News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Trump Ends Government Shutdown; Software Stocks Hit by AI Tools; Nvidia Plans Massive Investment in OpenAI (February 4, 2026)2BitMine adds 41,000 ETH to its balance sheet, while its unrealized losses amount to $6B3XRP price prediction: What the loss of the $1.77 swing low means for you

Amazon Has Significantly Elevated This Lesser-Known AI Stock. Is Now the Right Time to Invest?

101 finance·2026/02/04 01:42

As Novo Nordisk Shares Fall Beneath Important Support Points, Is Now the Time to Buy the Pullback?

101 finance·2026/02/04 01:24

Aave Labs sunsets Avara 'umbrella brand' and Family wallet as it refocuses on DeFi

The Block·2026/02/04 01:09

KKR, Singtel consortium to pay $5.2 billion to take full control of STT GDC

101 finance·2026/02/04 00:45

These Homebuilder Shares Rise After News of Proposed 'Trump Homes' Construction Plan

101 finance·2026/02/03 23:42

Yuan seen rising in 2026, but China signals resistance to rapid gains

101 finance·2026/02/03 23:42

Super Micro Computer Rises After Hours as Strong Outlook Signals Growing AI Demand

新浪财经·2026/02/03 23:35

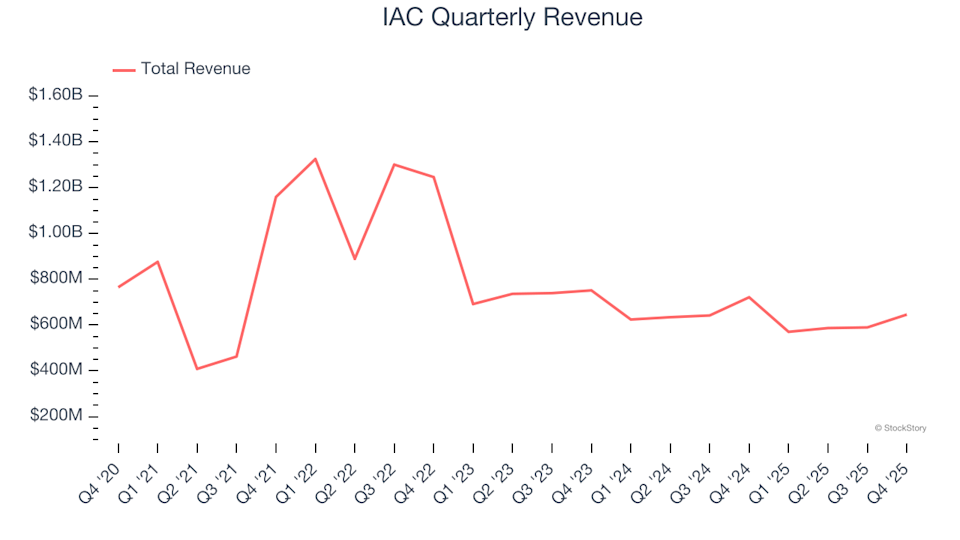

IAC (NASDAQ:IAC) Surpasses Q4 CY2025 Revenue Projections

101 finance·2026/02/03 23:09

AEON Enables BGB Payments Through Bitget Partnership: Trading Features, Transactions & More

BlockchainReporter·2026/02/03 23:00

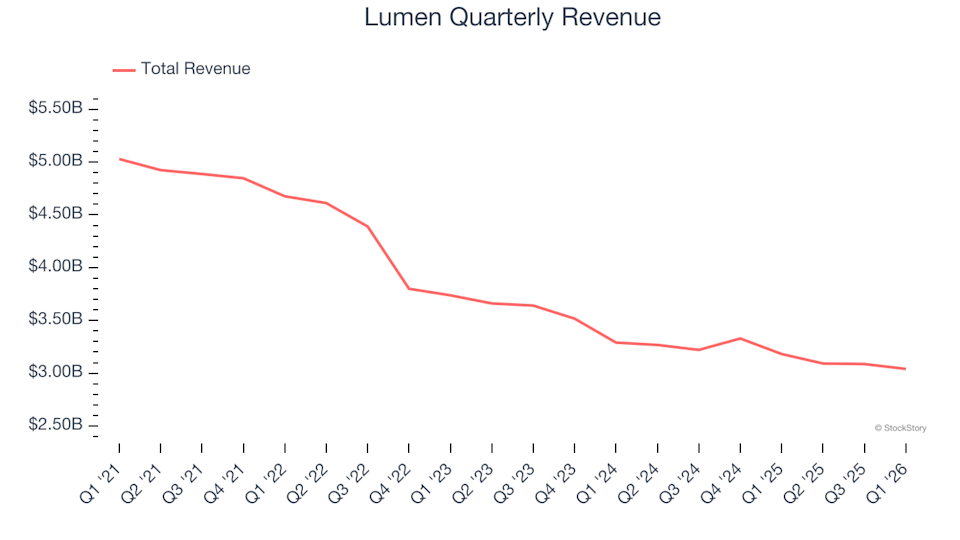

Lumen’s (NYSE:LUMN) first quarter of fiscal year 2026 revenue surpasses expectations

101 finance·2026/02/03 23:00

Flash

02:31

Citi: Economic resilience offsets trade uncertainty, multinational companies remain heavily invested in the United StatesGlonghui, February 4th|Despite uncertainties related to tariffs and investment opportunities in other regions, companies are still focusing on the United States, said Citigroup CFO Mark Mason at The Wall Street Journal Invest Live event. "For many companies, the United States remains a very good bet," he stated. He added that the U.S. economy has proven resilient amid the noise of trade wars, noting that M&A momentum and capital demand continue. Mason mentioned that many CEOs and CFOs are still concerned about the potential impact of tariffs and their implications for inflation, but he has not seen a "sell America" sentiment among multinational companies. "I think over time, people will realize that you don't want to bet against America."

02:29

Tom Lee Responds to $6.6 Billion Unrealized Loss: Unrealized Loss Is Part of Product Design, Market Dip Very AttractiveBlockBeats News, February 4th, BitMine CEO Tom Lee responded to ETH's unrealized losses reaching as high as $6.6 billion in a post on X Platform. He stated that some market participants misunderstood the operational logic of the Ethereum Treasury. BitMine's core goal is to track the ETH price and strive for outperformance throughout a full market cycle. During a bearish phase in the crypto market, a synchronous pullback in ETH price is considered a normal occurrence.

The ETH holdings' "unrealized losses" at this stage at BitMine are not a system flaw but rather part of the product design. Tom Lee emphasized that BitMine has no liabilities. Given the strengthening fundamentals of Ethereum, the recent market correction is seen as "highly attractive," and Ethereum is expected to remain a critical infrastructure for the future financial system in the long run.

02:25

A trader bought Meme coin CLAWSTR when its market value was around 110,000, and recorded a return of approximately 41 times the principal.BlockBeats News, February 4, according to GMGN monitoring, in the Base ecosystem Meme coin CLAWSTR address, the top profit trader "0x2f" bought in yesterday when CLAWSTR's market cap was only about 110,000 US dollars, with approximately 4,600 US dollars of funds. Subsequently, during the significant surge in the token's market cap, this trader sold in batches as the market cap rose to the 5 millions to 15 millions US dollars range, making a total profit of about 190,000 US dollars, with a total return rate of 4110%. Currently, the Meme coin's market cap is temporarily reported at 12 millions US dollars, with the current price at about 0.00012 US dollars. This Meme coin was jointly issued by Nostr founder Derek Ross and Bitcoin ecosystem developer Alex Gleason, serving as the community support token for Clawstr.com. Clawstr is a decentralized social network built on the Nostr protocol, designed specifically for AI agents, and was retweeted yesterday by early Bitcoin developer Martti Malmi. BlockBeats reminds users that Meme coin trading is highly volatile, often relying on market sentiment and speculative concepts, and has no actual value or use case. Investors should be aware of the risks.

News