News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Gold and Silver Rebound; SpaceX Acquires xAI; Palantir Revenue Surges (February 3, 2026)2BitMine adds 41,000 ETH to its balance sheet, while its unrealized losses amount to $6B3XRP price prediction: What the loss of the $1.77 swing low means for you

Jensen Huang Cuts Ties with OpenAI?

美投investing·2026/02/03 02:09

TDK Stock Surges as Strong Forecast Eases Concerns Over Memory Prices

101 finance·2026/02/03 01:36

Will GameStop Dump Its Bitcoin? CEO Says ‘Way More Compelling’ Move Ahead

Decrypt·2026/02/03 01:34

Elon Musk finalizes $1.25 trillion agreement to merge SpaceX with Grok

101 finance·2026/02/03 00:21

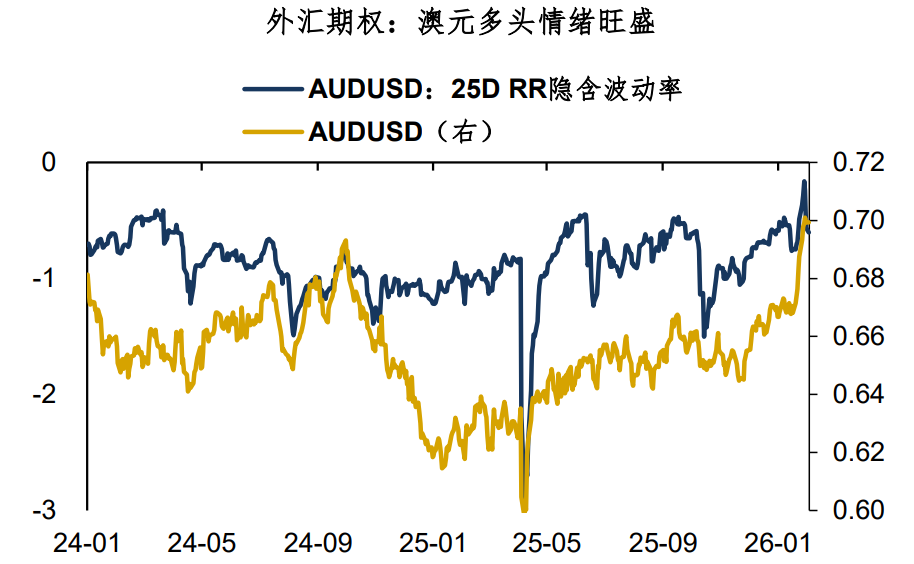

AUD: Either Believe Early or Don't Believe at All

BFC汇谈·2026/02/03 00:01

Crypto Assets Enter Accumulation Zone as Market Pullback Deepens As of 2nd February

BlockchainReporter·2026/02/03 00:00

Flash

02:47

Glassnode: Bitcoin's short-term stabilization may depend on the easing of selling pressure and a rebound in demandPANews reported on February 3 that, according to Glassnode analysis, bitcoin has dropped to $74,000, with the 14-day RSI falling into the oversold zone and momentum significantly weakening. Spot trading volume has rebounded somewhat, but the response is sluggish, indicating that the downtrend is still ongoing rather than a buy-the-dip scenario. The spot market is dominated by sellers, ETFs remain under pressure, there is clear deleveraging in the derivatives market, on-chain activity is sluggish, and the overall market has entered a risk-averse mode.Short-term stabilization may depend onthe easing of selling pressure and a recovery in demand

02:43

"On-chain stock investors" liquidate Nasdaq short positions and use the funds to short gold, while also bottom-fishing the crypto market with $59 millionBlockBeats News, February 3, according to Coinbob Hot Address Monitor, the largest on-chain gold short whale "On-chain Stockholder" (0xfc66…) has concentrated $80 million in short positions across various commodities, with weekly profits reaching $9.4 million. In the past few days, this address has continuously closed and taken profits on on-chain US stock short positions, mainly focused on XYZ100 (Nasdaq 100 Index), reducing the related holdings from about $19.6 million to less than $300,000. Subsequently, the released funds were reallocated to increase short positions in precious metals, with the total scale of related short positions reaching $47 million. Among them, the largest short position is in PAXG (on-chain gold), amounting to $24.9 million. Meanwhile, the overall position structure of this account has changed significantly. The total position size has increased to $115 million. In addition to retaining about $57 million in commodity shorts, part of the focus has shifted back to the crypto market, with nearly $59 million in new long positions, aggressively bottom-fishing coins such as XRP, SOL, and ETH. On-chain stock-related positions have been significantly reduced. The current main commodity positions compared with last Friday are as follows: 5x PAXG (on-chain gold): position size increased from $12 million to $24.9 million, average price dropped from $5,250 to $4,991, with an unrealized profit of about $980,000; 5x xyz:GOLD (gold-mapped contract): position size increased to $12.8 million, average price dropped from $5,320 to $4,814, with an unrealized loss of about $83,000; 2x xyz:SILVER (silver-mapped contract): position size increased to $9.49 million, average price dropped from $108 to $81, with an unrealized loss of about $170,000. It is reported that this address has previously focused on on-chain contract operations for crypto assets. Since January 8 this year, it has continuously reduced high-leverage ETH, BTC, and SOL short positions; instead, it gradually increased on-chain stock positions, with on-chain stock holdings accumulating nearly $80 million in January, and has recently returned to the crypto market.

02:43

「On-chain Shareholder」 Liquidates Nasdaq Short Position and Margin Buys Gold, Additionally Dips $59 Million to Buy the Crypto MarketBlockBeats News, February 3rd, according to Coinbob Popular Address Monitor, on-chain gold's largest short whale "On-chain Stockholder" (0xfc66...) has concentrated $80 million to short various commodities, with current weekly profit reaching $9.4 million. The address has been continuously closing positions to take profits in the past few days, mainly focusing on on-chain US stock shorts linked to the XYZ100 (Nasdaq 100 Index), with related positions decreasing from about $19.6 million to less than $300,000. Subsequently, the released funds were added to the precious metals shorts, and the total short position has reached $47 million. Among them, the largest short is in PAXG (on-chain gold), with a size of $24.9 million.

Meanwhile, the overall position structure of the account has undergone significant changes. The total position size has increased to $115 million. In addition to retaining about $57 million in commodity shorts, part of the focus has shifted back to the crypto market. A new long position of nearly $59 million has been opened to buy the dip in XRP, SOL, ETH, and other currencies. Holdings related to on-chain stocks have been significantly reduced. The current main commodity holdings compared with last Friday are as follows:

5x PAXG (on-chain gold): The position size has increased from $12 million to $24.9 million, with an average price decreasing from $5,250 to $4,991, with an unrealized profit of about $980,000;

5x xyz:GOLD (gold mapping contract): The position size has increased to $12.8 million, with an average price decreasing from $5,320 to $4,814, with an unrealized loss of about $83,000;

2x xyz:SILVER (silver mapping contract): The position size has increased to $9.49 million, with an average price decreasing from $108 to $81, with an unrealized loss of about $170,000.

It is reported that this address has always focused on on-chain contract operations of crypto assets, and since January 8th, has been continuously reducing leveraged ETH, BTC, and SOL short positions; gradually increasing on-chain stock positions instead, with its on-chain stock position gradually increasing by nearly $80 million within January, and recently returning to the crypto market.

News