News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Gold and Silver Rebound; SpaceX Acquires xAI; Palantir Revenue Surges (February 3, 2026)2BitMine adds 41,000 ETH to its balance sheet, while its unrealized losses amount to $6B3XRP price prediction: What the loss of the $1.77 swing low means for you

Canton Price Prediction: CC Jumps 75% As Institutional Burns Push Toward Deflation

CoinEdition·2026/02/03 06:21

India agrees to buy petroleum, defence goods, aircraft from US, official says

101 finance·2026/02/03 05:54

Bitcoin rebounds above $78,500; no basis for long-term rally yet: analysts

The Block·2026/02/03 05:12

Is HBAR Price Finding a Floor Despite Market Weakness?

Coinpedia·2026/02/03 04:30

BTC Price Enters a Reset Phase After $74,500 Crash Shakes Market Structure

Coinpedia·2026/02/03 04:30

DBS Bank Ethereum Accumulation Skyrockets: Strategic $5.8M Transfer Signals Major Institutional Move

Bitcoinworld·2026/02/03 03:51

Tesla introduces new Model Y variant in US priced at $41,990

101 finance·2026/02/03 03:39

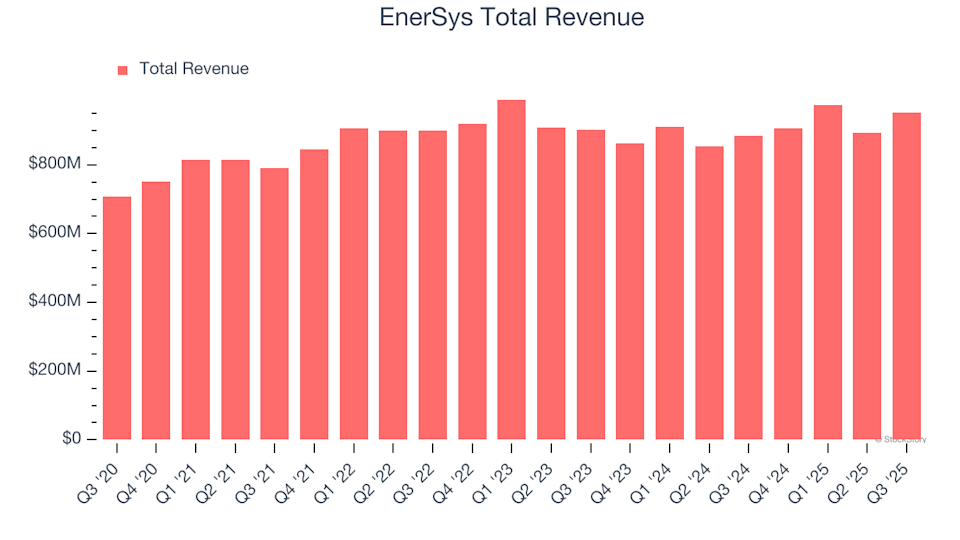

EnerSys (ENS) Q4 Preview: Key Insights Before Earnings Release

101 finance·2026/02/03 03:30

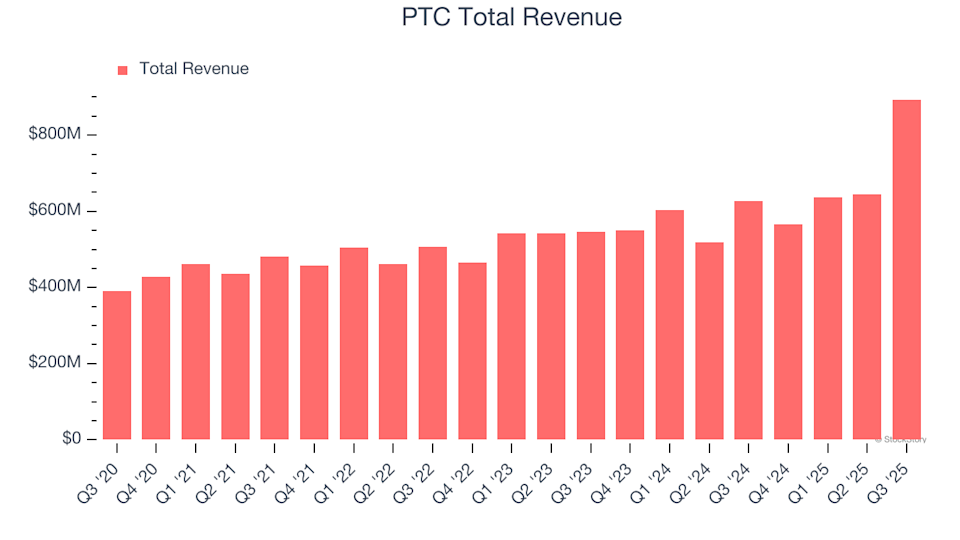

PTC (PTC) Q4 Preview: Key Information to Know Before Earnings Release

101 finance·2026/02/03 03:30

Flash

07:07

Can a US-Iran nuclear deal be reached in 2026? Even if Trump remains silent, what are cryptocurrency investors betting on?According to a report by Bijie Network: On the prediction market Polymarket, the probability of a US-Iran nuclear agreement being reached has surged, once climbing to 57% and eventually stabilizing at 53%, a significant increase from 30% a week ago. This shift stems from optimistic remarks made by Iran's Foreign Minister, who described the recent indirect talks as "productive," but emphasized that the prerequisite is the lifting of US sanctions. Meanwhile, the market shows a sharp decline in the probability of the US launching a military strike against Iran. More than $23,000 in bets have been placed on this outcome, and the final result will depend on whether the two sides reach a publicly announced agreement before the end of the year.

07:02

Data: Trend Research shows Ethereum's latest liquidation range has dropped to $1,685.63 - $1,855.16According to market news, the latest liquidation range for Trend Research's Ethereum holdings has now dropped to "$1,685.63 - $1,855.16": Today, Trend Research deposited 45,000 ETH ($105 million) to a certain exchange, and since February 1st, has cumulatively deposited 118,589.05 ETH ($289 million). Compared to the peak holding of 661,272.65 ETH, 17.9% has already been sold. The current specific liquidation data is as follows: TOP1 holding: 0xfaf1358fe6a9fa29a169dfc272b14e709f54840f collateralized 145,850 ETH and borrowed $216 million in stablecoins, liquidation price $1,791.06; TOP2 holding: 0xe5c248d8d3f3871bd0f68e9c4743459c43bb4e4c collateralized 114,899 ETH and borrowed $172 million in stablecoins, liquidation price $1,807.05; TOP3 holding: 0x85e05c10db73499fbdecab0dfbb794a446feeec8 collateralized 108,749 ETH and borrowed $163 million in stablecoins, liquidation price $1,808.1; TOP4 holding: 0x6e9e81efcc4cbff68ed04c4a90aea33cb22c8c89 collateralized 79,516 ETH and borrowed $117 million in stablecoins, liquidation price $1,781.06; TOP5 holding: 0x8fdc74bad4aa20904a362d4b69434a0cf4d97f43 collateralized 43,027 ETH and borrowed $66.25 million in stablecoins, liquidation price $1,855.16; TOP6 holding: 0xb8551abd2bb66498f6d257ae181d681fd2401e8a collateralized 41,036 ETH and borrowed $57.41 million in stablecoins, liquidation price $1,685.63.

06:57

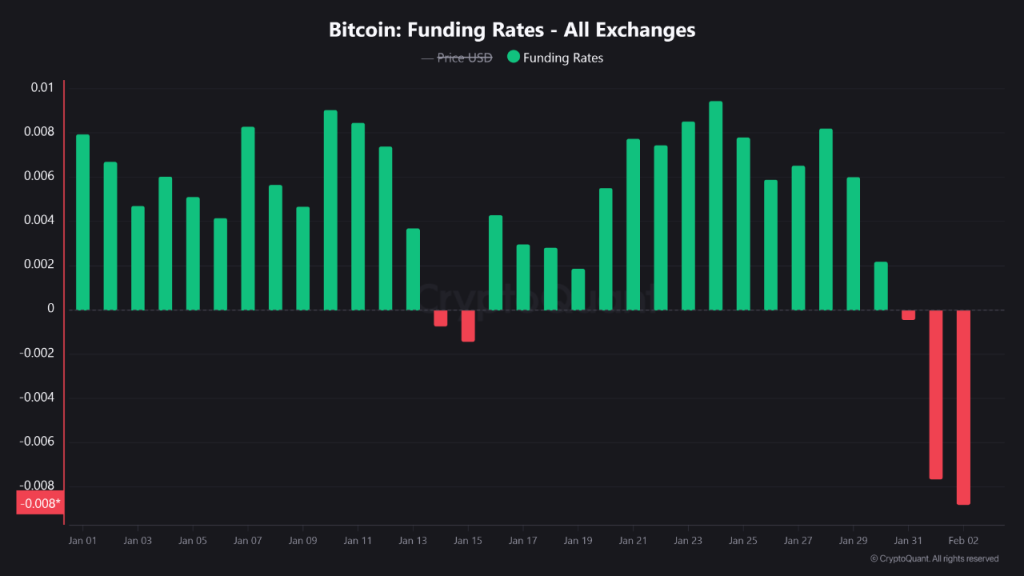

Cryptocurrency trading volume drops to 2024 lows as spot demand weakensBlockBeats News, February 3, analysis indicates that as liquidity contracts and risk appetite declines, spot trading volume in the crypto market has dropped sharply, with investor participation clearly weakening. Data shows that the spot crypto trading volume on major exchanges has halved from about $2 trillion in October last year to $1 trillion at the end of January, falling back to the low range since the start of 2024. CryptoQuant stated that since October, spot demand has continued to cool, and the market adjustment was largely triggered by the liquidation event on October 10. The current price of bitcoin has retreated about 37.5% from its October high, and tight liquidity has further compressed trading volume. Taking one exchange as an example, bitcoin's monthly spot trading volume has dropped from about $200 billion in October to the current $104 billion. In addition to weak demand, market liquidity is also under pressure. Analysis shows that stablecoins continue to flow out of exchanges, and combined with a reduction of about $10 billion in total stablecoin market cap, this has further weakened the buying base. On the macro level, institutions believe that short-term risks remain tilted to the downside. The head of research at Arctic Digital pointed out that the market's hawkish expectations for Kevin Warsh possibly becoming the chairman of the Federal Reserve could mean a slower pace of rate cuts, a stronger dollar, and rising real interest rates, thereby putting pressure on risk assets including crypto assets. However, some analysts still believe that the current adjustment helps to clear leverage and cool speculation. If there is a renewed inflow of bitcoin ETF funds, the advancement of crypto-friendly legislation, or if weaker economic data prompts a shift to looser monetary policy, the market may usher in a new rebound window.

News