News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Filecoin is a protocol-based decentralized data storage network designed to provide long-term, secure, and verifiable data storage capabilities.

This upgrade marks SunX's transformation from a single trading platform to a self-circulating and self-growing decentralized ecosystem hub.

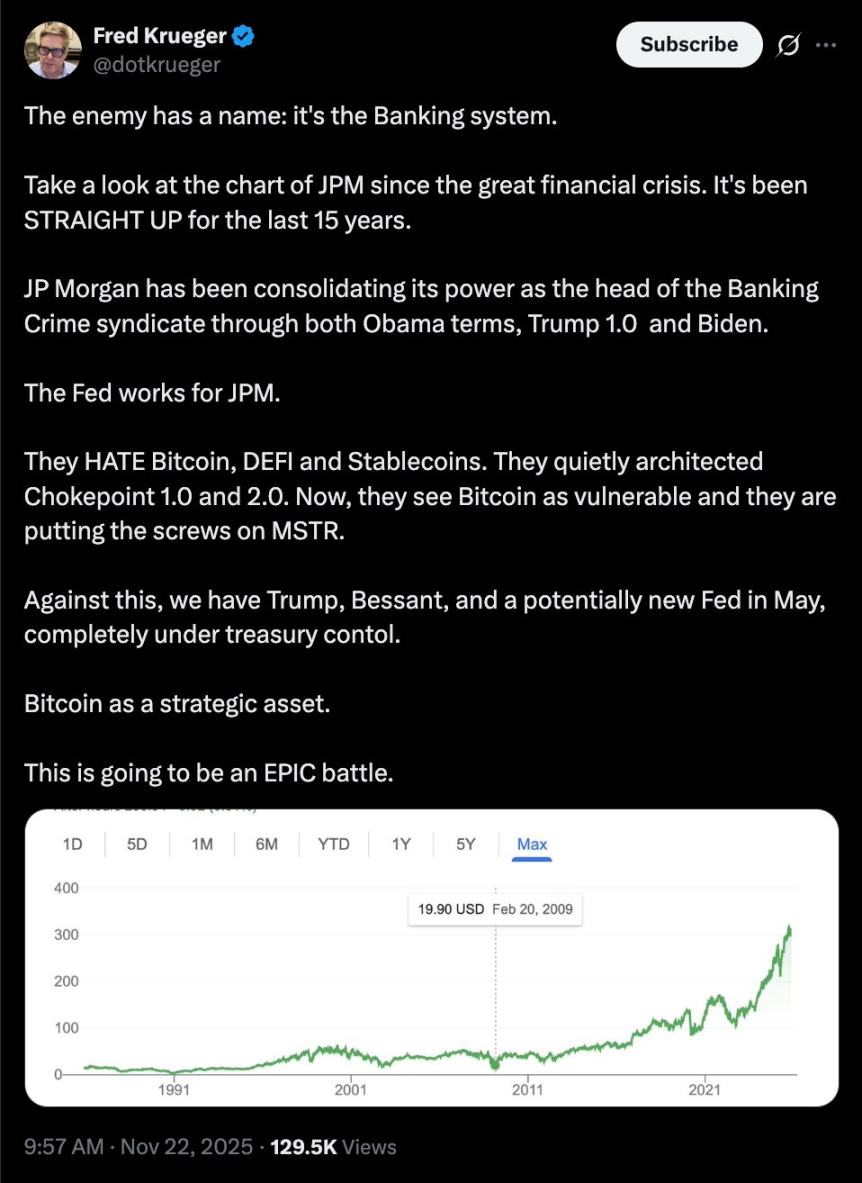

JPMorgan warned in a research report that if Strategy is eventually removed, it could trigger a mandatory sell-off worth $2.8 billion.

Adam Weitsman recently acquired 229 Meebits, further increasing his investment in the NFT sector.

Are stablecoins truly "the most dangerous cryptocurrencies," or are they "a global public good"?

In Brief Cryptocurrency market faces over $566 million in coin unlocks next week. Single-event and linear unlocks may impact market supply and investor sentiment. Investors are wary of potential short-term price fluctuations.

The latest On-Chain Rich List shows that cryptocurrency assets are highly concentrated in the hands of a few whales, and the wealth distribution pattern is becoming increasingly clear.