News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

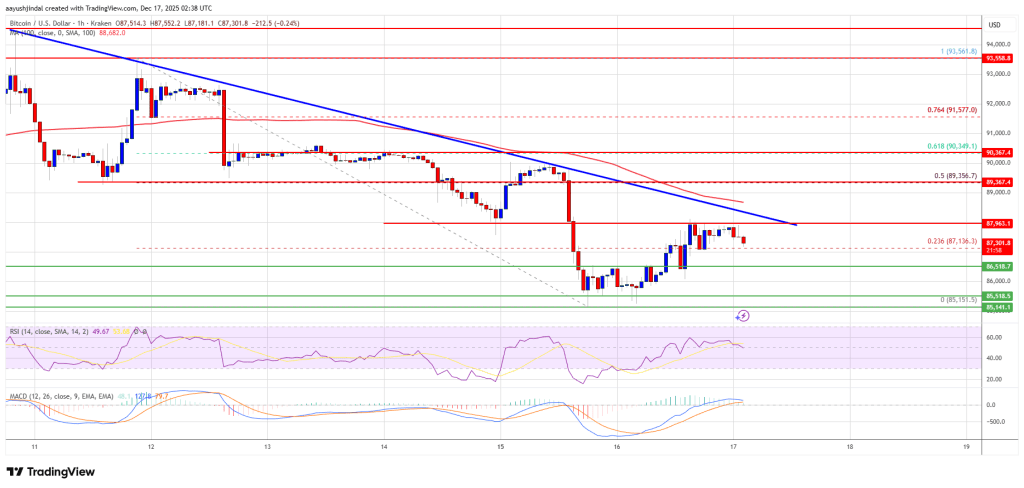

Bitcoin price regroups after decline—Is a directional breakout imminent?

币界网·2025/12/17 03:17

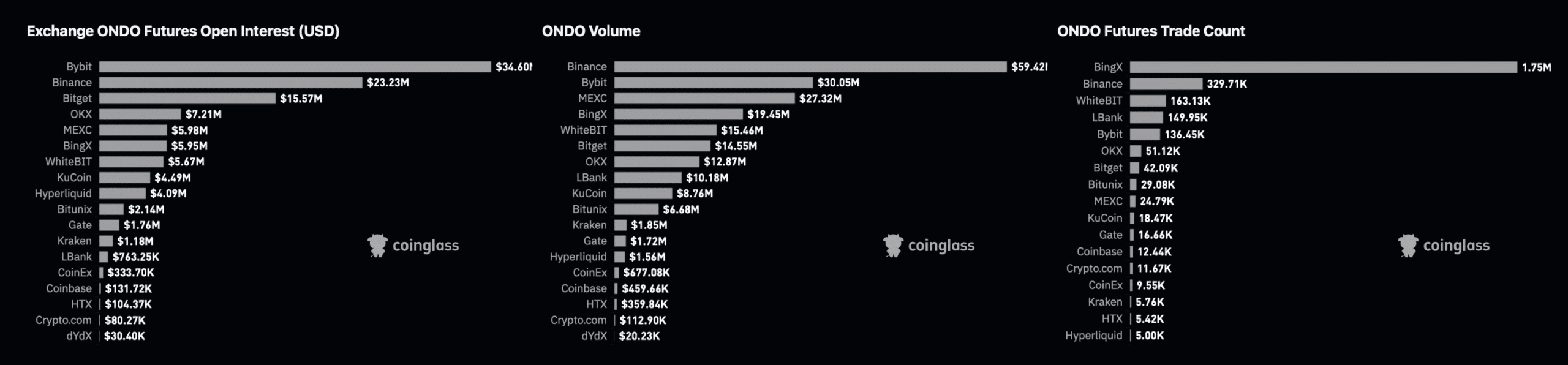

Two main reasons why the current decline of ONDO is only temporary.

币界网·2025/12/17 03:14

Mapping 2 reasons why ONDO’s current dip is only temporary

BlockBeats·2025/12/17 03:03

How much capital can Hyperliquid’s major move "Portfolio Margin" bring?

BlockBeats·2025/12/17 02:48

Won-Dollar Exchange Rate Soars: Hits Critical 1480 Level for First Time in 8 Months

Bitcoinworld·2025/12/17 02:42

The real impact of quantitative easing policies on cryptocurrencies

币界网·2025/12/17 02:36

Shocking Closure: Shima Capital Shuts Down After SEC Fraud Lawsuit

Bitcoinworld·2025/12/17 02:27

Flash

- 03:09Risc Zero has recently announced the shutdown of its official hosted proof service, as Boundless Network simultaneously enters a fully decentralized new stage.BlockBeats News, December 17th, Recently, Risc Zero announced the shutdown of its official hosted proof service, and the Boundless Network has entered a fully decentralized new stage, signaling the universal ZK proof market's complete transition to a fully open, decentralized, market-driven state. Risc Zero had officially provided zero-knowledge proofs to help developers access zero-knowledge computing capabilities without the need to build their hardware. With Boundless Network's functionality and verification capabilities gradually maturing, proof requests will now be handled by independent nodes in the Boundless Network, aligning the proof mechanism with blockchain features built on resilience and neutrality. Boundless: Open Proof Market Fully Decentralized Boundless is designed as a universal ZK proof market for multi-chain and application-oriented purposes, where any chain or application can have Boundless provide zero-knowledge proofs to enhance scalability and interoperability. The network employs mechanisms such as "Proof of Verifiable Work" (PoVW), rewarding Provers based on their actual computational effort. This creates a competitive environment that incentivizes provers to generate proofs faster and at a lower cost, benefiting all chains with efficient, user-friendly zero-knowledge proofs.

- 03:0610x Research: Everyone is optimistic about 2026, but the data does not support this viewAccording to Odaily, 10x Research posted on X stating that although the market generally remains optimistic, some closely watched indicators have started to diverge—a divergence that has historically often signaled a shift in market structure. Inflation dynamics, labor market trends, and interest rate expectations are no longer moving in sync, creating a macroeconomic backdrop that is far more fragile than the surface-level optimism suggests. Meanwhile, major asset classes are sending signals that leadership may be narrowing and that volatility may not remain contained for long. Market realities may soon become less forgiving. Now is a critical time to focus on fundamental data. Investors need to decide for themselves whether to continue fully betting on optimistic expectations for 2026 or to shift toward a more defensive strategy. As we wrote at the end of October, only those who sell at the top can buy at the bottom. Since then, Bitcoin has dropped 23%, and this volatility now appears to be spreading to other risk assets.

- 03:06Economist: Weakening Yen Clears the Path for Bank of Japan's December Rate Hike, Another Hike Likely if Decline PersistsBlockBeats News, December 17th, according to economist Alicia Garcia Herrero's analysis, the continued weakness of the yen is becoming a key factor driving the Bank of Japan and the Japanese government to reach a consensus this month and support the long-awaited rate hike decision. Despite concerns about U.S. tariffs and broader geopolitical risks, the Japanese economy has proven to be more resilient than expected. Short-term, medium-term, and long-term inflation expectations remain higher than the Bank of Japan's 2% target, strengthening the rationale for further policy normalization. Rising food prices have pushed up the core inflation rate, and the yen-to-dollar exchange rate is persistently weakening around 155, which could exacerbate imported inflationary pressures. Alicia Garcia Herrero expects the Bank of Japan to raise the policy rate by 25 basis points to 0.75% at the meeting on December 19th. Looking ahead, if the yen fails to stabilize after the rate hike and continues to weigh on real incomes, the Japanese government may also accept further tightening policies, potentially opening the door to another 25 basis point rate hike early next year. (Xinhua Finance)

News