News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily Report | Fed Maintains Hawkish Stance on Rates; Trump Threatens Iran Leading to Gold and Silver Pullback; Storage Sector Strong with Seagate Up Over 19% (January 29, 2026)2Bitcoin companies keep buying as AI pulls capital away – Inside ABTC’s move3DePIN startups raise $1B, generate $72M in onchain revenue in 2025

What Should You Anticipate From Franklin Resources (BEN) Q4 Earnings

101 finance·2026/01/29 03:09

Tesla plans $20 billion capital spending spree in push beyond human-driven cars

101 finance·2026/01/29 03:03

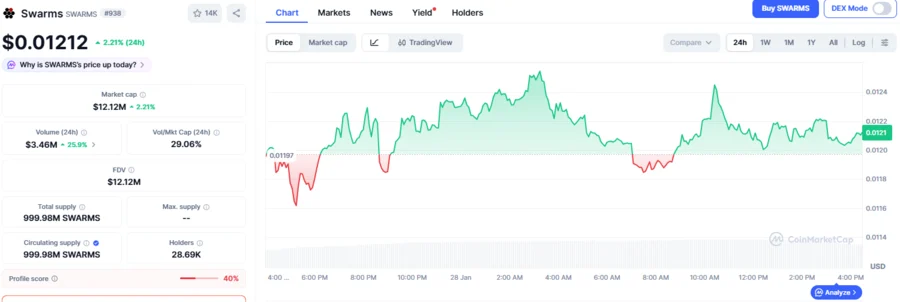

SWARMS Stabilizes Above $0.012 As Falling Wedge Signals a Looming 230% Spike: Analyst

BlockchainReporter·2026/01/29 03:00

LG Energy Solution Looks to ESS Expansion Amid Profit Challenges from EV Market Slowdown

101 finance·2026/01/29 02:48

SEC States That Tokenized Assets Are Considered Securities Before Being Viewed as Technology

101 finance·2026/01/29 02:39

FOMC Bitcoin Revelation: Why Federal Reserve Meetings Merely Trigger Market Repositioning, Not Direction

Bitcoinworld·2026/01/29 02:21

Scallop DeFi CEO Reveals Ambitious Vision in Exclusive Korea Economic Broadcasting Interview

Bitcoinworld·2026/01/29 02:06

Flash

03:27

SK Square shares rise 5% in the Korean stock marketGlonghui, January 29th|SK Square's stock price rose by 5% to 529,000 KRW after its subsidiary SK Hynix announced plans to cancel shares worth 12.24 trillion KRW.

03:25

Top Gainers in Cryptocurrency: Worldcoin, Canton, and Jupiter Maintain Gains During Market Pullback.According to a report by Bijie Network: In the past 24 hours, as the Federal Reserve kept interest rates unchanged and the overall market trend stabilized, Worldcoin (WLD), Canton (CC), and Jupiter (JUP) continued their upward momentum. WLD fell by 5%, retreating from its 100-day moving average after a 25% surge. Canton rose slightly by 2%, hovering near the key resistance level of $0.1624. Jupiter encountered resistance near its 50-day moving average at $0.2174, dropping by nearly 1%. Technical indicators suggest that as momentum approaches these key levels, prices may experience a reversal.

03:23

Philippine stock index drops over 1%Glonghui, January 29|The Philippine benchmark stock index fell by 1.5% to 6,260.50 points, marking its lowest level since January 7.

News