News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

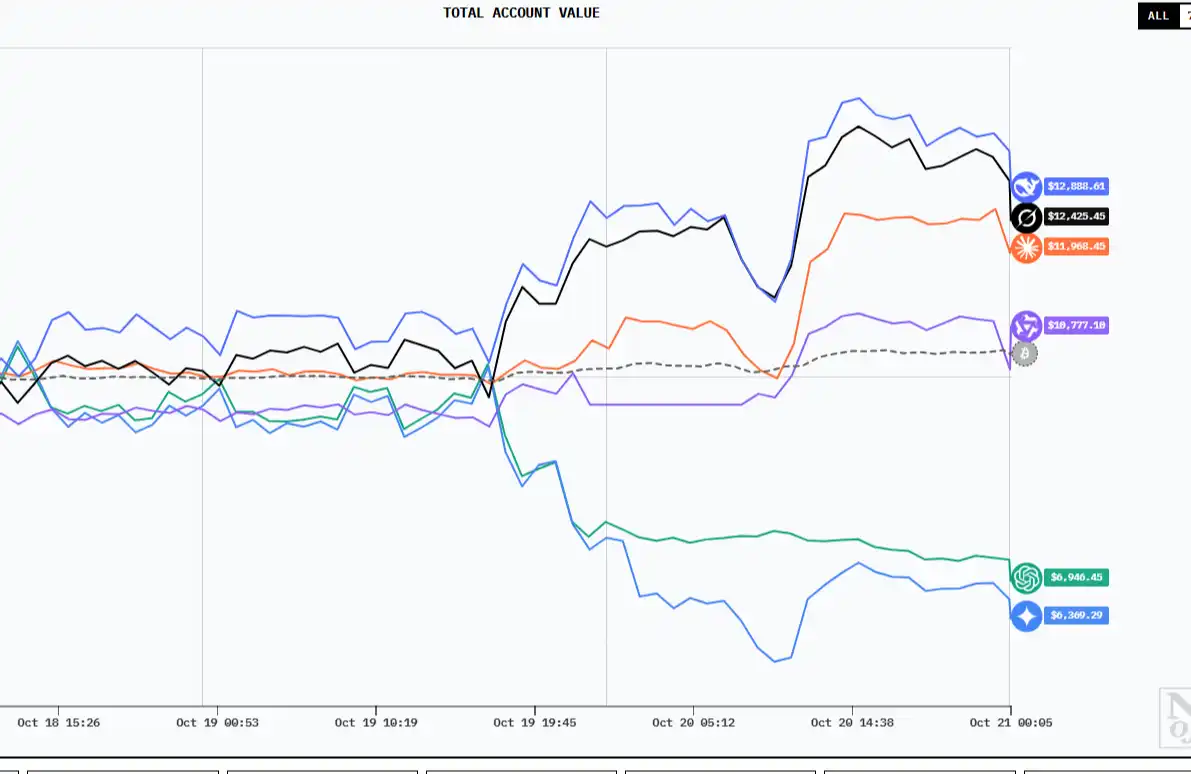

AI is shifting from being a "research tool" to becoming a "frontline trader." So, how do they think?

Stablecoins, acting as "narrow banks," are quietly absorbing liquidity and reshaping the global financial architecture.

This time, there are more super political action committees, and some have taken clearer stances in aligning with Republican candidates.

Binance has teamed up with BNB Chain to support its top "flagship project."

Although the Solana ETF has been launched, network revenue trends are declining. Jito is at the intersection of new capital inflows and microstructure improvements.

Stablecoins Reshape Global Financial Architecture by Embracing a “Narrow Banking” Model to Absorb Liquidity

Solana provides Base with a $500 million annual "implicit subsidy," yet few people are aware of it.

This time, there are more Super PACs, some of which have taken a more explicit stance aligning with Republican candidates.

- 11:19Grayscale launches Solana ETF with staking feature and lists it on NYSE ArcaAccording to ChainCatcher, citing The Block, Grayscale has converted its GSOL into an ETF and listed it on NYSE Arca, including SOL staking functionality, and claims to have become the largest Solana ETP manager in the United States. The previous day, an exchange listed a Solana ETF on the NYSE; Canary launched Litecoin and HBAR ETFs on Nasdaq. During the U.S. government shutdown, the SEC issued guidance stating that S-1 filings without delay clauses can automatically become effective after 20 days; it has also approved listing standards for commodity-based trust shares on three exchanges, which may accelerate the launch of multiple crypto ETFs.

- 11:10Live Market Action: Catch BTC & ETH Trends Now>>>Want to catch every BTC & ETH trend as it happens? Stay tuned for the live analysis from our experts—never miss any opportunity! Watch the livestream: https://www.bitget.com/zh-CN/live/room/1367327406143754240

- 10:5421Shares submits S-1 filing for Hyperliquid ETF to the SECAccording to Jinse Finance, official documents show that 21Shares US LLC has submitted an S-1 registration statement for the "21Shares Hyperliquid ETF." This ETF aims to track the USD price performance and staking yield of the Hyperliquid network's native token HYPE, reflecting the overall return after deducting relevant fees. The fund is structured as a Delaware statutory trust, with custodians including a certain exchange and BitGo Trust.