News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 17)|U.S. seasonally adjusted nonfarm payrolls for November increased by 64,000; BlackRock transferred approximately $140 million worth of ETH to a CEX2Bitget US Stock Morning Brief | Fed Independence Reaffirmed; NFP Beats Expectations; Tech Rally Lifts Market (December 17, 2025)

Russia Reaffirms Ban on Bitcoin and Ethereum Payments

DeFi Planet·2025/12/17 11:51

The strengthening of the Chinese yuan may support bitcoin prices

币界网·2025/12/17 11:34

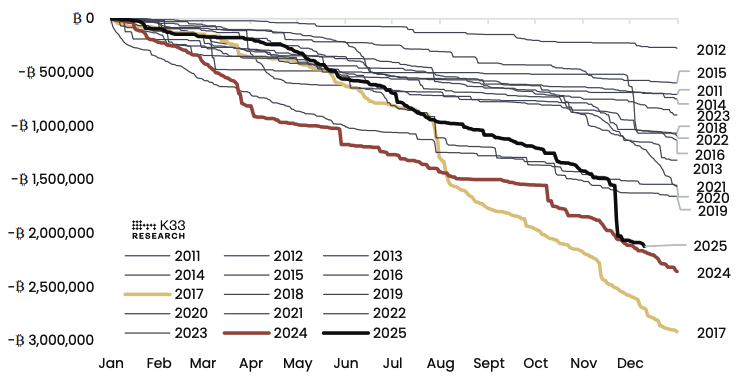

Sell-side pressure from long-term Bitcoin holders nears saturation: K33

The Block·2025/12/17 11:21

Unveiled: Infrared’s Token Generation Event Kicks Off on Berachain

Bitcoinworld·2025/12/17 11:12

IoTeX Publishes MiCA-Compliant Whitepaper to Expand EU Market Access for IOTX

DeFi Planet·2025/12/17 11:09

BlackRock moves 47K Ethereum in a day: But the real story isn’t a sell-off

AMBCrypto·2025/12/17 11:03

Flash

11:54

Messari: Stablecoin market cap on BNB Chain grows 32.3% to $13.9 billionPANews, December 17 – According to the latest report from Messari, in Q3 2025, BNB Chain's market capitalization increased by 51.6% quarter-on-quarter to $140.4 billion, ranking fifth among cryptocurrencies by market cap. The total value locked (TVL) in DeFi grew by 30.7% to $7.8 billion, surpassing Tron to take third place. The market cap of stablecoins rose by 32.3% to $13.9 billion, with USDT accounting for 57.4%. USDe surged more than tenfold quarter-on-quarter to $430 million, and USDF increased to $360 million.

11:47

The total market value of Hong Kong's spot virtual asset ETFs increased by 33% year-on-year in Q3, with the tokenization market also experiencing rapid growth.BlockBeats News, December 17, the Hong Kong Securities and Futures Commission (SFC) released the Q3 2025 Quarterly Report, showing that the scale of virtual asset investment products in Hong Kong continues to expand. As of the end of November, the total market value of SFC-approved spot virtual asset ETFs increased by 33% year-on-year to HKD 5.47 billion, and the number of products rose to 11, indicating a continued rise in demand for virtual asset investments through compliant channels. At the same time, tokenized financial products are developing rapidly. Since the launch of SFC-approved tokenized retail money market funds this year, the assets under management have surged by 557% year-on-year to HKD 5.48 billion as of the end of November, and the number of funds increased to 8, reflecting a significant improvement in the acceptance of tokenized products at the retail level. The regulators also emphasized risk warnings. In August, the SFC and the Hong Kong Monetary Authority jointly reminded investors to pay attention to market volatility related to the stablecoin concept, showing that while promoting virtual asset innovation, regulatory agencies are simultaneously strengthening risk management and investor protection.

11:46

Hong Kong's Q3 Virtual Asset Spot ETF Total Market Cap Grew by 33% Year-on-Year, Tokenization Market Also Experienced Rapid GrowthBlockBeats News, December 17th: The Securities and Futures Commission (SFC) of Hong Kong released its Q3 2025 Quarterly Report, indicating a continuous expansion of the Hong Kong virtual asset investment product market. As of the end of November, the total market value of SFC-approved virtual asset spot ETFs has grown by 33% year-on-year to 5.47 billion Hong Kong dollars, with the number of products increasing to 11. This demonstrates a persistent increase in demand for virtual asset investment through compliant channels.

At the same time, tokenized financial products are advancing rapidly. Since the launch earlier this year, SFC-approved tokenized retail currency market funds have seen a significant 557% year-on-year increase in assets under management to 5.48 billion Hong Kong dollars as of the end of November, with the number of funds reaching 8. This trend reflects a noticeable enhancement in the acceptance of tokenized products at the retail level.

The regulatory authorities have also highlighted risk warnings. In August, the SFC and the Hong Kong Monetary Authority jointly reminded investors to pay attention to market fluctuations related to the stablecoin concept, indicating that while promoting virtual asset innovation, regulatory agencies are concurrently strengthening risk management and investor protection.

News