News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Gold and Silver Rebound; SpaceX Acquires xAI; Palantir Revenue Surges (February 3, 2026)2BitMine adds 41,000 ETH to its balance sheet, while its unrealized losses amount to $6B3XRP price prediction: What the loss of the $1.77 swing low means for you

It’s foolish to pretend Bitcoin’s story doesn’t include $79k this year

CryptoSlate·2025/11/14 19:00

Monad Ecosystem Guide: Everything You Can Do After Mainnet Launch

Enter the Monad Arena.

深潮·2025/11/14 18:42

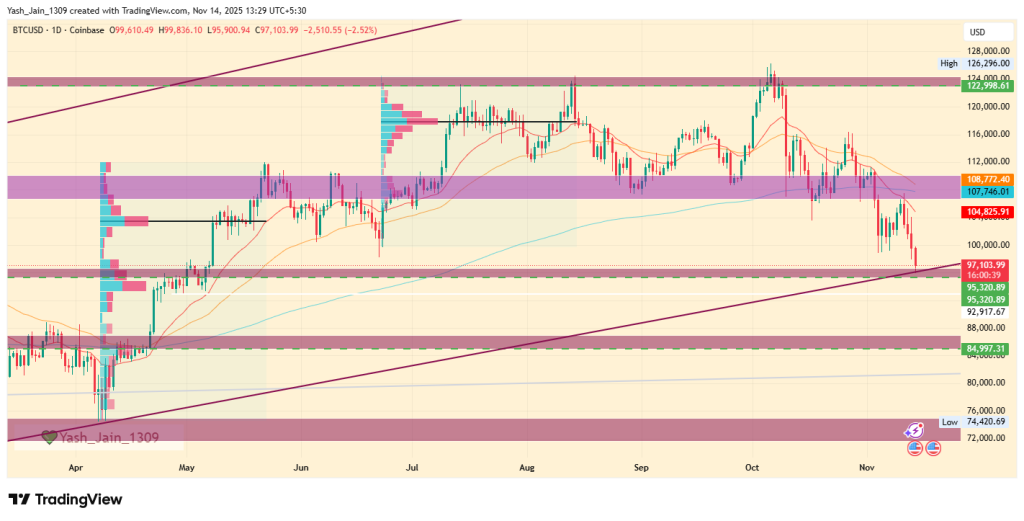

Comprehensive Data Analysis: BTC Falls Below the Critical $100,000 Level—Is the Bull Market Really Over?

Even if bitcoin is indeed in a bear market right now, this bear market may not last long.

深潮·2025/11/14 18:40

Options exchange Cboe enters the prediction market, focusing on financial and economic events

Options market leader Cboe has announced its entry into the prediction market. Rather than following the sports trend, it is firmly committed to a financially stable path and plans to launch its own products linked to financial outcomes and economic events.

深潮·2025/11/14 18:38

Grayscale formalizes its IPO filing

Cointribune·2025/11/14 18:06

Czech Bank Tests Crypto Assets In Pilot Program

Cointribune·2025/11/14 18:06

New XRP ETF Draws $58M Trading Volume, Tops This Year’s ETF Debuts

Cointribune·2025/11/14 18:06

Bitzuma Launches Research & Education Hub to Elevate Crypto Knowledge

DeFi Planet·2025/11/14 18:03

Bitcoin Price Prediction 2025, 2026 – 2030: How High Will BTC Price Go?

Coinpedia·2025/11/14 17:42

![Why Crypto Is Down Today [Live] Updates On November 14,2025](/news-static/client/media/cover-placeholder.101bcc72032a7c4f0a397f15f3252c92.svg)

Why Crypto Is Down Today [Live] Updates On November 14,2025

Coinpedia·2025/11/14 17:42

Flash

00:13

Cryptocurrency Market Review: Shiba Inu (SHIB) Surpasses 1,000,000,000,000 Tokens, Triggering a Bull Market; Bitcoin (BTC) Plunge May Have Reached Its Limit; Is Dogecoin (DOGE) in a Mini Bull Market?According to CoinWorld, Shiba Inu (SHIB) is showing potential signs of recovery, with its first significant green daily candlestick and a sharp surge in trading volume indicating that buyers may be stepping in after a substantial decline. Nevertheless, the overall trend remains downward and needs to be confirmed by a series of higher lows. Bitcoin (BTC) experienced a rapid drop, falling to the $70,000 range and breaking below key moving averages. The high trading volume suggests that sellers may have exhausted their strength, potentially forming a short-term stabilization zone. However, if support near $80,000-$82,000 cannot be regained, further declines to the $70,000 low are possible. Dogecoin (DOGE) has seen a notable rebound from the $0.10 area, with increased spot inflows providing a brief respite and sparking a minor bull run on shorter timeframes. However, since the asset remains below key declining moving averages, the overall downtrend persists, making sustained upward movement unlikely without a structural trend reversal.

00:12

Vitalik may have sold 1,441 ETH worth $3.297 million in the past two days as part of a "donation plan"BlockBeats News, February 4, according to monitoring by OnchainLens, in the past two days, Ethereum founder Vitalik Buterin has sold 1,441 ETH, with a total value of $3.297 million. According to previous analysis, five days ago Vitalik transferred 16,384 ETH from his personal address to a multi-signature address and started selling yesterday. This corresponds to the "multi-year donation plan" he announced on the 30th, which aims to support the development of open-source, secure, and verifiable full-stack software and hardware systems.

00:10

Bitwise CEO: Bitcoin currently lacks a "Schelling point catalyst"Jinse Finance reported that Bitwise CEO Hunter Horsley posted on X, stating, "I believe the current issue with Bitcoin is the lack of a 'Schelling point-style price catalyst.' A Schelling point catalyst refers to a potential opportunity that, once realized, will significantly drive up the coin price and thus become the focus of everyone's attention and discussion. In 2023, this catalyst was whether the Bitcoin spot ETF would be approved; in the first half of 2024, it was how much capital inflow the Bitcoin ETF could attract; in the second half of 2024, it is the U.S. presidential election, as well as the crypto industry potentially escaping a harsh regulatory environment; in the first half of 2025, it is the possibility of central banks in various countries establishing strategic Bitcoin reserves; and from the first half to the second half of 2025, the rise of Bitcoin treasury management companies has become the new focus. Now, in the first half of 2026, if you ask five different industry practitioners what the single most important catalyst for a significant rise in Bitcoin's price over the next year is, you are likely to get completely different answers, including vague trend statements such as 'institutional adoption.' I believe, overall, that a single, uncertain catalyst can no longer dominate the entire market, which is a sign of the industry's maturity. However, at the same time, this has created a vacuum in market attention. I think, although this may seem minor, it is an important reason for the current market sentiment weakness."

News