News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitcoin ETFs rebound with $166.5M inflows despite BTC price dip2Crypto Allocation in Asia: BlackRock’s Stunning $2 Trillion Prediction Reveals Institutional Shift3Solana Extends Losses Below $88 as Crypto Market Downturn Deepens

PNC Financial's Arm Rolls Out Premier Client for Mass-Affluent Clients

Finviz·2026/02/13 17:51

PayPal vs. Block: Which Fintech Stock is a Better Buy Right Now?

Finviz·2026/02/13 17:48

Apple shares seemed to be gaining momentum, but now they're facing setbacks once more.

101 finance·2026/02/13 17:48

Fiverr Stock Before Q4 Earnings: Buy Now or Wait for Results?

Finviz·2026/02/13 17:42

Wendy’s plans to shut down several hundred locations by the middle of 2026

101 finance·2026/02/13 17:42

Should You Buy, Sell or Hold SSRM Stock Before Q4 Earnings Release?

Finviz·2026/02/13 17:36

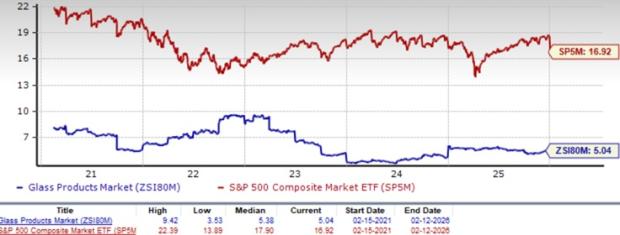

1 Stock to Watch & 1 to Avoid in a Challenging Glass Products Industry

Finviz·2026/02/13 17:36

CEO of the World’s Largest Bitcoin Mining Company Discussed the Future of BTC

BitcoinSistemi·2026/02/13 17:34

Why Is Bank of America (BAC) Down 0.1% Since Last Earnings Report?

Finviz·2026/02/13 17:33

Flash

17:33

Analyst: Tariff Inflation May Continue to Feed Through to Economy in Coming Months, Fed Seen Cutting Rates Twice This YearBlockBeats News, February 14th, Stephen Douglass of NISA Investment Advisors stated that about one-third of the inflation related to tariffs may still gradually transmit to the economy in the coming months.

This is expected to keep the economy performing well and keep the Federal Reserve on hold for a while. "We are back on track to achieve a soft landing," he said. "The labor market will stabilize, and the final ripples of tariff inflation will transmit in the first half of this year."

He expects that commodity inflation will drop below zero in the second half of the year, creating room for the Federal Reserve to resume rate cuts later than the market expects. "Our view for this year is to cut rates once in September and once in December." (FXStreet)

17:25

Gold price surpasses $5,000 again as mild inflation strengthens expectations of a Fed rate cutGold prices strengthened as traders further bet on a Federal Reserve rate cut following the release of mild inflation data, while some investors chose to buy the dip after a sharp decline in gold prices on Thursday. The relatively mild U.S. January inflation data effectively eased market concerns about rapidly rising inflation, boosting market expectations for a Fed rate cut. After the data was released, the yield on the U.S. 10-year Treasury note fell, and interest rate swap market traders estimated about a 50% chance that the Fed would implement a third rate cut before December. As a result, gold prices rose as much as 2.3% intraday. Generally, falling interest rates are favorable for non-yielding assets like gold. Spot gold rose 1.9% intraday to $5,016.90 per ounce. Silver rose 3.4% to $77.81 per ounce, while platinum and palladium prices also climbed, and the U.S. dollar index fluctuated within a limited range.

17:22

Data: 661.19 BTC were transferred out of an exchange, routed through an intermediary, and then flowed into another exchange.According to ChainCatcher, Arkham data shows that at 01:13, 661.19 BTC (worth approximately $16.74 million) were transferred from an exchange to an anonymous address (starting with bc1q05xs6...). Subsequently, this address transferred part of the BTC (243.82 coins) to an exchange.

News