News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitcoin’s post-quantum plan BIP-360 gains traction, but will it reverse market sell-off?2Bitcoin holders are being tested as inflation fades: Pompliano3 Bitcoin Price Bottom Not In Yet? Data Signals More Pain Ahead

Galxe (GAL) Migrates to GravityChain (G): What It Means for Crypto Traders and GAL Holders

BlockchainReporter·2026/02/17 05:00

Bitcoin’s long-term investors display signs of pressure following the February sell-off

101 finance·2026/02/17 04:39

Bitcoin Soars: BTC’s Triumphant Rally Surges Past $69,000 Milestone

Bitcoinworld·2026/02/17 04:21

CZ FUD Opportunity: Timeless Wisdom Reveals How Savvy Crypto Investors Thrive Amid Market Chaos

Bitcoinworld·2026/02/17 04:21

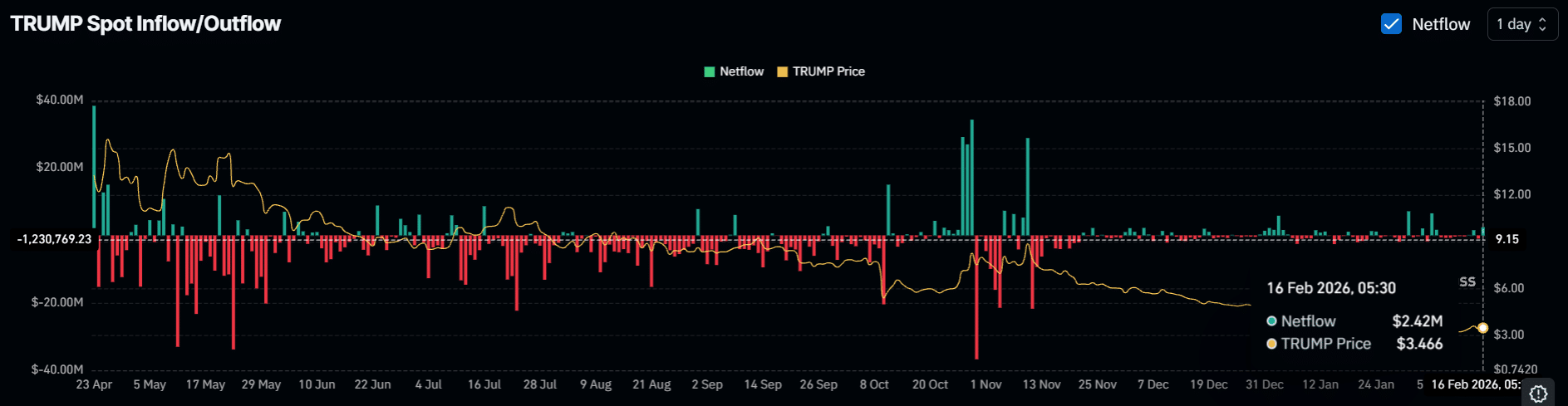

6.33 mln TRUMP tokens set to unlock: Will this lead to a 12% drop?

AMBCrypto·2026/02/17 04:03

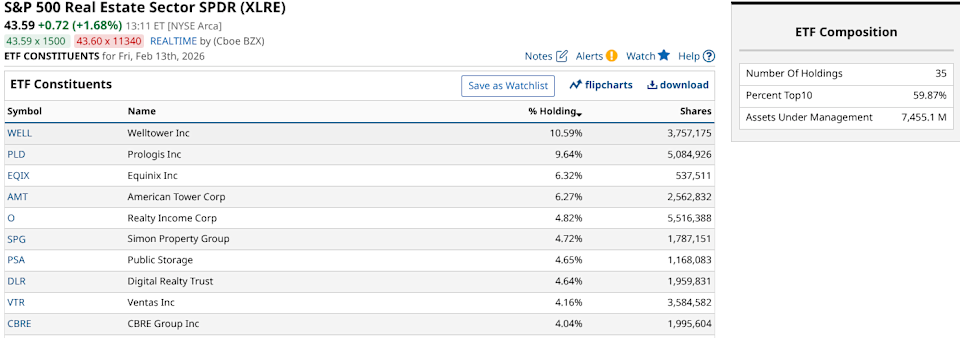

How to Approach These Two Historically High-Yield Sector ETFs During the Ongoing Rally

101 finance·2026/02/17 03:36

Trump’s emerging global strategy is encouraging Sweden to reconsider adopting the euro

101 finance·2026/02/17 03:30

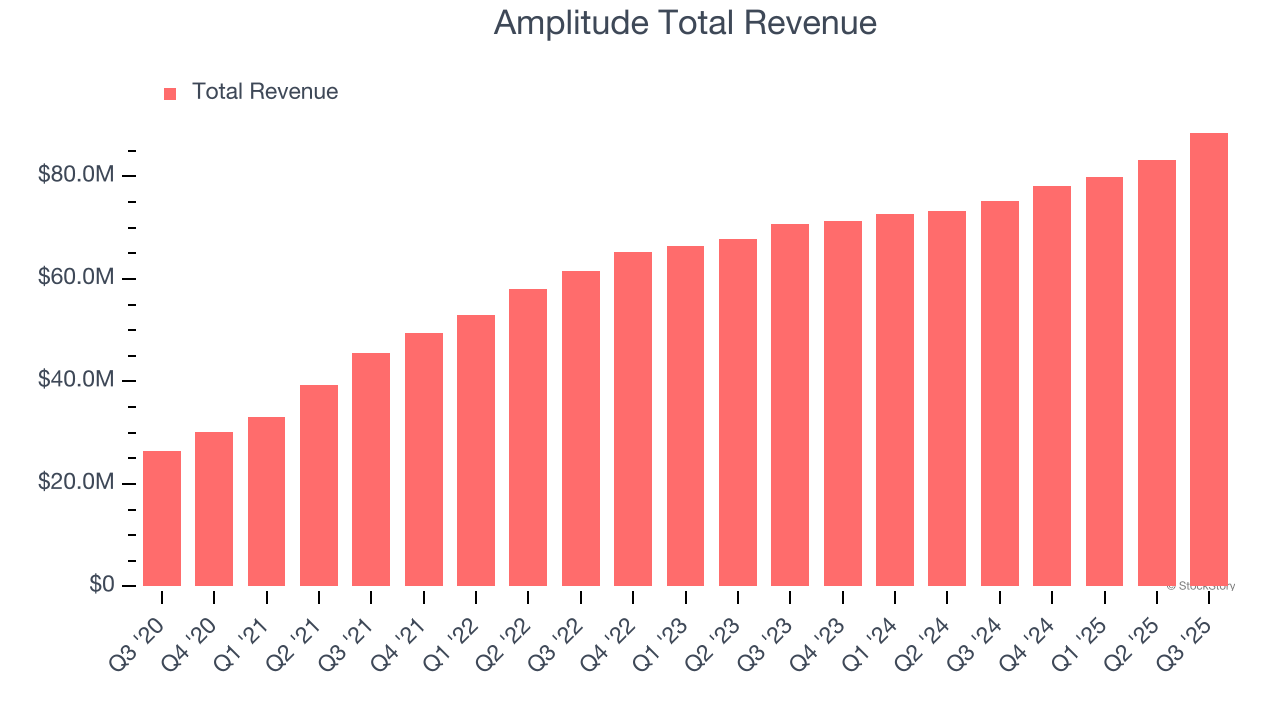

Amplitude Earnings: What To Look For From AMPL

Finviz·2026/02/17 03:09

Earnings To Watch: Insulet (PODD) Reports Q4 Results Tomorrow

Finviz·2026/02/17 03:09

Flash

05:05

RPL surges 62% in 24 hours, set for largest protocol upgradeBlockBeats News, February 17, according to market data from a certain exchange, RPL's 24-hour increase has expanded to 62%, with a market capitalization rising to $62 million, and the current price is $2.80. On the news front, Rocket Pool's largest-ever protocol upgrade, Saturn One, will be officially deployed on the Ethereum mainnet at 00:00 UTC on February 18, 2026 (08:00 AM Beijing time, 00:00 AM UK time). The upgrade is seen by the community as a "turning point." Key highlights of the Saturn One upgrade (directly benefiting RPL holders and protocol growth): · RPL Fee Switch officially activated: Protocol revenue (ETH fees) will be partially distributed to users staking RPL, achieving true value capture and shifting from pure governance/staking to a "dividend" model. · Minimum ETH requirement for node operators halved to 4 ETH (previously 8 ETH): Significantly lowers the entry barrier, expected to attract more nodes to join, driving explosive growth in TVL and rETH adoption. · Introduction of Megapools: Allows node operators to create larger pools, improving capital efficiency, reducing gas costs, and supporting adjustable commission control. · rETH optimization + subsequent inflation reduction: The liquid staking token rETH will have an upgraded experience, RPL inflation will gradually decrease, further supporting long-term value.

05:03

RPL Surges 62% in 24 Hours Ahead of Major Protocol UpgradeBlockBeats News, February 17th, according to an exchange market data, RPL's 24-hour price surge has expanded to 62%, with a market cap of $62 million and a current price of $2.80.

On the news front, Rocket Pool's largest-ever protocol upgrade, Saturn One, is set to be officially deployed on the Ethereum mainnet on February 18, 2026, at 00:00 UTC (8:00 AM East 8 Zone, 00:00 AM UK Time). The upgrade is seen by the community as a "turning point".

Key highlights of the Saturn One upgrade (directly benefiting RPL holders and protocol growth):

· RPL Fee Switch officially activated: Protocol revenue (ETH fees) will be partially allocated to users staking RPL, achieving true value capture, shifting from pure governance/staking to a "dividend" model.

· Node operator minimum ETH requirement halved to 4 ETH (from 8 ETH): Significantly reducing the entry barrier, expected to attract more nodes, driving TVL and rETH adoption rates to surge.

· Introduction of Megapools: Allows node operators to create larger pools, improving capital efficiency, reducing gas costs, and supporting adjustable commission controls.

· rETH Optimization + Subsequent Inflation Reduction: Enhanced experience for the liquid staking token rETH, gradual reduction in RPL inflation, further bolstering long-term value.

04:50

Micron Technology invests $200 billions to build a factory to overcome AI memory bottlenecksGelonghui, February 17|Micron Technology is the largest memory chip manufacturer in the United States. These tiny silicon chips are used to store and transmit data, powering a wide range of devices from smartphones and automotive computers to laptops and data centers. Micron Technology is ramping up capacity to address the most severe supply crunch the memory industry has seen in over 40 years. In Boise, where the company is headquartered, Micron is investing $50 billion to more than double its 450-acre campus, including the construction of two new chip factories (wafer fabs). The first batch of silicon wafers from the initial fab is expected to roll out by mid-2027, for the production of DRAM—a type of memory used to make high-bandwidth memory (HBM) chips, which are increasingly vital for advanced artificial intelligence (AI) computing. Both factories are expected to be operational by the end of 2028. And that's not all. Near Syracuse, Micron has just broken ground on a $100 billion wafer fab complex, the largest private investment in New York State's history. At the end of last year, Micron announced a $9.6 billion investment in a wafer fab in Hiroshima, Japan, while its competitor SK Hynix announced in January that it would build a $13 billion wafer fab in South Korea; in addition, the company is constructing a $4 billion manufacturing complex in Indiana. Behind this frenzied manufacturing arms race is the AI boom. "I've worked here for 28 years and have never seen anything as disruptive as AI," said Scott Gatzemeier, vice president in charge of Micron's $200 billion U.S. expansion plan. "As we shift from training to inference, the amount of data required surges, and we simply don't have enough cleanroom capacity to meet demand. We realized we had a huge problem." Since April last year, Micron's stock price has risen more than fivefold to about $414, bringing the company's market capitalization close to $500 billion.

News