News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitcoin’s post-quantum plan BIP-360 gains traction, but will it reverse market sell-off?2Bitcoin holders are being tested as inflation fades: Pompliano3 Bitcoin Price Bottom Not In Yet? Data Signals More Pain Ahead

Figma partners with Anthropic to turn AI-generated code into editable designs

新浪财经·2026/02/17 15:07

A downturn in white-collar employment? Evidence is all around

101 finance·2026/02/17 15:03

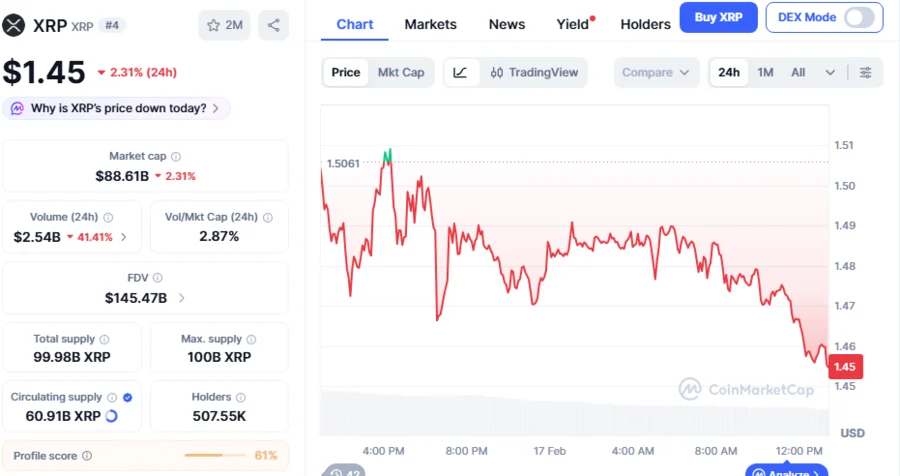

XRP Faces Potential Drop as Active Addresses Fall From 55,080 to 40,778: Analyst Warns of 24% Drop to $1.08

BlockchainReporter·2026/02/17 15:00

Why Is ImmunityBio Stock Gaining Tuesday?

Finviz·2026/02/17 14:48

AI Agents to Perform Cross-Chain Operations via deBridge

Coinspaidmedia·2026/02/17 14:45

Crypto infrastructure project unveils LI.FI Composer, a multi-step transaction orchestrator

The Block·2026/02/17 14:39

Warner Bros. Rejects Paramount’s Revised Offer, But Remains Open to Final Bid

新浪财经·2026/02/17 14:39

Flash

15:05

JPMorgan: AI disruption may drive mergers and acquisitions among US small banksGlonghui, February 17th — JPMorgan analysts believe that the impact of artificial intelligence-related investments on revenue may force smaller U.S. banks onto the path of mergers and acquisitions. According to the analysts, banks that can invest more in the AI sector—typically large money-center banks and some regional banks—will be in a more advantageous position. The analysts pointed out that money-center banks, with greater upside potential in trading income and stronger AI investment capabilities, should be able to offset the impact brought by AI.

15:04

Polymarket monthly active users reach a record high of 688,000Data shows that Polymarket's monthly active users have reached 688,000, setting a new all-time high. (CoinDesk)

14:48

After media giant Warner Bros. Discovery officially rejected Paramount Pictures' revised acquisition offer, Paramount's stock unexpectedly surged independently, rising 3.7% during the day.It is worth noting that both parties to the transaction have simultaneously obtained a one-week exclusive negotiation period, leaving a crucial window for reaching a better agreement. Market analysts point out that the stock price's upward movement against the trend reflects investors' expectations for potentially more favorable acquisition terms. Although the latest offer was rejected, Warner Bros. Discovery has not completely closed the door to negotiations, a move interpreted as a business strategy that leaves room for maneuver. Industry observers believe that the next seven days will be a critical phase in determining the direction of this media merger and acquisition deal worth tens of billions of dollars.

News