News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Trump's Tariff Threats Escalate; Gold and Silver Prices Hit New Highs; US Stock Futures Generally Decline (Jan 20, 2026)2 Bitcoin Market Sentiment Has Changed, Analyst Says: Why 2022 Is the Wrong Comparison3FG Nexus ETH Sale: Nasdaq Giant’s Strategic $8 Million Ethereum Move Reveals Cautious Crypto Stance

Shares across Asia follow European markets downward amid worries about Trump's interest in acquiring Greenland

101 finance·2026/01/20 04:30

US Dollar Index drops under 99.00 amid rising tensions between the US and EU

101 finance·2026/01/20 04:30

The Battle of Super Apps in the AI Era Begins | Zhou Yahui’s Investment Notes: AI Era Series Part 2

晚点Latepost·2026/01/20 04:29

FARTCOIN sinks 18% – New year’s memecoin mania starts to unwind!

AMBCrypto·2026/01/20 04:03

Bitcoin Price Regains Momentum—Can Bulls Push BTC Above Bearish Pressure?

Coinpedia·2026/01/20 03:30

Bitcoin Crash Glitch: BTC Price Flashes $0 on Starknet DEX After Error

Coinpedia·2026/01/20 03:30

BHP Raises Copper Forecast After Achieving Record Production, While Iron Ore and Coal Deliver

101 finance·2026/01/20 03:27

Japanese Yen rises as intervention fears and safe-haven flow offset political uncertainty

101 finance·2026/01/20 03:27

Flash

04:34

MakinaFi suffers an attack losing approximately 1,299 ETH, with part of the funds handled by MEV buildersAccording to disclosures by PeckShield, the MakinaFi platform suffered a hacker attack, resulting in a loss of approximately 1,299 ETH, valued at around $4.13 million. Part of the funds was front-run by an MEV builder (address 0xa6c2��…). Currently, the stolen funds are stored in two addresses: 0xbed2…dE25 (about $3.3 million) and 0x573d…910e (about $880,000).

04:29

Meme coin WhiteWhale's market cap plummeted by 60% within 5 minutes early this morning due to several large holders collectively selling over 48 million tokens.BlockBeats News, January 20, according to GMGN monitoring, the Meme coin WhiteWhale on the Solana chain experienced a sudden sell-off around midnight today, with its market cap plummeting from about $50 million to nearly $20 million within 5 minutes, a drop of approximately 60%. As of press time, its market cap has rebounded to $37 million, with the current price around $0.038, and a 24-hour decline of 36%. Monitoring data shows that this decline was triggered by concentrated selling from several addresses on the top holders list. Addresses (6kas…), (5tf1…), and (5AAn…) collectively sold over 48.36 million tokens in a short period starting at 00:27, with a total value of about $1.6 million, causing significant downward pressure on the token price in a short time. Currently, there are many Meme coins with the same name in the market. The token contract with the highest liquidity at present is: 「WhiteWhale」: a3W4qutoEJA4232T2gwZUfgYJTetr96pU4SJMwppump BlockBeats reminds users that Meme coin trading is highly volatile, mostly driven by market sentiment and hype, and lacks actual value or use cases. Investors should be aware of the risks.

04:27

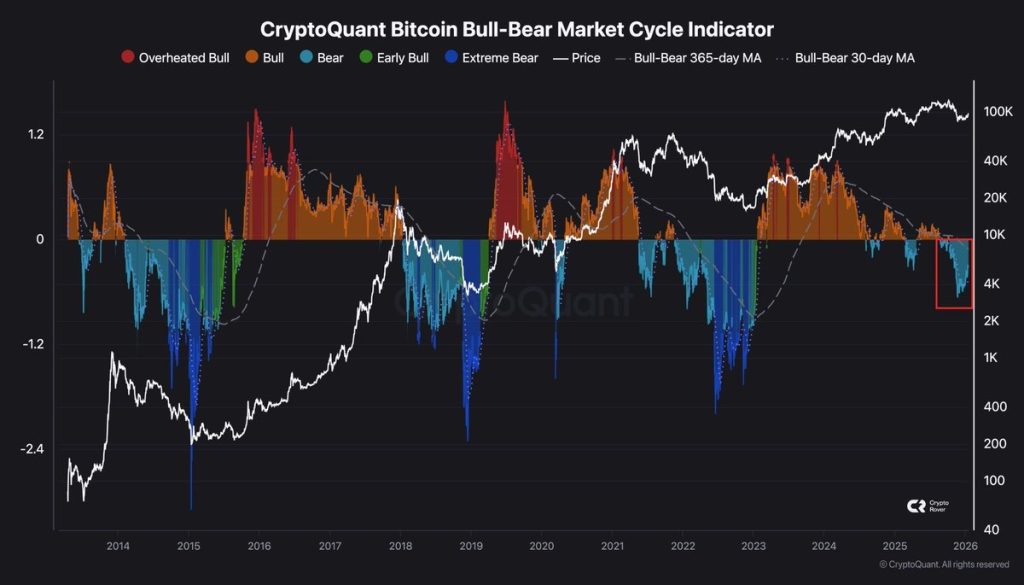

Opinion: Geopolitical Noise Does Not Change Bitcoin’s Positive TrendJinse Finance reported that some analysts stated that despite a significant pullback in bitcoin on Monday, resilient ETF inflows have offset short-term volatility, making the long-term price outlook for bitcoin technically constructive. According to CoinGecko data, the cryptocurrency has stabilized around $92,000, with little change over the past 24 hours. This stabilization occurred after Monday's sell-off, when escalating US-European trade tensions led to over $865 million in liquidations. Digital asset investment firm ZeroCap stated in a report released on Tuesday: "The market recovered relatively quickly, with bitcoin stabilizing in this range, showing strong bottom support, and most macro 'noise' has already been priced in." The firm's analysts compared the current market pattern to an "early-stage risk appetite rotation," noting that strong structural capital flows from spot bitcoin ETFs are more persistent than short-term positions. Although ETF net inflows reached their highest level in three months last week, other analysts remain cautious. Sean Dawson, Head of Research at on-chain options platform Derive, also expressed a cautious view.

News