News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | U.S. Shutdown Crisis Averted; Iran Tensions Boost Oil; Gold Rebounds Amid Microsoft Earnings Split (January 30, 2026)2Bitcoin Plunge Could Get Much Worse as Death Cross Gains Power3 Crypto Market Today Turns Red But LTH Data Signals Structural Stability

How to Execute Liquidity Sweep Reversal Trades (15-Minute Method)

101 finance·2026/02/01 03:30

Napco (NSSC) Q4 Preview: Key Information Before Earnings Release

101 finance·2026/02/01 03:12

What Can You Anticipate From Woodward’s (WWD) Fourth Quarter Earnings

101 finance·2026/02/01 03:09

‘Stablecoin ordinance has taken effect’ – Hong Kong pushes for crypto regulation

AMBCrypto·2026/02/01 03:03

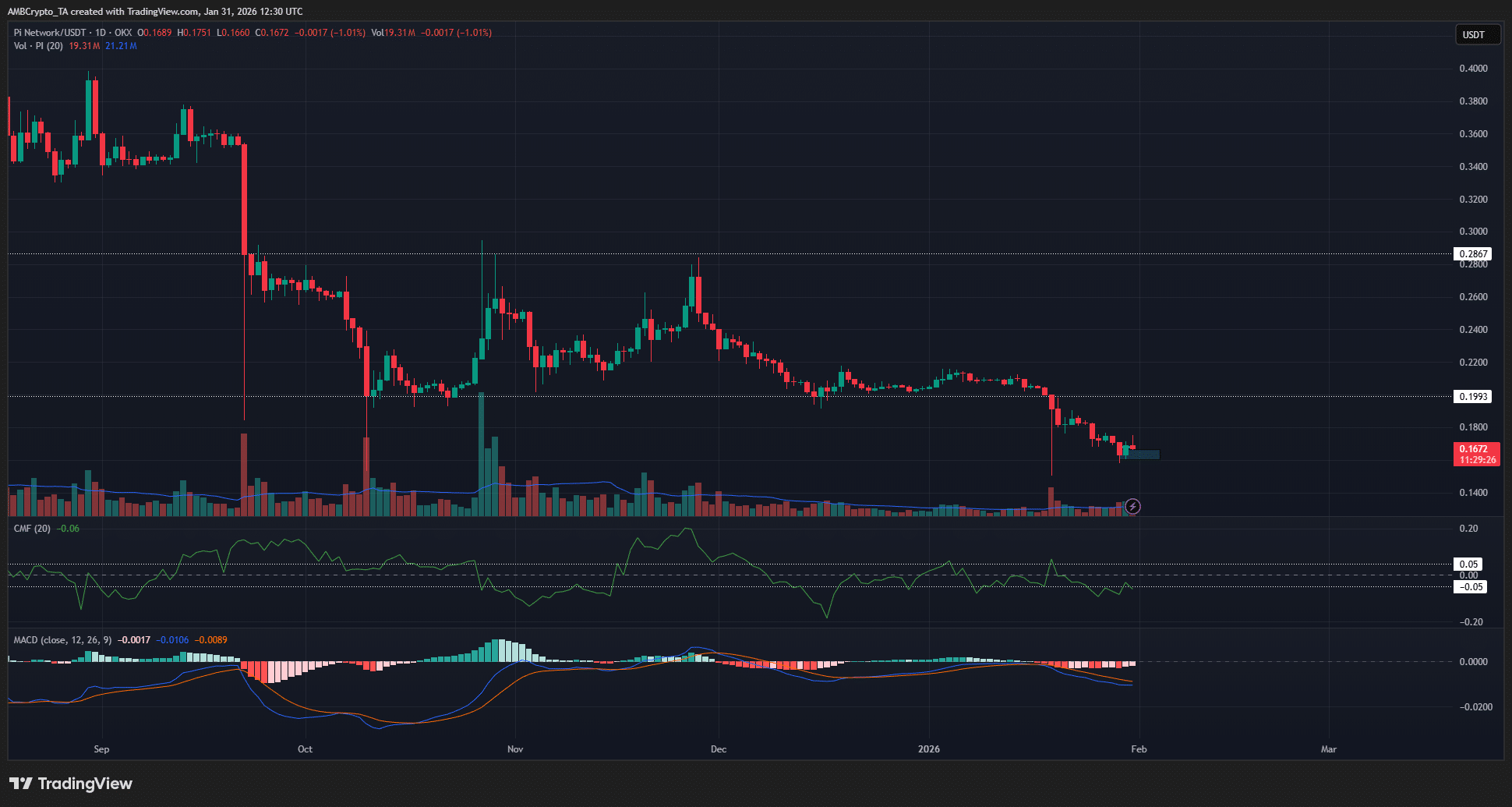

Pi Network: Why THESE supply zones keep PI bulls in check

AMBCrypto·2026/02/01 01:03

Phoenix Finance Joins ATT Global to Drive DePIN-Powered Yield via Real-World Advertising Assets

BlockchainReporter·2026/02/01 01:00

174 Americans Hit in $36.9M Crypto Scam as DOJ Hands Prison Sentence

Coinpedia·2026/02/01 00:30

Top Reasons Why Bitcoin Price Could Retest $75,000 in Early February

Coinpedia·2026/02/01 00:30

Canton Extends Bullish Trend—Is a Small Pullback on the Horizon?

Coinpedia·2026/02/01 00:30

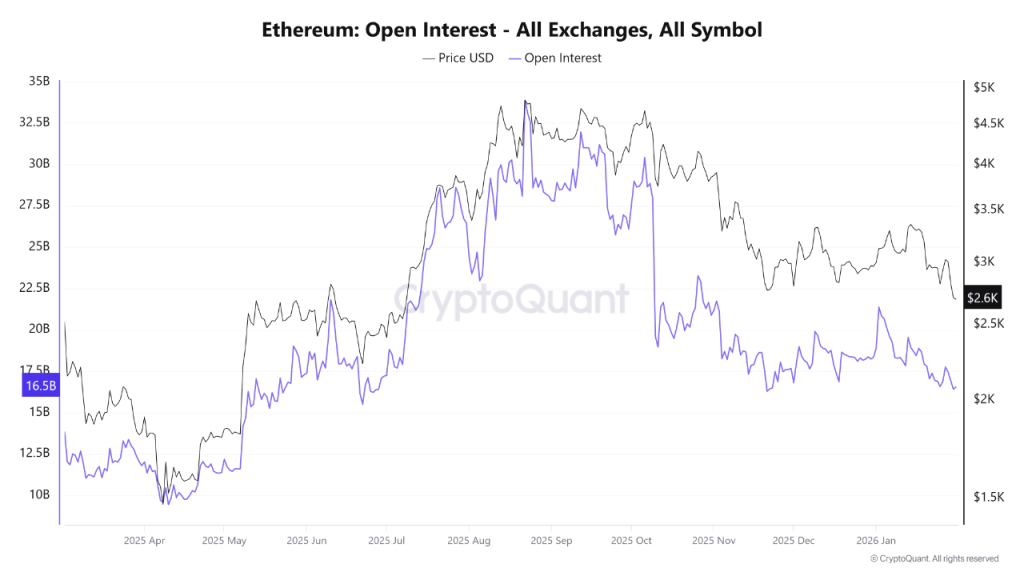

Ethereum Price Shows Rising Leverage Risk as Market Participation Thins

Coinpedia·2026/02/01 00:30

Flash

04:19

A certain whale fully closed their $LIT long position after 34 days, incurring a loss of $3.7 million.PANews reported on February 1 that, according to Onchain Lens monitoring, after holding a $LIT long position for approximately 34 days, the whale "0xf39" has fully closed the position, incurring a loss of $3.7 million.

04:19

India Schedules Special Stock Market Trading Session on Sunday; Metal Stocks and ETFs Hit HardGlonghui, February 1st|The Indian government will announce the annual budget for the 2026-27 fiscal year on February 1st (Sunday). The Indian stock market is holding a special trading session today for the budget announcement. The Indian NIFTY Metals Index saw its early session losses widen to as much as 5%. Hindustan Copper led the index decline, falling by 16.1%, while Hindustan Zinc dropped 10.8%. Precious metals ETFs plunged, with HDFC Gold ETF and SBI Gold ETF both falling over 10%, and HDFC Silver ETF dropping nearly 15%. According to the Bombay Stock Exchange, the reference prices for gold and silver ETFs traded on the exchange will be based on the net asset value of the fund from the previous trading day (T-1 day). Trading prices must fluctuate within a ±20% range of the T-1 day net asset value. The Indian currency and bond markets are closed today and will resume trading on February 2nd (Monday).

04:11

Goldman Sachs trader: The big picture hasn't changed, don't "overinterpret" the sharp drop in the past two days, especially considering the strong rally in January.Glonghui, February 1st|Mark Wilson, head of trading at Goldman Sachs, stated that despite recent sharp market fluctuations, investors should not overinterpret this "position washout," as the core drivers that have propelled the market since the beginning of the year have not fundamentally changed. The market set several extreme records this week. Microsoft suffered its second-largest single-day market cap loss in history, and silver plunged 30% in a single day. The notional trading volume of the silver ETF SLV exceeded $32 billion, and the gold ETF GLD saw trading volumes surpass $30 billion for two consecutive days. Silver volatility soared to extreme levels only seen during the global financial crisis and the COVID-19 lockdowns. In his weekly report, Wilson pointed out that when assessing the severity of this adjustment, it should be compared with the gains since January. He emphasized that key variables such as the continued strength of the US dollar, unabated enthusiasm for AI investments, robust US economic growth momentum, and geopolitical reshaping have not changed. Market performance since the beginning of the year still reflects these core trends—rare earths up 35%, nuclear energy stocks up 21%, and European defense up 20%. The direct trigger for this adjustment was excessive crowding in investor positions. Total exposure was already at the extreme 99th percentile, and the performance of systematic quantitative strategies showed that crowding had become a prominent issue. Wilson believes that this rapid pullback is more of a technical adjustment rather than a shift in fundamental logic.

News