News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily Report | U.S. Tariffs on Eight European Countries Spark Backlash; Gold and Silver Hit New Highs; Fed PCE Data Awaits Release (January 19, 2026)2Atomic Wallet raises red flags in viral $479k Monero loss claim3Bitcoin Sheds 30% of Open Interest: Is a Rebound Imminent?

Analog Devices' Upcoming Quarterly Earnings: Key Information You Should Be Aware Of

101 finance·2026/01/19 14:39

Best Crypto to Buy Now: Stability Signals & Potential 2000x Breakouts Before February 2026

BlockchainReporter·2026/01/19 14:30

Decentralized autonomous organizations require reconsideration, according to Ethereum's co-founder

101 finance·2026/01/19 14:30

Bitcoin’s ‘digital gold’ narrative takes a hit as as Greenland tensions rattle markets

101 finance·2026/01/19 14:30

NYSE 24/7 Trading: The Revolutionary Leap into On-Chain Tokenization

Bitcoinworld·2026/01/19 14:21

Tether’s Strategic Leap: Partnering with Bitqik to Empower Laos with Vital Financial Literacy

Bitcoinworld·2026/01/19 14:21

Bitcoin Long-Term Holders Show Remarkable Restraint as Slowing Sell-Off Signals Potential $110K Breakthrough

Bitcoinworld·2026/01/19 14:21

HwyHaul celebrates its 7th anniversary by advancing toward autonomous freight with AI-driven innovations

101 finance·2026/01/19 14:15

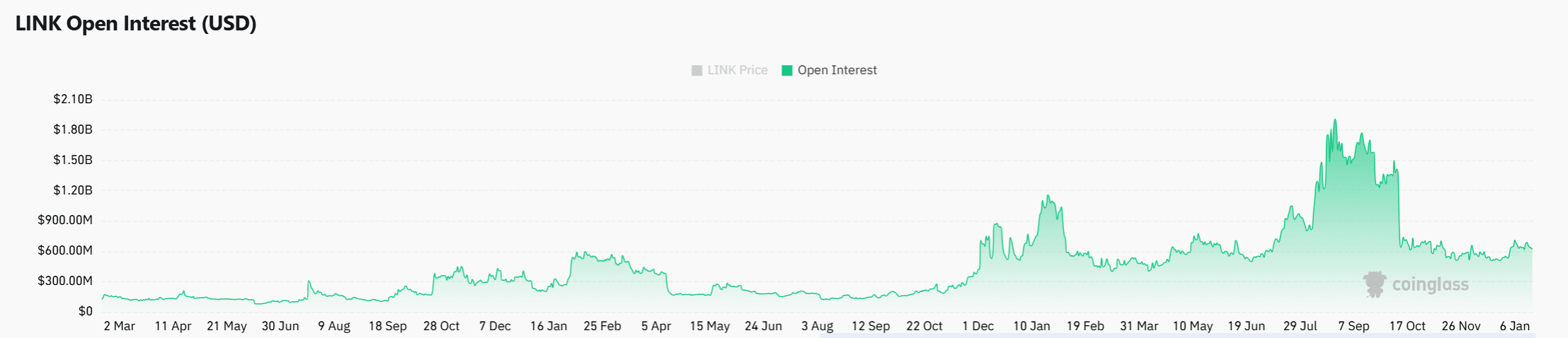

Chainlink’s price struggles – But whales are positioning, not panicking

AMBCrypto·2026/01/19 14:03

Nordson Earnings Outlook: Key Points to Watch

101 finance·2026/01/19 14:03

Flash

14:41

Wintermute: The Four-Year Cycle Is Becoming Obsolete, Liquidity and Investor Attention Are the New Drivers of the Crypto MarketAccording to Odaily, Wintermute posted on X stating that the traditional four-year bitcoin cycle is being phased out. Market performance is no longer determined by self-fulfilling time narratives, but rather by the direction of liquidity flows and the focal points of investor attention. Wintermute's OTC liquidity data shows that the transmission of crypto-native wealth has weakened in 2025. ETF and DAT have evolved into "walled gardens," providing sustained demand for large-cap assets, but capital does not naturally rotate into the broader market. As retail interest shifts to stocks, 2025 has become an extremely concentrated year, with altcoin rebounds averaging 20 days, down from 60 days in 2024. For 2026, in order for the market to break through the limitations of mainstream coins, at least one of the following three things needs to happen: 1. ETF and DAT expand their investment scope, with ETF applications for SOL and XRP already beginning to emerge. 2. Mainstream coins perform strongly; a robust rebound in bitcoin or ETH could generate a wealth effect and spread to the broader market. 3. Retail attention shifts back from stocks (AI, rare earth, quantum) to cryptocurrencies, bringing new capital inflows and stablecoin minting. The outcome in 2026 will depend on whether any of these catalysts can significantly broaden liquidity beyond a handful of large-cap assets, or whether concentration will persist.

14:37

Analyst: If Trump appoints an overly compliant Federal Reserve Chair, the bond market will swiftly punish the United StatesJinse Finance reported that the CEO of hedge fund Picton Investments stated that if U.S. President Donald Trump appoints a Federal Reserve Chair who is seen as overly compliant, the bond market will quickly "discipline" the United States; meanwhile, precious metals remain a good tool for hedging against political volatility. "There is a correlation between the number of posts on Truth Social and the so-called 'debasement trade' in the market, which refers to hedging trades based on commodities such as gold and silver," said David Picton. He was referring to Trump's preferred social media platform.

14:37

Wintermute: Cryptocurrency Market Breaks Free from Downtrend with ETF Expansion, Top Assets Lead the Way in Driving Retail FocusBlockBeats News, January 19th, Wintermute released a new article stating that 2025 did not bring the expected market rally, but it may be seen as the beginning of cryptocurrency transitioning from a speculative asset to a more mature asset class. The traditional four-year cycle pattern is breaking down. Market performance is no longer driven by a self-fulfilling time narrative, but rather depends on liquidity flows and the concentrated focus of investors.

In 2025, there was no scenario of funds flowing from Bitcoin to Ethereum and then to the altcoin market. With retail interest shifting to the stock market, 2025 became an extremely centralized year. The average rebound cycle of altcoins shortened to 20 days (compared to 60 days in 2024). A few top assets absorbed the majority of new funds, while the broader market struggled. To break through the limits of the top assets in the market, at least one of the following needs to happen:

· ETFs and digital asset trust funds expanding their investment scope

· Top assets like BTC, ETH leading the surge

· Retail attention (from the stock market, etc.) returning

The ultimate outcome will depend on whether the above catalysts can truly expand liquidity beyond a few large-cap assets or if market centralization continues to intensify. Understanding the potential flow of capital and the required structural changes will determine the market's operating logic in 2026.

News