News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

![[English Thread] Wake-up Call and Review for the Crypto Industry in 2025: Where Is the Direction of the Next Cycle?](/news-static/client/media/cover-placeholder.101bcc72032a7c4f0a397f15f3252c92.svg)

In recent years, a completely new ecosystem has been forming around bitcoin.

What is preventing enterprises from applying blockchain technology to business scenarios?

Analyst Conaldo reviewed bitcoin’s market performance last week using a quantitative trading model, successfully executing two short-term trades with a total return of 6.93%. The forecast for this week is that bitcoin will continue to fluctuate within a range, and corresponding trading strategies have been formulated. Summary generated by Mars AI. The accuracy and completeness of this summary, generated by the Mars AI model, are still being updated and iterated.

Everything you've been hoping for may have already arrived; it just looks different from what you expected.

- 03:24UXLINK Releases Full Review of Security Incident Process, Over $11 Million in Assets Stolen Due to External AttackJinse Finance reported that UXLINK CEO Rolland Saf released a security incident review report, providing a comprehensive explanation of the asset theft incident and emphasizing that the event was not caused by internal factors within the project team. According to the report, the attacker posed as a business partner and used deepfake video conferences, among other methods, to compromise the personal devices of several SAFE key holders over several months, stealing passwords, private keys, and other sensitive information, and ultimately gaining control of the old arb-UXLINK smart contract. The hacker then illegally minted additional tokens, transferred and sold assets, resulting in total losses exceeding $11 million. The incident occurred during Korea Blockchain Week, with several core members present at the event. The team promptly reported to exchanges, partner security agencies, and law enforcement authorities in multiple countries, confirming that the attack originated externally rather than internally.

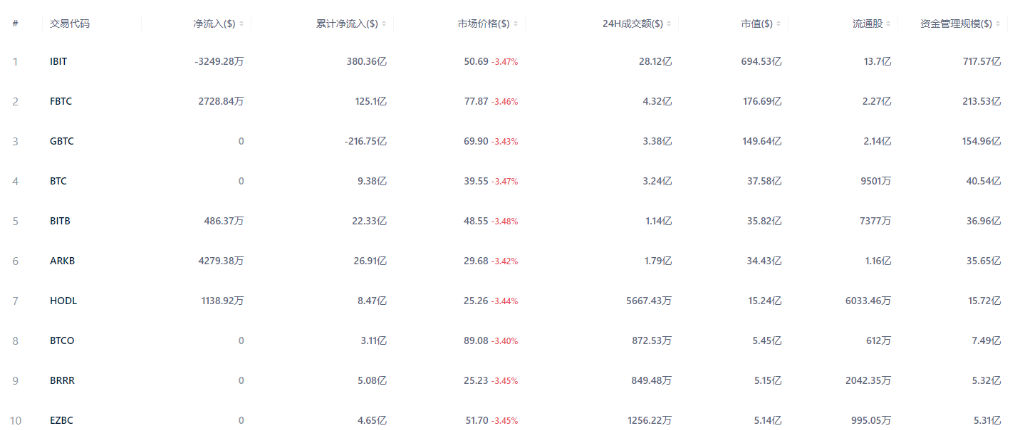

- 03:24glassnode: Bitcoin shows early signs of recovery, but market sentiment and positioning remain cautiousJinse Finance reported that glassnode released its weekly market commentary, stating that although bitcoin rebounded to around $94,000, the market remains unconvinced. Market momentum has improved and trading volume has increased, but spot CVD (Cumulative Volume Delta, a key metric for measuring the net difference between buyers' and sellers' trading volumes) and open interest have both declined, indicating intensified potential selling pressure. Meanwhile, options trading shows a demand for hedging downside risks, and ETF outflows suggest weak market demand. Overall, bitcoin is showing early signs of recovery momentum, but market sentiment and positions remain cautious, indicating that the market is still rebuilding confidence after recent volatility.

- 03:16Gensyn launches Delphi, an open market for machine intelligenceJinse Finance reported that the blockchain-based AI computing protocol Gensyn announced on Twitter the launch of Delphi, an open market for machine intelligence. Delphi is now live on the Gensyn testnet. Delphi operates as an automated market maker based on a decentralized on-chain Logarithmic Market Scoring Rule (LMSR), providing continuous liquidity from the first trade to final settlement. It allows users to observe the competitive performance of machine learning models in benchmark tests in real time and to make equity investments in the models. Model evaluation, trade execution, and price changes are all dynamically completed on-chain.

![[Bitpush Daily News Highlights] Strategy increases holdings by another 10,624 bitcoin, bringing total holdings to 660,624; BitMine added 138,452 ETH last week, Tom Lee is optimistic about Ethereum strengthening in the coming months; US CFTC approves Ethereum, Bitcoin, and USDC as collateral for derivatives markets.](https://img.bgstatic.com/multiLang/image/social/7e5c26545777dcf500ecdd4ceb4b3f701765168389911.png)