News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Jan.16)|CME to Launch ADA, LINK and XLM Futures on Feb 9; Bitmine Purchases 24,068 ETH; Polygon Lays Off 30% to Pivot Toward Stablecoin Payments2Atomic Wallet raises red flags in viral $479k Monero loss claim3Bitcoin Sheds 30% of Open Interest: Is a Rebound Imminent?

Japanese Yen retreats from its highest level in a week against the USD; upward momentum appears to remain strong

101 finance·2026/01/19 04:15

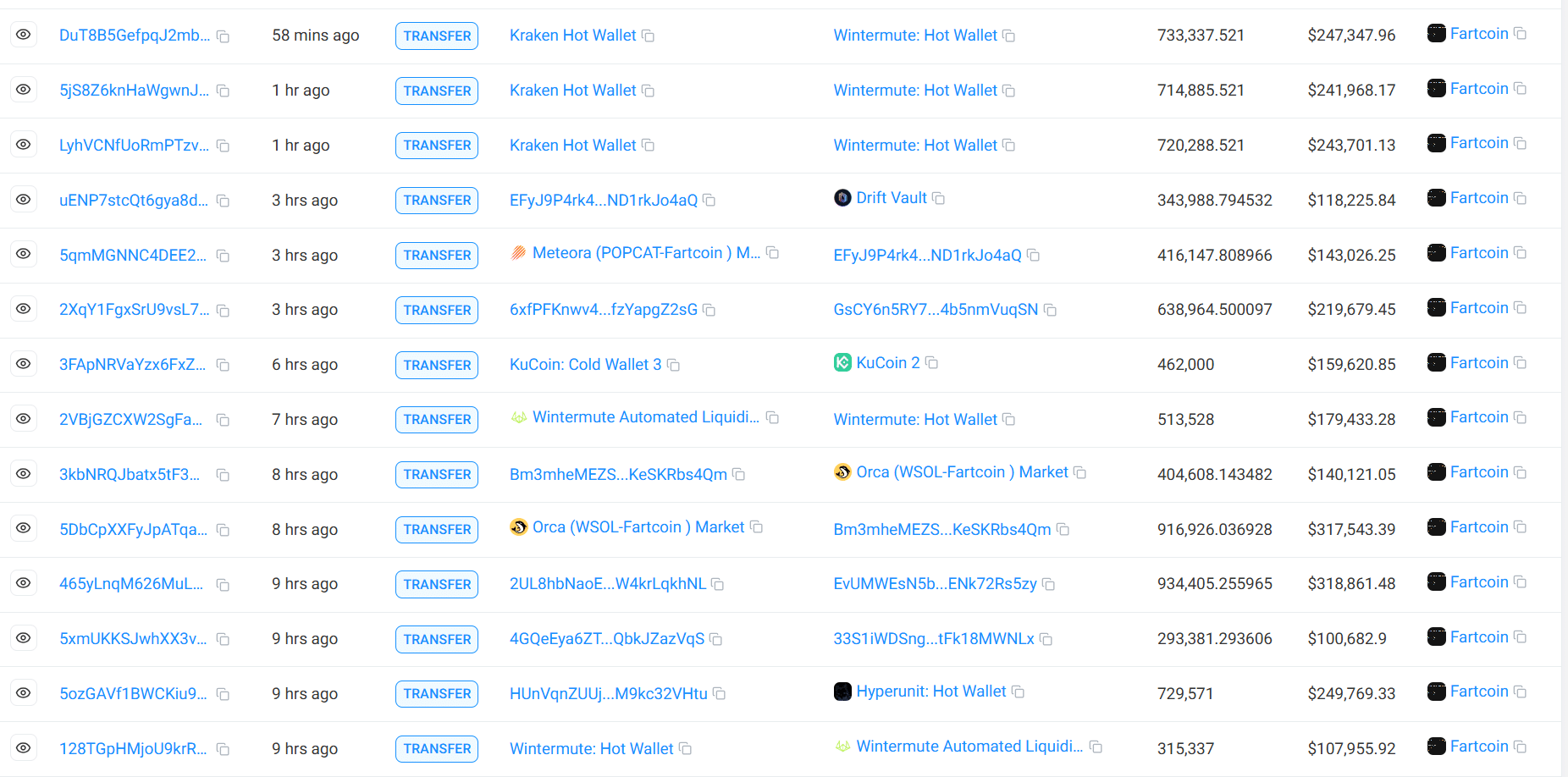

FARTCOIN falls 10%, cracks below $0.36 – Was this a liquidity trap?

AMBCrypto·2026/01/19 04:03

USD/JPY, EUR/USD, USD/CHF: FX Futures Positions | COT Analysis

101 finance·2026/01/19 03:21

Australian Dollar remains steady as China’s economy grows in the fourth quarter of 2025

101 finance·2026/01/19 03:09

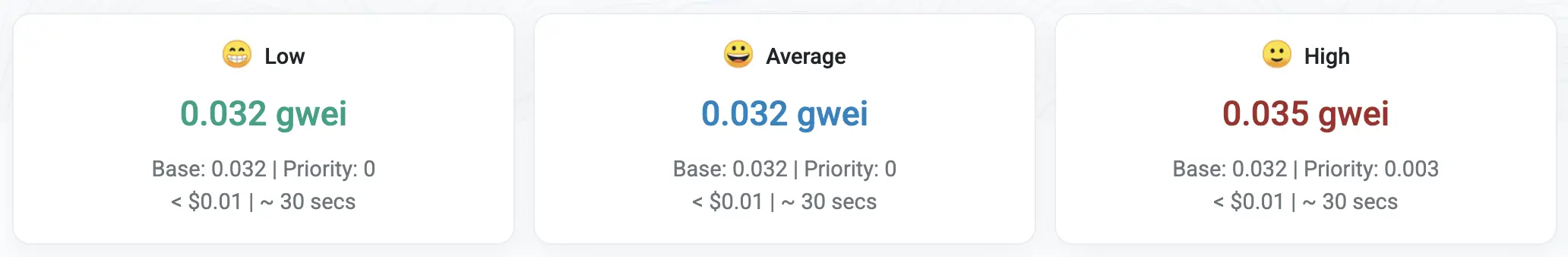

How Ethereum quietly crushed its $50 gas problem in 2026

AMBCrypto·2026/01/19 03:03

Syrah Prolongs Tesla Offtake Remedy Deadline While Vidalia Certification Progresses

101 finance·2026/01/19 01:45

The Timing Game: Crypto Winners Track Live News and the Macro Calendar

Cointurk·2026/01/19 01:30

Flash

04:14

Matrixport: Crypto Traders Shift to Range-Bound StrategiesMatrixport's daily chart analysis points out that despite Trump once again issuing tariff threats, the implied volatility of bitcoin and ethereum has only risen slightly. Since mid-November, the volatility of the cryptocurrency market has dropped significantly, with volatility points decreasing by about 18 to 25 over the past two months, showing a clear compression trend. Traders have not chased upside gains or hedged downside risks through options tools, but have instead increased spot holdings and sold call options in the ethereum market to achieve volatility arbitrage in a low-leverage, range-bound market environment.

04:04

Analyst: Bitcoin Support Level Around $85,000, Range-Bound Movement Expected in the Second Half of the MonthBlockBeats News, January 19th, according to Decrypt, Bitcoin briefly fell below $92,000, with a 24-hour network-wide liquidation of over $865 million. Fisher8 Capital investment analyst Lai Yuen stated that the crypto market's decline was mainly due to the resurgence of the US-Europe trade war and market concerns about Trump's new round of tariff proposals.

Bitget's Chief Analyst Ryan Lee said: "The recent pullback in Bitcoin is more driven by changes in global risk sentiment rather than the cryptocurrency market's own fundamentals. Rising macroeconomic uncertainty, combined with profit-taking after the previous sharp rise, has led investors to adopt a more cautious strategy across various markets such as stocks, commodities, and digital assets." Looking ahead, Lee expects Bitcoin to maintain a range-bound pattern in the second half of January, with support possibly forming around $85,000.

03:57

Trove shifts to Solana to rebuild DEX, TROVE token launch postponed to January 19PANews reported on January 19 that Trove recently announced it will abandon its deployment plan on Hyperliquid and instead rebuild its TROVE token and perpetual contract DEX on Solana. Previously, a liquidity provider supporting Hyperliquid withdrew 500,000 HYPE holdings, prompting a strategic adjustment for the project. The TROVE token TGE has been postponed to January 19 at 24:00 (UTC+8). The project team will arrange refunds totaling approximately $2.44 million for some ICO participants, and the funds will be transferred to a multi-signature account for subsequent distribution.

News