Bitget Futures — Position Risk Control

[Estimated reading time: 5 mins]

Bitget's position risk control mechanism is a crucial protective feature designed to help users manage risk in the highly volatile cryptocurrency market. This system is especially important for limiting potential losses caused by high-leverage trading. Below is an overview of how Bitget's risk control for opening positions works.

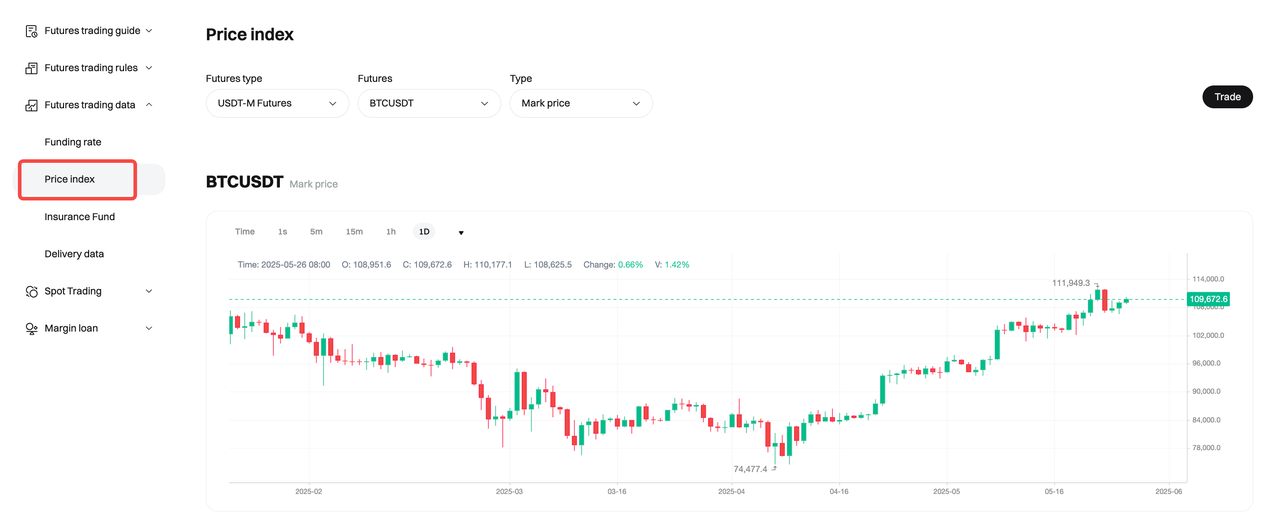

Deviation between the mark price and market price

In futures trading, Bitget uses a mark price to assess the value of open positions and avoid unnecessary liquidations triggered by sudden spikes or drops in market price. The mark price is derived from the index price, which reflects a weighted average of spot prices across multiple leading exchanges, and incorporates futures market factors to maintain stable pricing. This mechanism helps smooth out short-term volatility and reduces risk exposure caused by abnormal price fluctuations on any single exchange.

Risk control for high-leverage trading

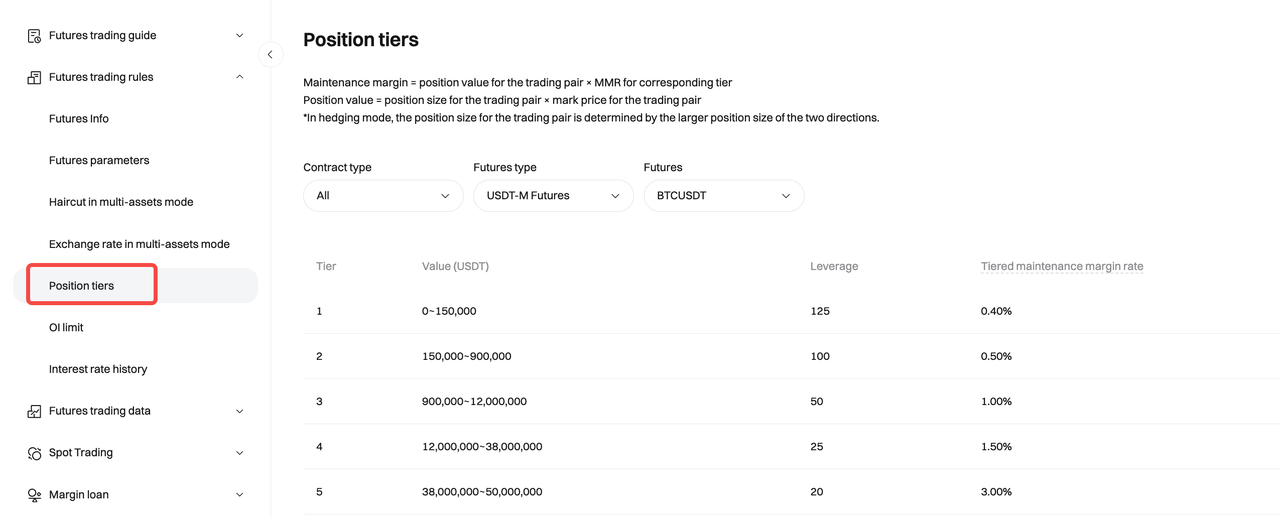

High leverage is a defining feature of crypto futures, but it also introduces significant risk. Bitget's risk control mechanism helps users safeguard their assets by dynamically adjusting margin requirements and setting risk limits. When the market price fluctuates slightly, Bitget's system will monitor the risk level of users' positions in real-time. It promptly issues alerts or triggers partial liquidation to prevent account balances from falling below the required thresholds.

Users can monitor their position risk status in real-time via the Bitget app and are encouraged to adjust leverage or top-up margin as needed. Bitget also provides an auto-deleveraging (ADL) feature to further reduce risks associated with high leverage.

Maintenance margin ratio (MMR) management

The MMR is the key indicator of position health, calculated as:

• MMR = current position's maintenance margin ÷ (account equity – amount frozen for orders under isolated margin mode – unrealized PnL of the cross margin position – isolated margin for the position)

When a position’s MMR approaches 100%, it indicates that the position no longer has sufficient margin to remain open. At this point, the system may trigger partial or full liquidation to prevent further losses.

MMR reflects the balance between position requirements and available margin. It is a dynamic measure, changing as market prices fluctuate or as other positions in the account affect the available margin. More details are available in Maintenance margin calculation for classic account futures.

Summary

Bitget's position risk control combines fair pricing via mark price, high-leverage safeguards, and maintenance margin ratio monitoring, creating a secure and transparent futures trading environment. Whether you're a beginner or a seasoned trader, Bitget's professional tools and real-time monitoring features can help you optimize your trading strategy and control risk effectively.

FAQs

1. What is Bitget's position risk control?

Bitget's position risk control is a protective system that helps users manage risk in volatile crypto markets, particularly when using high leverage. It monitors positions in real time, adjusts margin requirements, and can trigger alerts or partial liquidation to prevent excessive losses.

2. What is the mark price in futures trading?

The mark price is a reference price used to calculate the value of open positions. It is based on the index price, which reflects a weighted average of spot prices from multiple leading exchanges, and is adjusted using market references to maintain stable pricing. Bitget uses the mark price to reduce the risk of unnecessary liquidations caused by short-term price spikes or drops on a single exchange.

3. How does Bitget manage high-leverage trading risks?

Bitget dynamically adjusts margin requirements, sets risk limits, issues alerts, and can partially liquidate positions. The system also includes an auto-deleveraging (ADL) feature to further reduce risks for high-leverage trades.

4. What is the maintenance margin ratio (MMR) and why is it important?

The MMR = current position's maintenance margin ÷ (account equity – amount frozen for orders under isolated margin mode – unrealized PnL of the cross margin position – isolated margin for the position). MMR indicates the health of a position. Bitget monitors MMR in real time, and if it approaches 100%, the system may trigger partial or full liquidation to prevent further losses.

Disclaimer and Risk Warning

All trading tutorials provided by Bitget are for educational purposes only and should not be considered financial advice. The strategies and examples shared are for illustrative purposes and may not reflect actual market conditions. Cryptocurrency trading involves significant risks, including the potential loss of your funds. Past performance does not guarantee future results. Always conduct thorough research, understand the risks involved. Bitget is not responsible for any trading decisions made by users.

Join Bitget, the World's Leading Crypto Exchange and Web3 Company