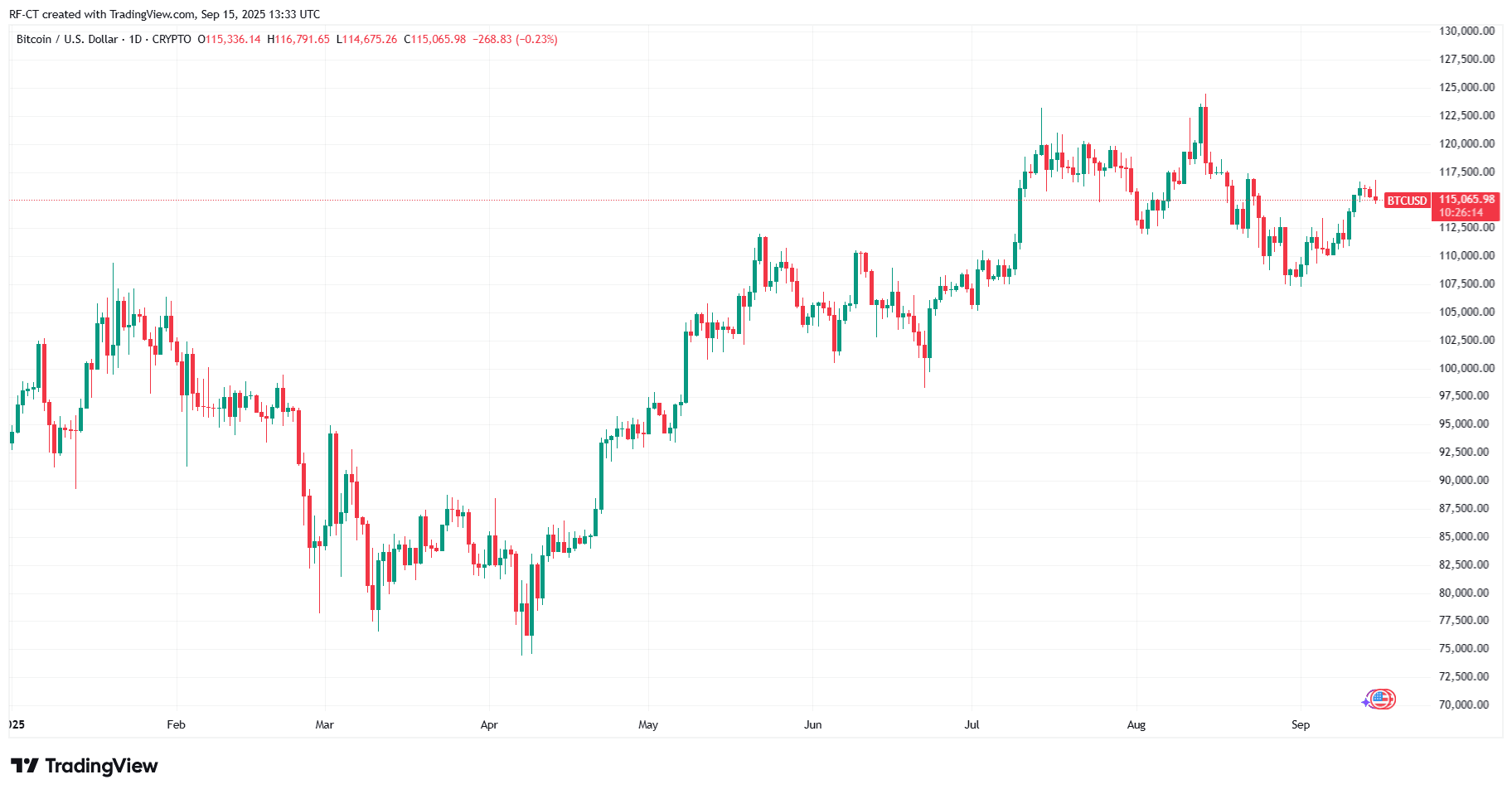

Bitcoin eyes long liquidations as gold passes $3.7K for first time

Cointelegraph·2025/09/16 21:39

Bitcoin analyst predicts 35% rally after 9th bullish RSI signal fires

Cointelegraph·2025/09/16 21:39

Flash

- 00:59President of the European Commission: The Commission will soon propose the 19th round of sanctions against Russia, targeting cryptocurrencies and others.ChainCatcher News, according to market sources, European Commission President Ursula von der Leyen stated that the Commission will soon propose the 19th round of sanctions against Russia, targeting cryptocurrency, banking, and energy.

- 00:38Tether executive: The company is returning to the US market, aiming to become the dominant stablecoin issuer in the country.ChainCatcher News, according to Bloomberg, Bo Hines, Tether Holdings SA's digital asset and US strategic advisor, stated that Tether is returning to the US market with the goal of becoming the country's dominant stablecoin issuer, replicating its overseas success. Last week, Tether announced a new token plan, USAT, led by Hines and launched in cooperation with Cantor Fitzgerald LP and others. The aim is to provide instant settlement and reduce costs, specifically tailored for the US market. Tether CEO Paolo Ardoino said the company's advantage lies in the distribution network built over the past 11 years, while competitor Circle has expanded its business through revenue sharing with certain exchanges. Ardoino stated that Tether does not need to rent distribution channels as it owns its own. Although Circle has made a high-profile announcement about going public, Tether has no intention of following suit, as the company made a profit of $13.7 billions last year and does not need to raise funds. Instead, it plans to invest in business development by building new distribution channels, and has already invested $5 billions in the US, including a $775 million investment in Rumble Inc.

- 00:00Santander Bank's digital bank Openbank has now launched POL token trading services in Germany.Jinse Finance reported that Polygon announced on its social media platform that Openbank, a 100% digital bank under Grupo Santander, has launched trading services for Polygon's native token (POL) in Germany. Customers can now directly buy, sell, or hold Polygon's native token POL on the platform without the need to transfer funds to any other platform.