News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Macro headwinds test Bitcoin price as $70K crumbles amid US market volatility2Trump filling Democratic seats at SEC, CFTC could advance crypto bill talks, TD Cowen says3Bitcoin price ignores $168M Strategy buy, and falls as Iran tensions escalate

Waystar (WAY) Climbs 8.5% on Swing to Profits, Double-Digit Outlook

Finviz·2026/02/18 06:39

Pi Network Price Prediction: PI Surges 40% As Mainnet Migration Halts And Supply Pressure Drops

CoinEdition·2026/02/18 06:03

Wall Street Expands Its Presence in Prediction Markets Through Recent ETF Applications

101 finance·2026/02/18 06:00

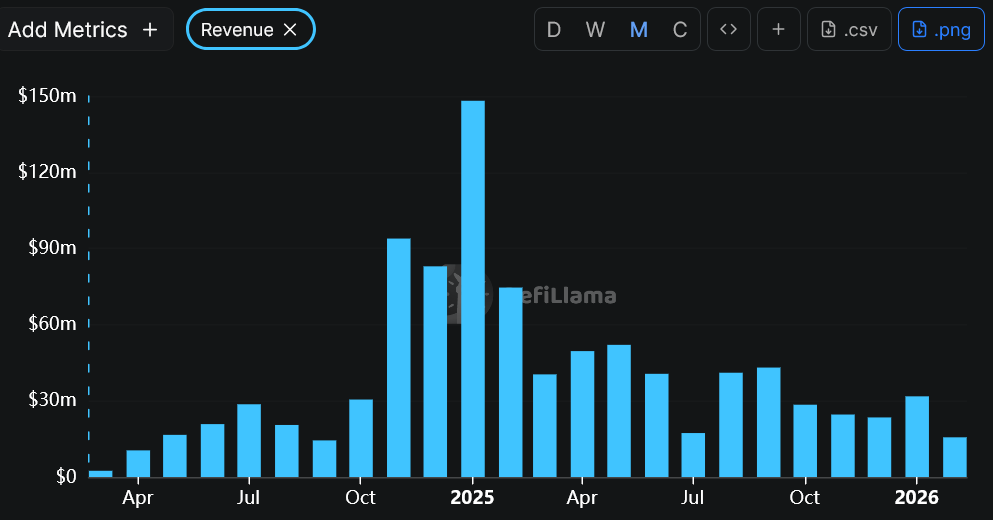

Pump.fun rolls out trader cashbacks amid memecoin 'capitulation'

Cointelegraph·2026/02/18 05:51

Oracle Glitch Results in $1.8 Million Bad Debt for DeFi Lender Moonwell

101 finance·2026/02/18 05:51

Bitcoin's tech stock divergence is a 'fire alarm' for fiat: Arthur Hayes

Cointelegraph·2026/02/18 05:33

“AI Can’t Touch Cash”: BitGo CEO Sees Crypto as AI’s Native Currency

CoinEdition·2026/02/18 05:12

BRICS Launches Decentralized Payment System to Bypass the US Dollar

CoinEdition·2026/02/18 04:39

Flash

06:33

Black Swan Fund founder warns that the S&P 500 may surge to 8,000 points before a sharp reversalMark Spitznagel, founder of Universa Investments, stated that the upward trend in the US stock market may continue, with the S&P 500 index possibly rising to 8,000 points or even higher, but a sharp reversal may follow. He pointed out that the current market is in a "Goldilocks zone," with the stock market rising due to factors such as declining inflation and interest rates, as well as an economic slowdown that is not excessive. However, he warned that "the biggest bubble in human history" has entered its final stage and expressed concerns that the Federal Reserve maintaining current interest rate levels for an extended period could make corporate financing difficult. He believes that the lagging effects of monetary policy will exacerbate economic deterioration, ultimately leading to a rapid decline in the stock market.

06:03

Data: GMGN Smart Money 24h Net Inflow Ranking, LISA Tops the ListChainCatcher News, according to GMGN data, the top 5 tokens by net smart money inflow in the past 24 hours are as follows: 1. LISA (Eehw....ump): Net inflow of $4,000, up 6218.9% in the past 24 hours, currently priced at $0.0002. 2. automaton (oBeM....ump): Net inflow of $4,000, up 13618.3% in the past 24 hours, currently priced at $0.0004. 3. Pixel (2fLw....ump): Net inflow of $3,000, up 7641.4% in the past 24 hours, currently priced at $0.0002. 4. GAS (25E8....ump): Net inflow of $3,000, up 23926.1% in the past 24 hours, currently priced at $0.0008. 5. Percolator (8PzF....ump): Net inflow of $969, down 16.9% in the past 24 hours, currently priced at $0.0008.

05:55

European Central Bank: Lagarde has not yet made any decision regarding the end of her term. European Central Bank: ECB President Lagarde is fully focused on her mission and has not yet made any decision regarding the end of her term. (Jin10)

News