News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily Report | US-Japan-EU-Mexico Collaborate on Key Minerals Development; Nasdaq Introduces Fast Inclusion Rules; Software Stocks Continue Under Pressure (February 5, 2026)2Hyperliquid treasury seeks revenue boost using HYPE holdings as options collateral3Bitcoin drops following Treasury Secretary Bessent's statement that the US government cannot require banks to rescue crypto

Japan election outlook: How a significant LDP victory might impact the economy, government bonds, and the yen

101 finance·2026/02/05 06:24

Analysis-'Software-mageddon' leaves investors bargain-hunting but wary

101 finance·2026/02/05 06:12

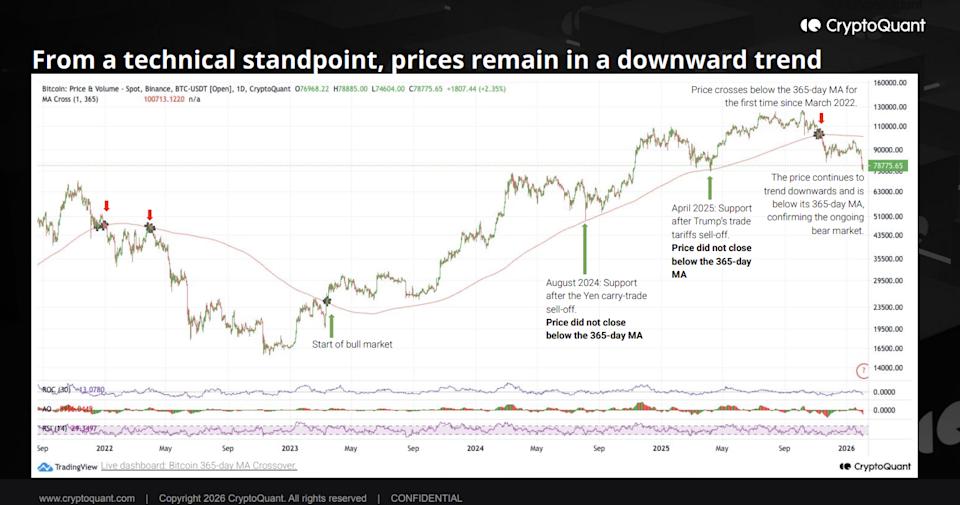

Bitcoin Drops: Compare Today to Past Markets Now!

Cointurk·2026/02/05 06:09

Sony Stock Rises 6% Following Upgraded Outlook and Strong Sales

101 finance·2026/02/05 04:30

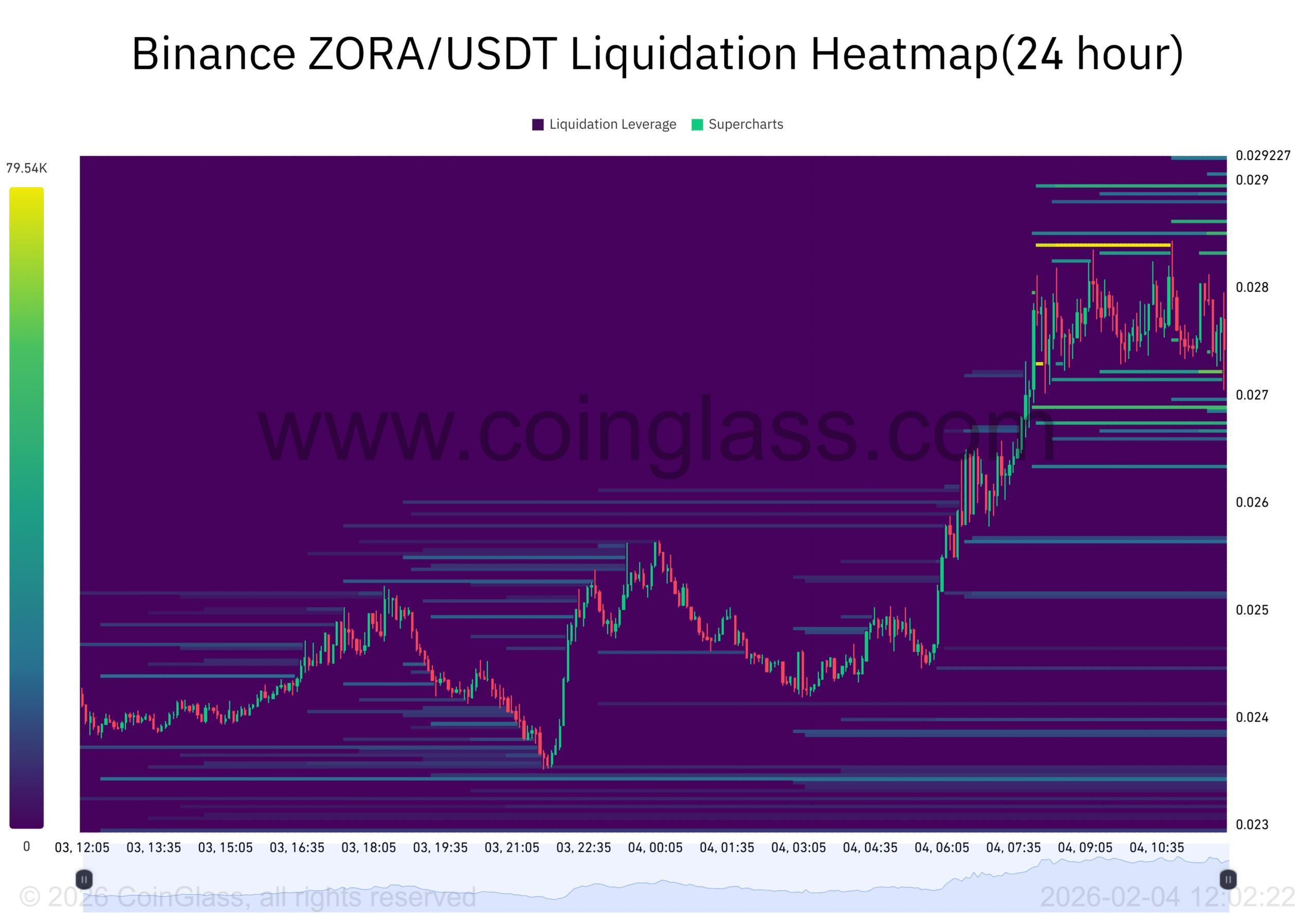

ZORA rebounds from multi-month lows: Early trend reversal or short squeeze?

AMBCrypto·2026/02/05 03:33

Flash

06:33

A whale bought $7 million worth of HYPE at an average price of $34.9BlockBeats News, February 5th, according to AI Auntie's monitoring, a whale address has accumulated $7 million worth of HYPE in the past 12 hours, with an average cost of $34.9. The current unrealized loss is $272,000; meanwhile, HYPE has retraced 11.4% from its recent peak of $37.87 to the current price of $33.54.

06:30

Analyst: De-escalation of US-Iran Tensions Could Trigger Larger-Scale Profit-Taking in Gold MarketBlockBeats News, February 5th - EFG International, the asset management arm of UBS Group, believes that there are currently various factors that could lead to further downside in the gold price. EFG's Chief Economist GianLuigi Mandruzzato pointed out that the intense volatility seen in the European gold market on January 29th, when gold briefly touched $5,600 per ounce, highlights the increasing risk of a pullback.

He stated that although currently a low probability, any de-escalation of the Iran situation could prompt investors to reassess their gold positions. Additionally, Mandruzzato added that the appointment of the new Federal Reserve Chair - someone seen as independent from Trump and credible on inflation issues - is expected to boost investor confidence in dollar assets, thereby reducing the demand for safe-haven assets. (FXStreet)

06:28

An address accumulated $7 million worth of HYPE in the past 12 hours and is currently at an unrealized loss of $272,000.According to Odaily, on-chain analyst Ai Yi has monitored that address (0x8d0…59244) is currently accumulating HYPE. In the past 12 hours, this address has purchased HYPE worth $7 million, with an average entry cost of $34.9. Currently, the price of HYPE is $33.54, down 11.4% from the recent short-term peak of $37.87. The address is currently experiencing an unrealized loss of $272,000.

News